Official Promissory Note Template for the State of North Carolina

In North Carolina, a Promissory Note serves as a crucial financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring both parties understand their obligations. It is essential to include details such as the due date, any penalties for late payments, and the circumstances under which the note can be enforced. Additionally, the Promissory Note may require signatures from both parties, often needing witnesses or notarization to enhance its validity. Understanding the intricacies of this form is vital, as it protects the lender's rights while providing the borrower with clear terms of repayment. Whether you are borrowing money for personal reasons or for business purposes, knowing how to properly utilize the North Carolina Promissory Note can help you avoid potential disputes and ensure a smooth financial transaction.

Key takeaways

When filling out and using the North Carolina Promissory Note form, keep these key takeaways in mind:

- Clear Identification: Clearly identify the borrower and lender. Include full names and addresses to avoid confusion.

- Loan Amount: Specify the exact amount being borrowed. This figure should be written both in numbers and words for clarity.

- Interest Rate: State the interest rate clearly. If the loan is interest-free, indicate that explicitly.

- Repayment Terms: Outline the repayment schedule. Include due dates and any conditions for late payments.

- Signatures: Ensure that both parties sign the document. This step is crucial for the note to be legally binding.

By following these guidelines, you can create a clear and effective Promissory Note that protects both parties involved in the agreement.

Guide to Writing North Carolina Promissory Note

After obtaining the North Carolina Promissory Note form, you will need to fill it out accurately. This form will require specific information about the loan agreement between the borrower and the lender. Follow these steps to ensure that you complete the form correctly.

- Enter the date: Write the date when the note is being created at the top of the form.

- Identify the borrower: Fill in the full name and address of the person or entity borrowing the money.

- Identify the lender: Provide the full name and address of the person or entity lending the money.

- Specify the loan amount: Clearly state the total amount of money being borrowed.

- Outline the interest rate: Indicate the interest rate that will be applied to the loan, if any.

- Set the repayment terms: Describe how and when the borrower will repay the loan, including payment frequency and due dates.

- Include any late fees: If applicable, mention any fees that will be charged for late payments.

- Sign the document: Both the borrower and lender must sign the form to make it legally binding.

- Provide witness signatures: If required, have a witness sign the document as well.

Once you have completed the form, make copies for both parties. Keep a signed copy for your records. You may also want to consult with a legal professional to ensure that everything is in order.

Discover Popular Promissory Note Templates for Specific States

Promissory Note Georgia - In some cases, a Promissory Note may be used to lend money to a business.

Promissory Note Illinois - A promissory note is more flexible than a traditional loan agreement.

For those looking to complete the sale of a motorcycle in Texas, it's important to have a proper Texas Motorcycle Bill of Sale, which can be efficiently obtained from resources like smarttemplates.net, ensuring a smooth and legally binding transaction between the buyer and seller.

Promissory Note Template Michigan - It can be customized to fit the specific needs of the lender and borrower.

