Official Articles of Incorporation Template for the State of Ohio

When embarking on the journey of establishing a business in Ohio, one of the most critical steps is the completion of the Articles of Incorporation form. This essential document serves as the foundation for your corporation, outlining key details that define its structure and purpose. Among the major aspects included in this form are the corporation's name, which must be unique and compliant with state regulations, and its principal office address, providing a point of contact for legal and administrative matters. Additionally, the form requires the identification of the corporation's registered agent, a designated individual or entity responsible for receiving legal documents on behalf of the corporation. The Articles of Incorporation also necessitate the inclusion of the corporation's purpose, which describes the business activities it will engage in, and the number of shares authorized for issuance, a crucial element for potential investors. Understanding these components is vital, as they not only lay the groundwork for your business but also ensure compliance with Ohio law, setting the stage for future growth and success.

Key takeaways

Filling out the Ohio Articles of Incorporation form is an essential step in establishing a corporation in Ohio. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. It officially registers your business with the state and outlines its basic structure.

- Accurate Information is Crucial: Ensure that all information provided, such as the corporation's name, address, and purpose, is accurate. Mistakes can lead to delays or complications in the incorporation process.

- Filing Fees Apply: Be prepared to pay a filing fee when submitting your Articles of Incorporation. This fee varies based on the type of corporation you are forming, so check the latest rates.

- Follow Up on Your Submission: After submitting the form, keep track of your application status. You may receive confirmation or additional instructions from the state, which are important for moving forward.

Guide to Writing Ohio Articles of Incorporation

After completing the Ohio Articles of Incorporation form, you will need to submit it to the Ohio Secretary of State's office. This process is crucial for officially establishing your business entity in Ohio. Ensure that all information is accurate and complete to avoid any delays.

- Obtain the Ohio Articles of Incorporation form from the Ohio Secretary of State's website or office.

- Fill in the name of your corporation. Ensure it complies with Ohio naming requirements.

- Provide the purpose of your corporation. Be clear and concise about what your business will do.

- Enter the duration of the corporation, which can be perpetual or a specified number of years.

- List the address of the corporation’s principal office. This must be a physical address in Ohio.

- Designate a registered agent. Include the agent's name and address, which must also be in Ohio.

- Specify the number of shares the corporation is authorized to issue, if applicable.

- Provide the names and addresses of the incorporators. These are the individuals responsible for filing the articles.

- Sign and date the form. Ensure that the signature is from an incorporator.

- Submit the completed form along with the required filing fee to the Ohio Secretary of State's office.

Discover Popular Articles of Incorporation Templates for Specific States

Nc Articles of Incorporation - Review the requirements to avoid common filing mistakes.

The complete guide to Residential Lease Agreement requirements is an invaluable resource for understanding the critical elements of this document. It provides clarity on vital aspects such as terms, responsibilities, and conditions governing the rental process, ensuring both landlords and tenants are well-informed.

Georgia Secretary of State Corporations - Outline the rights of shareholders.

Articles of Incorporation Illinois Search - Establishes the rules for succession of directors and officers.

