Official Durable Power of Attorney Template for the State of Ohio

In Ohio, the Durable Power of Attorney (DPOA) form is a crucial legal tool that empowers individuals to designate someone they trust to make decisions on their behalf, particularly when they are unable to do so themselves. This form covers a wide range of financial and healthcare matters, ensuring that your chosen agent can handle everything from managing bank accounts to making medical decisions. It remains effective even if you become incapacitated, which is why it’s labeled as “durable.” The DPOA allows for flexibility; you can specify the extent of your agent's authority, whether it’s broad or limited. It’s also important to note that the form must be signed and notarized to be valid, ensuring that your wishes are respected and legally binding. Understanding the nuances of this document can help you secure peace of mind, knowing that your affairs will be managed according to your preferences, even in challenging circumstances.

Key takeaways

Filling out and using the Ohio Durable Power of Attorney form is an important step in ensuring that your financial and medical decisions are handled according to your wishes. Here are some key takeaways to consider:

- Choose a trusted agent: Select someone who understands your values and can make decisions on your behalf when you are unable to do so.

- Be specific about powers granted: Clearly outline the powers you wish to give your agent. This could include financial matters, healthcare decisions, or both.

- Consider signing in front of witnesses: Although not always required, having witnesses can help validate the document and may prevent disputes later.

- Review and update regularly: Life circumstances change, so it’s wise to review your Durable Power of Attorney periodically to ensure it still reflects your wishes.

Guide to Writing Ohio Durable Power of Attorney

Filling out the Ohio Durable Power of Attorney form is a straightforward process. It is important to ensure that all information is accurate and complete. This document allows someone to make decisions on your behalf if you become unable to do so. Follow these steps carefully to fill out the form correctly.

- Obtain the Ohio Durable Power of Attorney form. You can find it online or through legal resources.

- Begin by filling in your full name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your attorney-in-fact. This person will have the authority to act on your behalf.

- Clearly specify the powers you are granting. You can choose general powers or limit them to specific actions. Be precise in your wording.

- Indicate when the powers become effective. You can choose to have them take effect immediately or upon a certain event, such as incapacitation.

- Sign and date the form at the designated area. Your signature must match the name you provided at the beginning.

- Have the form witnessed. Ohio law requires that two witnesses sign the document. They cannot be related to you or benefit from your estate.

- Consider having the document notarized. Although not required, notarization can add an extra layer of validation.

After completing the form, keep a copy for your records. Provide copies to your attorney-in-fact and any relevant family members. It is wise to review the document periodically to ensure it still meets your needs.

Discover Popular Durable Power of Attorney Templates for Specific States

Michigan Power of Attorney Form - It is important to review the document periodically to make necessary updates.

This Motorcycle Bill of Sale form is vital for ensuring a smooth transaction for both parties involved. For further insights, you can explore our comprehensive guide to the Motorcycle Bill of Sale template at your essential source.

North Carolina Durable Power of Attorney Form 2023 - This essential form grants a trusted individual the authority to make decisions in your best interest.