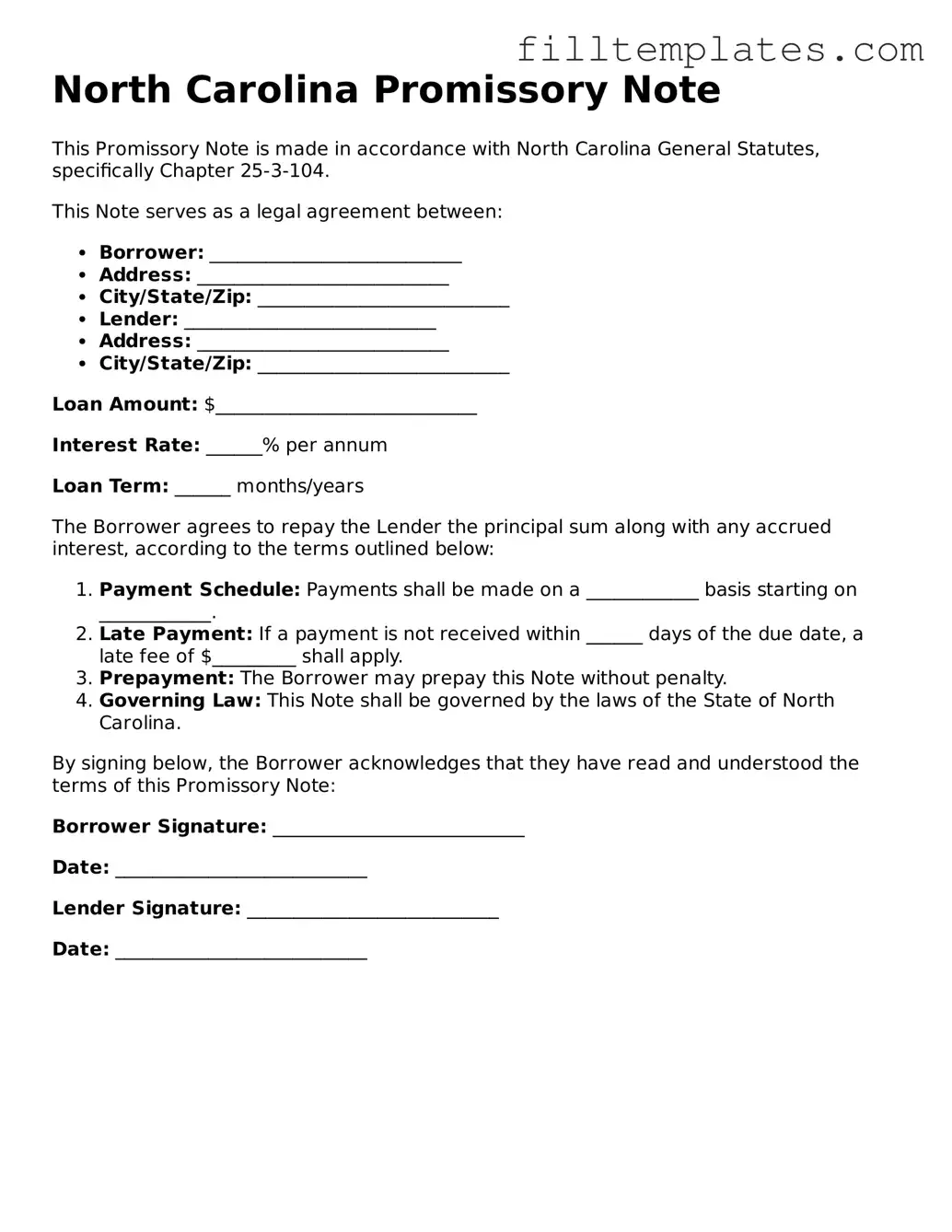

Form Preview Example

North Carolina Promissory Note

This Promissory Note is made in accordance with North Carolina General Statutes, specifically Chapter 25-3-104.

This Note serves as a legal agreement between:

- Borrower: ___________________________

- Address: ___________________________

- City/State/Zip: ___________________________

- Lender: ___________________________

- Address: ___________________________

- City/State/Zip: ___________________________

Loan Amount: $____________________________

Interest Rate: ______% per annum

Loan Term: ______ months/years

The Borrower agrees to repay the Lender the principal sum along with any accrued interest, according to the terms outlined below:

- Payment Schedule: Payments shall be made on a ____________ basis starting on ____________.

- Late Payment: If a payment is not received within ______ days of the due date, a late fee of $_________ shall apply.

- Prepayment: The Borrower may prepay this Note without penalty.

- Governing Law: This Note shall be governed by the laws of the State of North Carolina.

By signing below, the Borrower acknowledges that they have read and understood the terms of this Promissory Note:

Borrower Signature: ___________________________

Date: ___________________________

Lender Signature: ___________________________

Date: ___________________________

Documents used along the form

When engaging in a lending or borrowing arrangement in North Carolina, a Promissory Note serves as a critical document outlining the terms of the loan. However, it is often accompanied by several other forms and documents that help clarify the agreement and protect the interests of both parties involved. Below is a list of common documents that may be used alongside a North Carolina Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive outline of the relationship between the borrower and lender.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets pledged by the borrower. It outlines the lender's rights to the collateral in case of default.

- Room Rental Agreement: To establish clear terms between landlords and tenants, utilize our comprehensive Room Rental Agreement guidelines to facilitate the rental process.

- Disclosure Statement: This document provides essential information about the loan, such as fees, interest rates, and the total cost of the loan over its term. It ensures that borrowers are fully informed before signing.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from a third party. This document holds the guarantor responsible for the loan if the borrower defaults, adding an extra layer of security for the lender.

- Amortization Schedule: This schedule breaks down each payment into principal and interest components, illustrating how the loan balance decreases over time. It helps borrowers understand their payment obligations clearly.

- Loan Modification Agreement: If the terms of the loan need to be adjusted after the initial agreement, this document outlines the new terms and conditions, ensuring both parties are on the same page.

- Release of Liability: Once the loan is repaid, this document confirms that the borrower has fulfilled their obligations, releasing them from any further liability under the Promissory Note.

Understanding these documents can empower borrowers and lenders alike, fostering a smoother transaction and minimizing potential disputes. Each form plays a vital role in ensuring that both parties are protected and aware of their rights and responsibilities throughout the lending process.