Official Deed in Lieu of Foreclosure Template for the State of Ohio

In the challenging landscape of homeownership, the Ohio Deed in Lieu of Foreclosure offers a potential lifeline for those facing financial difficulties. This legal instrument allows a homeowner to voluntarily transfer their property title to the lender, effectively bypassing the lengthy and often stressful foreclosure process. By doing so, the homeowner can mitigate the impact on their credit score and may even avoid additional legal fees associated with foreclosure proceedings. The form itself outlines essential details, including the property description, the parties involved, and any relevant disclosures. Importantly, it also addresses potential liabilities, ensuring that both the homeowner and lender understand their rights and obligations. This option can serve as a strategic move for those seeking a fresh start while also providing lenders with a more efficient resolution to distressed properties. Understanding the nuances of this form can empower homeowners to make informed decisions during difficult times.

Key takeaways

When considering a Deed in Lieu of Foreclosure in Ohio, it is essential to understand the implications and process involved. Here are some key takeaways to keep in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders often have specific criteria that must be met before accepting a Deed in Lieu.

- Consulting Professionals: It is advisable to seek legal or financial advice before proceeding. Professionals can help clarify your options and consequences.

- Impact on Credit: While a Deed in Lieu may be less damaging than foreclosure, it can still negatively affect your credit score.

- Negotiating Terms: Homeowners can negotiate terms with their lender, including potential forgiveness of remaining debt.

- Completing the Form: Ensure that all sections of the Deed in Lieu of Foreclosure form are filled out accurately to avoid delays or complications.

- Recording the Deed: After the form is completed and signed, it must be recorded with the county recorder’s office to make the transfer official.

Understanding these key points can help homeowners navigate the process more effectively. Taking informed steps is crucial in making the best decision for your situation.

Guide to Writing Ohio Deed in Lieu of Foreclosure

Once you have decided to proceed with a Deed in Lieu of Foreclosure in Ohio, the next step is to fill out the necessary form accurately. This document will allow you to transfer ownership of your property back to the lender, helping to avoid the lengthy and often stressful foreclosure process. It’s important to take your time and ensure that all information is correct to prevent any delays.

- Begin by downloading the Ohio Deed in Lieu of Foreclosure form from a reliable source or your lender.

- At the top of the form, fill in the date when you are completing the document.

- Provide the name of the borrower(s) as it appears on the mortgage. This is typically the same name(s) on the title of the property.

- Enter the address of the property being transferred. Ensure that you include the complete street address, city, state, and zip code.

- Next, write the name of the lender or mortgage company that will receive the deed. This should be the same entity that holds your mortgage.

- In the designated section, indicate the legal description of the property. This information can usually be found on your mortgage documents or property tax records.

- Review any additional clauses or statements that may require your attention. Make sure you understand what each section means.

- Sign the document where indicated. If there are multiple borrowers, ensure that all parties sign the form.

- Have your signature notarized. This step is crucial, as it verifies your identity and the authenticity of the document.

- Make copies of the completed and notarized form for your records before submitting it to your lender.

Discover Popular Deed in Lieu of Foreclosure Templates for Specific States

Foreclosure Process in Georgia - The Deed in Lieu of Foreclosure helps maintain the homeowner's credit score better than a foreclosure would.

For anyone navigating the process of vehicle transactions, having a reliable helpful Motor Vehicle Bill of Sale template can prove invaluable, ensuring all necessary information is accurately documented for a smooth exchange.

