Official Transfer-on-Death Deed Template for the State of North Carolina

The North Carolina Transfer-on-Death Deed form serves as a valuable estate planning tool that allows individuals to designate beneficiaries for their real property without the need for probate. This deed enables property owners to retain full control over their assets during their lifetime, ensuring that they can sell, mortgage, or otherwise manage their property as they see fit. Upon the owner’s passing, the designated beneficiaries automatically receive the property, streamlining the transfer process and potentially avoiding the complications and costs associated with probate. It is important to note that the deed must be properly executed and recorded to be effective, and it can be revoked or altered at any time before the owner’s death. Understanding the nuances of this form can help individuals make informed decisions about their estate planning strategies, ensuring that their wishes are honored and their loved ones are provided for in a straightforward manner.

Key takeaways

When filling out and using the North Carolina Transfer-on-Death Deed form, it is essential to keep several key points in mind. Below are important takeaways that can guide individuals through the process.

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive the property upon the owner's death.

- To be valid, the deed must be signed by the property owner in the presence of a notary public.

- It is important to record the deed with the county register of deeds where the property is located to ensure it is legally effective.

- Beneficiaries do not have any rights to the property until the owner passes away, which helps maintain control during the owner's lifetime.

- The form must include a clear legal description of the property to avoid any disputes in the future.

- Property owners can change or revoke the deed at any time before their death, providing flexibility in estate planning.

- Consulting with an attorney is advisable to ensure the deed complies with North Carolina laws and meets the owner's intentions.

- Tax implications may arise for beneficiaries, so understanding potential tax consequences is crucial.

- Using a Transfer-on-Death Deed can help avoid the probate process, simplifying the transfer of property to beneficiaries.

Guide to Writing North Carolina Transfer-on-Death Deed

Once you have the North Carolina Transfer-on-Death Deed form in hand, it's important to fill it out carefully to ensure that your intentions are clearly documented. This form allows you to designate beneficiaries who will receive your property upon your passing, without the need for probate. Following the steps below will guide you through the process of completing the form accurately.

- Begin by entering your name and address at the top of the form. Ensure that this information is correct, as it identifies you as the property owner.

- Next, provide a description of the property you wish to transfer. Include the full address and any relevant details that clearly identify the property.

- In the designated area, list the names of the beneficiaries who will inherit the property. Be specific and double-check the spelling of each name.

- Indicate the relationship of each beneficiary to you. This can help clarify your intentions for those reviewing the document in the future.

- Next, date the form. This date is important as it marks when the deed was executed.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- After notarization, make copies of the completed deed for your records and for each beneficiary.

- Finally, file the original deed with the appropriate county register of deeds office where the property is located. This step is crucial for the deed to take effect.

Discover Popular Transfer-on-Death Deed Templates for Specific States

Transfer on Death Deed Georgia Form - This deed can prevent potential complications that arise from intestate succession laws.

An Employment Verification Form is a critical document utilized by employers to authenticate the employment history of current or former employees. This form generally contains essential details such as the employee's job title, dates of employment, and occasionally salary information. For accurate verification, many employers rely on resources like OnlineLawDocs.com, ensuring that the applicant's employment history is correctly represented to prospective employers, lending institutions, or government agencies.

Ohio Transfer on Death Form - This approach to property transfer offers a clear alternative to more complex estate planning options.