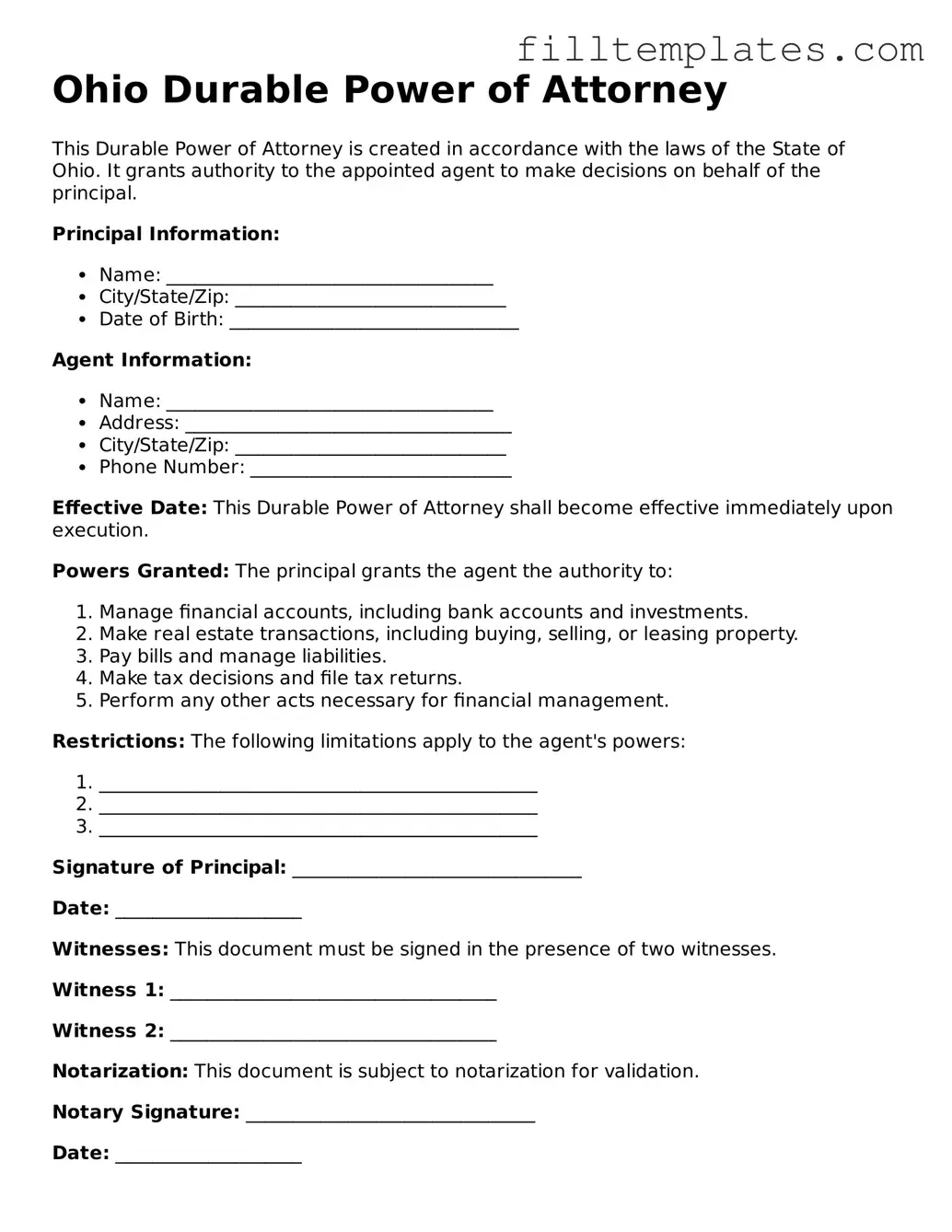

Form Preview Example

Ohio Durable Power of Attorney

This Durable Power of Attorney is created in accordance with the laws of the State of Ohio. It grants authority to the appointed agent to make decisions on behalf of the principal.

Principal Information:

- Name: ___________________________________

- City/State/Zip: _____________________________

- Date of Birth: _______________________________

Agent Information:

- Name: ___________________________________

- Address: ___________________________________

- City/State/Zip: _____________________________

- Phone Number: ____________________________

Effective Date: This Durable Power of Attorney shall become effective immediately upon execution.

Powers Granted: The principal grants the agent the authority to:

- Manage financial accounts, including bank accounts and investments.

- Make real estate transactions, including buying, selling, or leasing property.

- Pay bills and manage liabilities.

- Make tax decisions and file tax returns.

- Perform any other acts necessary for financial management.

Restrictions: The following limitations apply to the agent's powers:

- _______________________________________________

- _______________________________________________

- _______________________________________________

Signature of Principal: _______________________________

Date: ____________________

Witnesses: This document must be signed in the presence of two witnesses.

Witness 1: ___________________________________

Witness 2: ___________________________________

Notarization: This document is subject to notarization for validation.

Notary Signature: _______________________________

Date: ____________________

Documents used along the form

When an individual in Ohio executes a Durable Power of Attorney (DPOA), several other documents may complement this legal instrument, enhancing its effectiveness and addressing various aspects of personal and financial management. Below is a list of commonly used forms that often accompany a DPOA.

- Healthcare Power of Attorney: This document designates a person to make medical decisions on behalf of the individual if they become incapacitated. It ensures that healthcare preferences are honored even when the individual cannot communicate them.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they are unable to express their preferences, particularly in end-of-life scenarios. This document provides guidance to healthcare providers and family members.

- Financial Power of Attorney: Similar to a DPOA, this form specifically grants authority to manage financial affairs. It can be tailored for specific transactions or broader financial management, depending on the individual's needs.

- Will: A will outlines how an individual's assets will be distributed upon their death. While it does not address incapacity, it is a crucial document for estate planning and can work in conjunction with a DPOA.

- Motor Vehicle Bill of Sale: This essential form documents the sale of a vehicle, ensuring legal transfer of ownership is recognized in Texas. For detailed templates and information, visit smarttemplates.net.

- Trust Agreement: A trust can manage assets during an individual's lifetime and after their death. This document allows for more control over asset distribution and can help avoid probate, making it a valuable tool in estate planning.

- Advance Directive: This broader term encompasses both the healthcare power of attorney and living will. It provides a comprehensive approach to an individual's healthcare decisions and preferences.

- Beneficiary Designations: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the individual's death. Keeping these designations updated is crucial for ensuring that assets are distributed according to one's wishes.

- Real Estate Power of Attorney: This specialized form grants authority to manage real estate transactions. It allows an agent to buy, sell, or manage property on behalf of the individual, which can be particularly useful in real estate dealings.

- Authorization for Release of Medical Records: This document permits healthcare providers to share an individual's medical information with designated individuals. It is essential for ensuring that those making healthcare decisions have access to necessary medical history.

Incorporating these documents into a comprehensive planning strategy can provide clarity and ensure that an individual's wishes are respected in both health and financial matters. Each document serves a specific purpose, and together they create a framework for effective decision-making during challenging times.