Form Preview Example

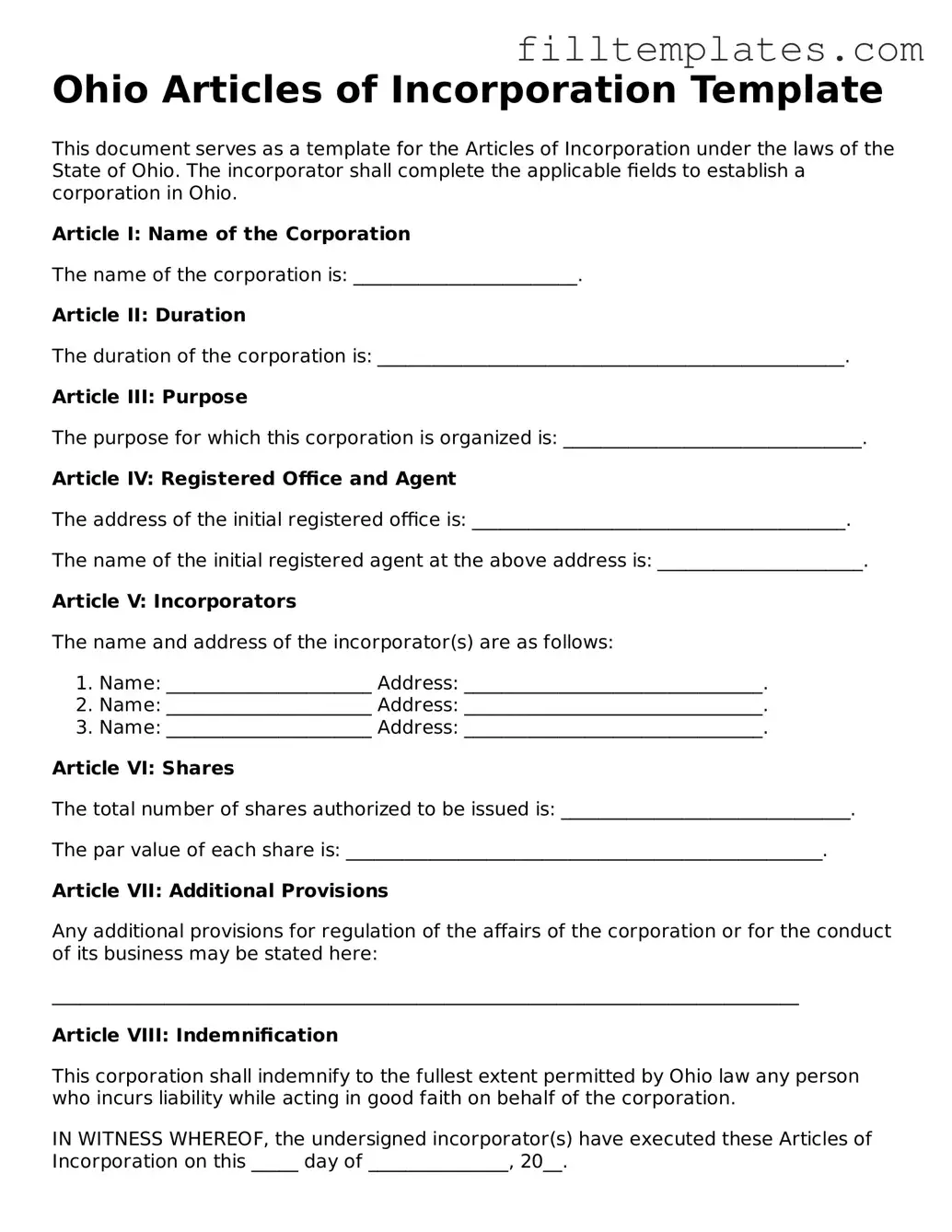

Ohio Articles of Incorporation Template

This document serves as a template for the Articles of Incorporation under the laws of the State of Ohio. The incorporator shall complete the applicable fields to establish a corporation in Ohio.

Article I: Name of the Corporation

The name of the corporation is: ________________________.

Article II: Duration

The duration of the corporation is: __________________________________________________.

Article III: Purpose

The purpose for which this corporation is organized is: ________________________________.

Article IV: Registered Office and Agent

The address of the initial registered office is: ________________________________________.

The name of the initial registered agent at the above address is: ______________________.

Article V: Incorporators

The name and address of the incorporator(s) are as follows:

- Name: ______________________ Address: ________________________________.

- Name: ______________________ Address: ________________________________.

- Name: ______________________ Address: ________________________________.

Article VI: Shares

The total number of shares authorized to be issued is: _______________________________.

The par value of each share is: ___________________________________________________.

Article VII: Additional Provisions

Any additional provisions for regulation of the affairs of the corporation or for the conduct of its business may be stated here:

________________________________________________________________________________

Article VIII: Indemnification

This corporation shall indemnify to the fullest extent permitted by Ohio law any person who incurs liability while acting in good faith on behalf of the corporation.

IN WITNESS WHEREOF, the undersigned incorporator(s) have executed these Articles of Incorporation on this _____ day of _______________, 20__.

Signature of Incorporator: ______________________________________.

Name of Incorporator (printed): ________________________________.

Documents used along the form

When forming a corporation in Ohio, several important documents accompany the Articles of Incorporation. Each of these forms plays a crucial role in ensuring that your corporation is set up correctly and complies with state regulations. Below is a list of commonly used forms and documents that you may need to consider.

- Bylaws: This document outlines the internal rules and procedures for managing the corporation. It details the roles of directors and officers, meeting protocols, and other operational guidelines.

- Initial Resolution: This is a formal decision made by the board of directors during the initial meeting. It typically includes the appointment of officers and the adoption of bylaws.

- Employer Identification Number (EIN) Application: Also known as Form SS-4, this application is submitted to the IRS to obtain a unique number for tax purposes. An EIN is essential for opening a business bank account and filing taxes.

- Statement of Information: Some states require this document to be filed periodically. It provides updated information about the corporation, including its address and the names of officers and directors.

- Bill of Sale: Essential for transferring ownership of a vehicle, the Bill of Sale serves as proof of transaction and includes important information about the vehicle and parties involved; for more details, visit OnlineLawDocs.com.

- Business License Application: Depending on the nature of your business and its location, you may need to apply for various local or state licenses to operate legally.

- Shareholder Agreements: This agreement outlines the rights and responsibilities of shareholders. It can cover aspects such as the transfer of shares and the management of the corporation.

- Operating Agreement: While more common for LLCs, this document can also be beneficial for corporations. It details the management structure and operational procedures, especially if there are multiple owners.

- Annual Report: Many states require corporations to file annual reports that provide updated information about the business. This document helps maintain good standing with the state.

- Certificate of Good Standing: This certificate is issued by the state and confirms that your corporation is legally registered and compliant with all state requirements.

Understanding these documents can simplify the process of establishing and maintaining your corporation in Ohio. Each form serves a specific purpose and contributes to the overall legality and functionality of your business. Be sure to review each requirement carefully to ensure compliance and smooth operation.