Form Preview Example

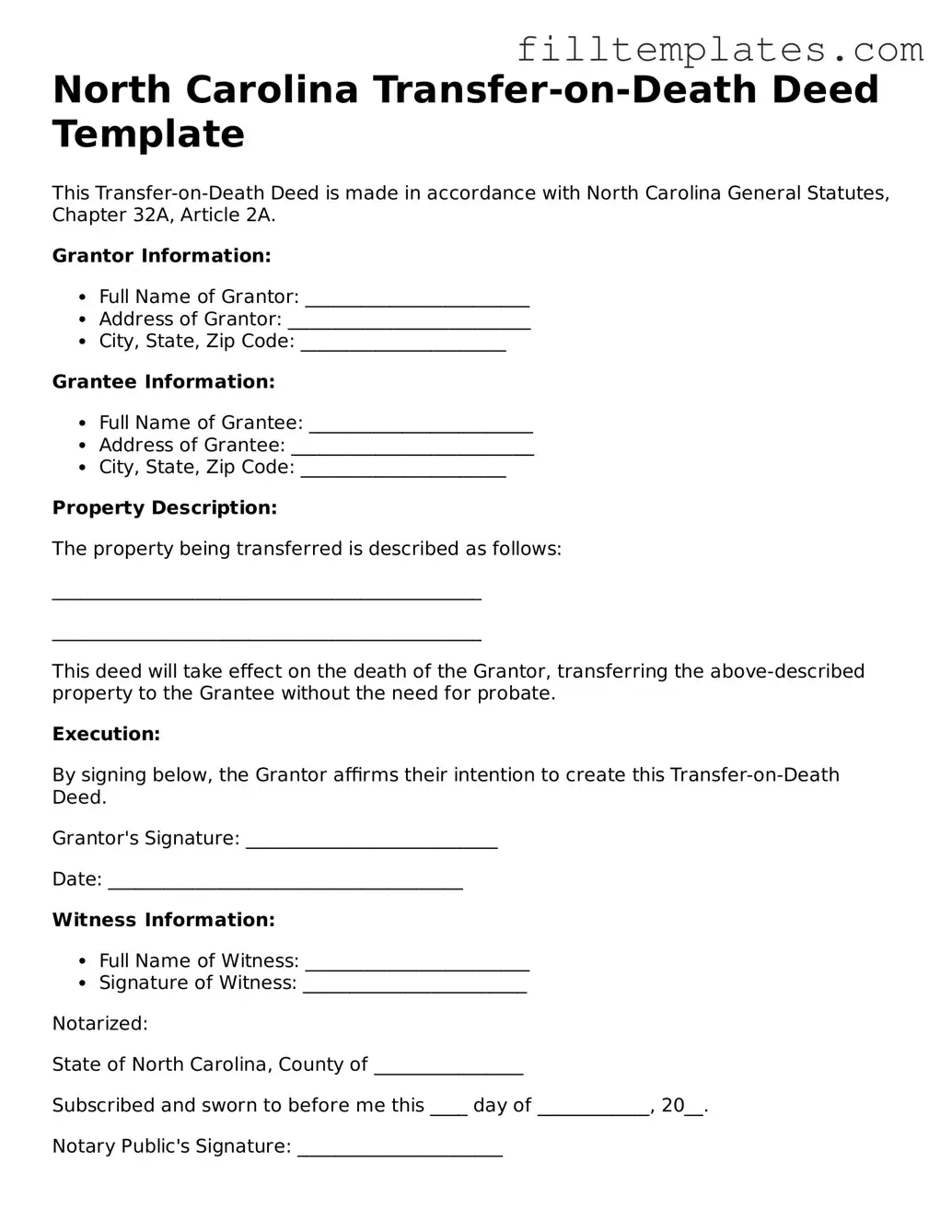

North Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with North Carolina General Statutes, Chapter 32A, Article 2A.

Grantor Information:

- Full Name of Grantor: ________________________

- Address of Grantor: __________________________

- City, State, Zip Code: ______________________

Grantee Information:

- Full Name of Grantee: ________________________

- Address of Grantee: __________________________

- City, State, Zip Code: ______________________

Property Description:

The property being transferred is described as follows:

______________________________________________

______________________________________________

This deed will take effect on the death of the Grantor, transferring the above-described property to the Grantee without the need for probate.

Execution:

By signing below, the Grantor affirms their intention to create this Transfer-on-Death Deed.

Grantor's Signature: ___________________________

Date: ______________________________________

Witness Information:

- Full Name of Witness: ________________________

- Signature of Witness: ________________________

Notarized:

State of North Carolina, County of ________________

Subscribed and sworn to before me this ____ day of ____________, 20__.

Notary Public's Signature: ______________________

My Commission Expires: _______________________

Documents used along the form

The North Carolina Transfer-on-Death Deed is a valuable tool for individuals looking to transfer property upon their death without going through probate. However, several other forms and documents are often used in conjunction with this deed to ensure a smooth transfer process and to address various legal considerations. Below is a list of these important documents.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by covering assets not included in the deed.

- Affidavit of Heirship: A sworn statement used to establish the heirs of a deceased person. This document can help clarify ownership of property when the deceased did not leave a will.

- Property Deed: The legal document that conveys ownership of real estate. A current property deed is necessary to complete the Transfer-on-Death Deed accurately.

- Power of Attorney: A document that grants someone the authority to act on another's behalf in legal or financial matters. This can be useful if the property owner becomes incapacitated.

- Living Trust: A trust created during a person's lifetime that can hold assets, including real estate. It allows for the seamless transfer of property upon death, often avoiding probate.

- Dirt Bike Bill of Sale Form: To simplify the selling process, review the essential Dirt Bike Bill of Sale documentation to ensure all necessary information is captured.

- Notice of Death: A document filed to inform interested parties of a person's death. This can be particularly important for creditors and heirs.

- Estate Inventory: A detailed list of all assets owned by a deceased person. This document helps in understanding the full scope of the estate and aids in the distribution process.

- Beneficiary Designation Forms: These forms allow individuals to name beneficiaries for specific assets, such as life insurance policies or retirement accounts, ensuring those assets pass directly to the named individuals.

- Tax Returns: Filing the final tax return for a deceased individual is essential. It may affect the estate's value and the distribution of assets.

Each of these documents plays a critical role in the estate planning and property transfer process in North Carolina. Understanding their functions can help individuals navigate the complexities of transferring property effectively and ensure that their wishes are honored after their passing.