Official Real Estate Purchase Agreement Template for the State of North Carolina

The North Carolina Real Estate Purchase Agreement form serves as a crucial document in the process of buying and selling real estate within the state. This form outlines the essential terms and conditions that govern the transaction between the buyer and the seller. Key components include the purchase price, the description of the property, and the closing date. Additionally, the agreement addresses contingencies, such as inspections and financing, which can affect the finalization of the sale. Both parties must also consider the earnest money deposit, which demonstrates the buyer's commitment to the purchase. The form stipulates the responsibilities of each party, ensuring clarity and reducing the potential for disputes. By laying out these details, the agreement facilitates a smoother transaction process, allowing both buyers and sellers to understand their rights and obligations clearly.

Key takeaways

When filling out and using the North Carolina Real Estate Purchase Agreement form, it’s essential to understand the key elements involved. Here are some important takeaways to keep in mind:

- Complete Information: Ensure all parties' names, addresses, and contact details are accurately filled in. This clarity helps avoid confusion later.

- Property Description: Provide a detailed description of the property. Include the address, parcel number, and any relevant features to identify it clearly.

- Purchase Price: Clearly state the agreed-upon purchase price. This figure is crucial for both parties and should be prominently displayed.

- Earnest Money: Specify the amount of earnest money deposit. This shows the buyer's commitment and is typically held in escrow until closing.

- Contingencies: Outline any contingencies that may affect the sale, such as financing, inspections, or the sale of another property. These conditions protect both parties.

- Closing Date: Set a target closing date. This date should be realistic and agreed upon by both the buyer and seller.

- Review and Sign: Before signing, both parties should thoroughly review the agreement. It’s advisable to consult with a real estate professional or attorney if there are any uncertainties.

By keeping these key points in mind, you can navigate the North Carolina Real Estate Purchase Agreement with greater confidence and clarity.

Guide to Writing North Carolina Real Estate Purchase Agreement

Filling out the North Carolina Real Estate Purchase Agreement form is an important step in the process of buying or selling a property. This document outlines the terms of the sale and serves as a binding contract between the buyer and seller. After completing the form, both parties will need to review the details to ensure accuracy before signing.

- Obtain the form: Start by downloading or acquiring the North Carolina Real Estate Purchase Agreement form from a reliable source.

- Identify the parties: Clearly write the full names and contact information of both the buyer(s) and seller(s) at the top of the form.

- Property details: Fill in the property address, including city, county, and zip code. Make sure to include any relevant legal descriptions if required.

- Purchase price: Specify the agreed-upon purchase price for the property. This amount should be clearly stated in both numerical and written form.

- Earnest money: Indicate the amount of earnest money the buyer will provide as a show of good faith. Mention how this money will be held (e.g., in escrow).

- Financing details: Describe the type of financing the buyer intends to use, such as a mortgage or cash purchase. Include any contingencies related to financing.

- Closing date: Enter the proposed closing date for the transaction. This is the date when ownership will officially transfer.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as inspections or appraisals.

- Signatures: Ensure both the buyer and seller sign and date the agreement at the bottom of the form. If applicable, include witness signatures as well.

Once you have completed the form, review it carefully for any errors or omissions. It’s advisable to consult with a real estate professional or attorney to ensure that all necessary details are accurately captured and that your interests are protected.

Discover Popular Real Estate Purchase Agreement Templates for Specific States

Purchase and Sale Agreement Georgia - A Real Estate Purchase Agreement often includes clauses for default and remedies.

Purchase Agreement Michigan Template - Details the rights of the buyer to visit the property prior to completion.

The Employment Application PDF form is a standardized document used by candidates to provide their personal, educational, and professional information when applying for a job. This form ensures that employers have consistent data on all applicants, simplifying the hiring process. To obtain this essential form, you can visit OnlineLawDocs.com, which serves as a valuable resource for both employers looking to fill positions and individuals seeking employment opportunities.

Ohio Residential Real Estate Purchase Agreement - This form is a foundational tool for successful real estate transactions.