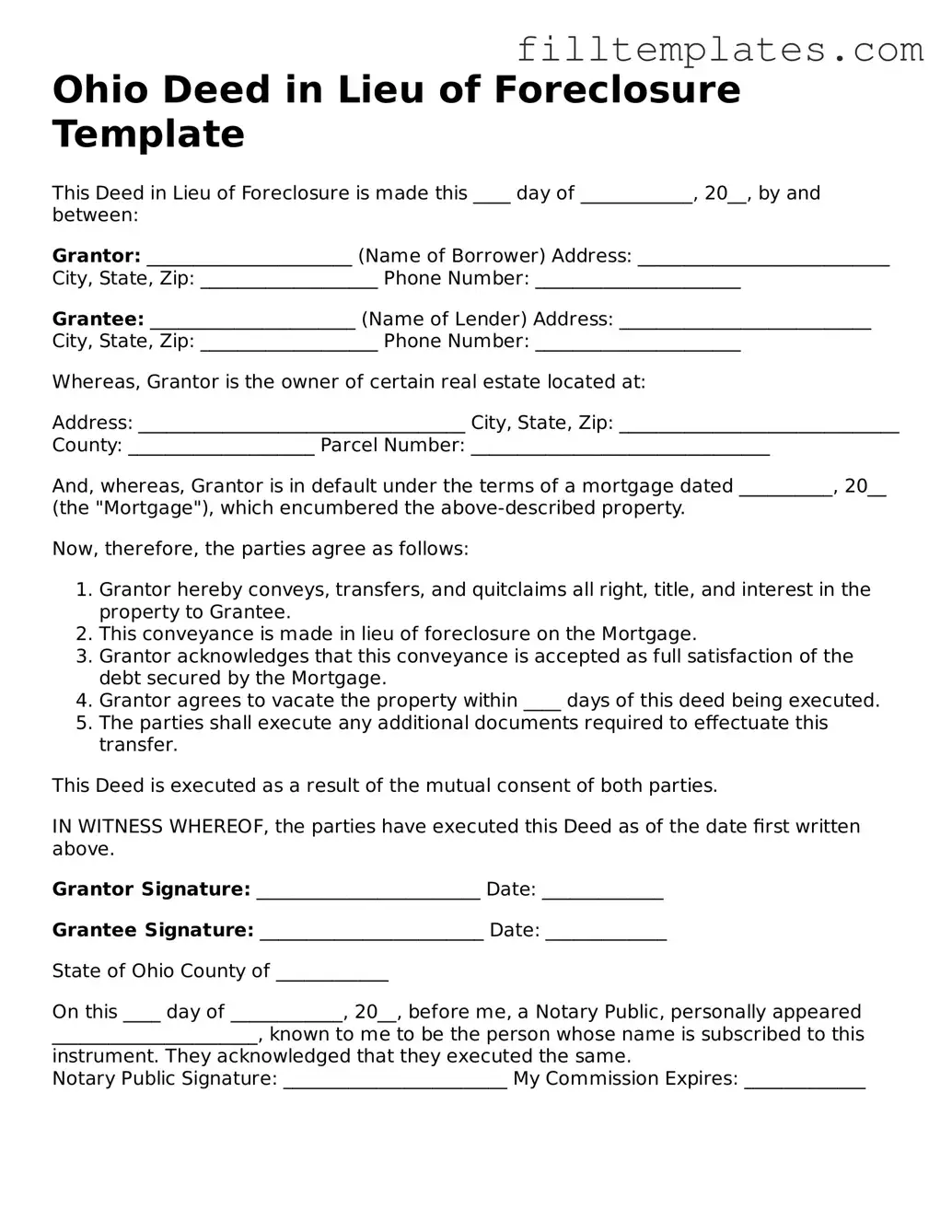

Form Preview Example

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ____ day of ____________, 20__, by and between:

Grantor: ______________________ (Name of Borrower) Address: ___________________________ City, State, Zip: ___________________ Phone Number: ______________________

Grantee: ______________________ (Name of Lender) Address: ___________________________ City, State, Zip: ___________________ Phone Number: ______________________

Whereas, Grantor is the owner of certain real estate located at:

Address: ___________________________________ City, State, Zip: ______________________________ County: ____________________ Parcel Number: ________________________________

And, whereas, Grantor is in default under the terms of a mortgage dated __________, 20__ (the "Mortgage"), which encumbered the above-described property.

Now, therefore, the parties agree as follows:

- Grantor hereby conveys, transfers, and quitclaims all right, title, and interest in the property to Grantee.

- This conveyance is made in lieu of foreclosure on the Mortgage.

- Grantor acknowledges that this conveyance is accepted as full satisfaction of the debt secured by the Mortgage.

- Grantor agrees to vacate the property within ____ days of this deed being executed.

- The parties shall execute any additional documents required to effectuate this transfer.

This Deed is executed as a result of the mutual consent of both parties.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first written above.

Grantor Signature: ________________________ Date: _____________

Grantee Signature: ________________________ Date: _____________

State of Ohio County of ____________

On this ____ day of ____________, 20__, before me, a Notary Public, personally appeared ______________________, known to me to be the person whose name is subscribed to this instrument. They acknowledged that they executed the same.

Notary Public Signature: ________________________

My Commission Expires: _____________

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. This process often involves several other forms and documents that facilitate the transfer and protect the interests of both parties. Below is a list of commonly used documents in conjunction with the Ohio Deed in Lieu of Foreclosure.

- Mortgage Release Document: This document formally releases the borrower from their mortgage obligations upon the transfer of the property. It ensures that the borrower is no longer liable for the mortgage debt.

- Property Condition Disclosure: This form provides information about the condition of the property. It helps the lender understand any existing issues or repairs needed, which may affect the property's value.

- Release of Liability: This agreement releases the former homeowner from future liability for the mortgage debt once the Deed in Lieu has been executed, ensuring that they are not held responsible for any remaining balance. For more information, visit smarttemplates.net.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no undisclosed liens or claims against it. It protects the lender by ensuring clear title is transferred.

- Release of Liability Agreement: This document outlines the terms under which the lender agrees to release the borrower from any further liability related to the mortgage. It can clarify any potential future claims.

- Settlement Statement: This statement details the financial aspects of the transaction, including any amounts owed, credits, and the final settlement costs. It provides transparency for both parties.

- Notice of Default: While not always required, this document notifies the borrower of their default status. It serves as a formal acknowledgment of the situation leading to the deed in lieu process.

Understanding these documents can help homeowners navigate the deed in lieu process more effectively. Each document serves a specific purpose and contributes to a smoother transition for both the borrower and the lender.