Form Preview Example

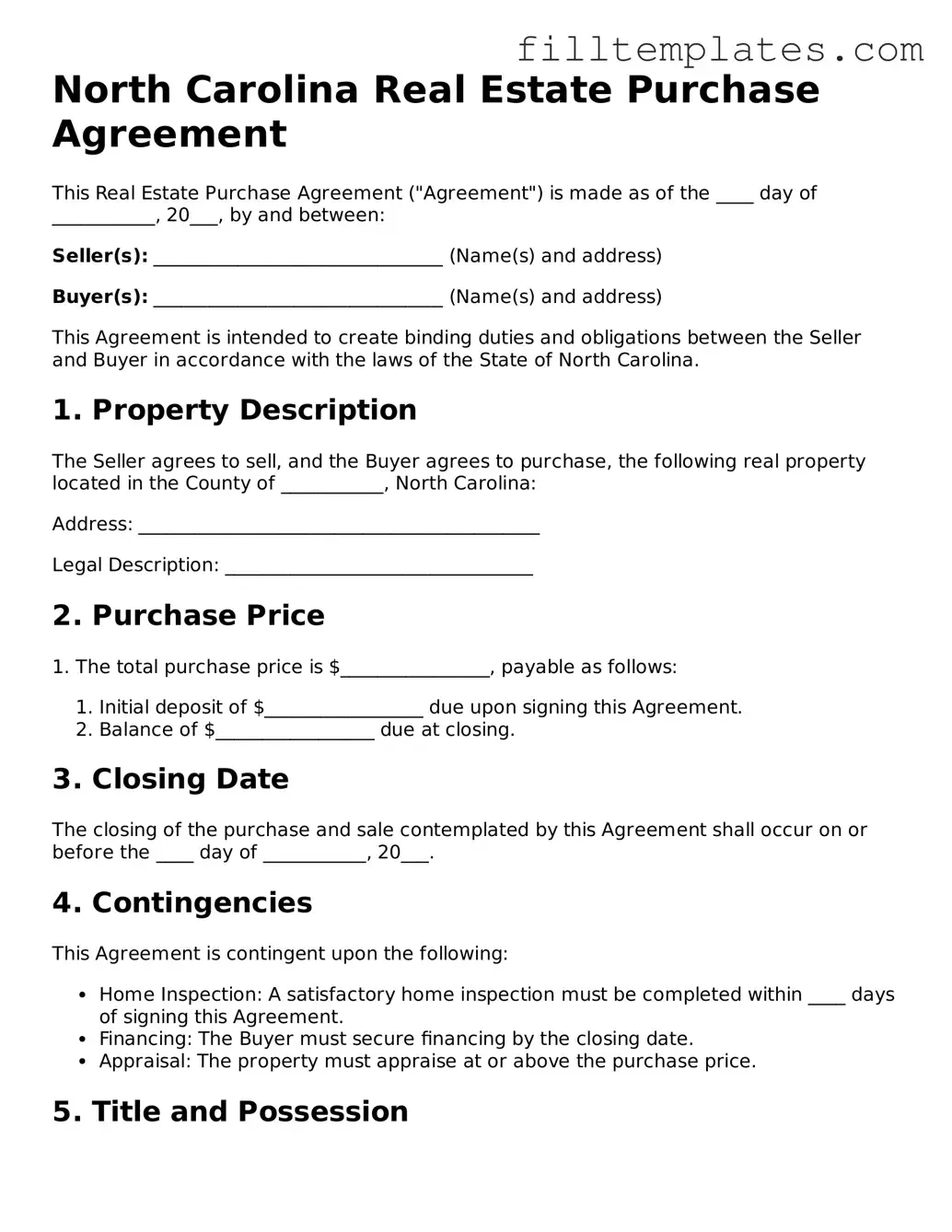

North Carolina Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made as of the ____ day of ___________, 20___, by and between:

Seller(s): _______________________________ (Name(s) and address)

Buyer(s): _______________________________ (Name(s) and address)

This Agreement is intended to create binding duties and obligations between the Seller and Buyer in accordance with the laws of the State of North Carolina.

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase, the following real property located in the County of ___________, North Carolina:

Address: ___________________________________________

Legal Description: _________________________________

2. Purchase Price

1. The total purchase price is $________________, payable as follows:

- Initial deposit of $_________________ due upon signing this Agreement.

- Balance of $_________________ due at closing.

3. Closing Date

The closing of the purchase and sale contemplated by this Agreement shall occur on or before the ____ day of ___________, 20___.

4. Contingencies

This Agreement is contingent upon the following:

- Home Inspection: A satisfactory home inspection must be completed within ____ days of signing this Agreement.

- Financing: The Buyer must secure financing by the closing date.

- Appraisal: The property must appraise at or above the purchase price.

5. Title and Possession

The Seller agrees to provide clear title to the property and shall convey it by a General Warranty Deed. Possession of the property shall be delivered to the Buyer on the date of closing.

6. Governing Law

This Agreement shall be governed by the laws of the State of North Carolina.

7. Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

_________________________

Seller Signature

_________________________

Buyer Signature

Documents used along the form

When engaging in real estate transactions in North Carolina, several documents complement the Real Estate Purchase Agreement. Each of these forms serves a specific purpose and helps ensure that both buyers and sellers are protected throughout the process. Understanding these documents can lead to a smoother transaction.

- Property Disclosure Statement: This document requires sellers to disclose known issues with the property. It helps buyers make informed decisions and protects sellers from future legal claims regarding undisclosed defects.

- Offer to Purchase and Contract: Often used in conjunction with the Real Estate Purchase Agreement, this document outlines the terms of the offer made by the buyer. It includes details like price, closing date, and contingencies.

- Title Search and Title Insurance: A title search verifies the legal ownership of the property and checks for any liens or claims against it. Title insurance protects the buyer and lender from any future disputes over property ownership.

- Closing Disclosure: This document provides a detailed account of all closing costs associated with the transaction. It ensures that buyers understand their financial obligations before finalizing the sale.

- Deed: The deed is the legal document that transfers ownership from the seller to the buyer. It must be signed and recorded to be valid.

- Home Inspection Report: This report is generated after a professional home inspection. It outlines the condition of the property and identifies any necessary repairs, allowing buyers to negotiate terms accordingly.

- Loan Estimate: If the buyer is financing the purchase, this document provides an estimate of the mortgage terms, including interest rates and monthly payments. It helps buyers understand their financial commitments.

- Motorcycle Bill of Sale Form: For those engaging in motorcycle transactions, refer to the frequently used motorcycle bill of sale documentation to ensure all sales are legally validated.

- Radon Disclosure: In North Carolina, sellers must disclose information about radon levels in the home. This document ensures that buyers are aware of potential health risks associated with radon exposure.

Being familiar with these documents not only aids in navigating the real estate process but also empowers buyers and sellers to protect their interests. Each form plays a vital role in ensuring a transparent and successful transaction.