Official Employment Verification Template for the State of Ohio

When starting a new job or applying for certain benefits in Ohio, you may encounter the Ohio Employment Verification form. This important document serves as a tool for employers to confirm an employee's work history, including details such as job title, dates of employment, and salary information. Designed to streamline the hiring process, the form helps ensure that both employers and prospective employees have accurate information. It is often required by various agencies, including financial institutions or government programs, to verify income and employment status. Completing the form accurately is crucial, as it can affect not only employment opportunities but also eligibility for loans, housing, and other essential services. Understanding how to fill out this form correctly can save time and prevent potential issues down the line.

Key takeaways

Filling out the Ohio Employment Verification form can seem daunting, but it’s an important step for both employers and employees. Here are some key takeaways to help you navigate the process smoothly.

- Understand the Purpose: This form is primarily used to verify an employee’s employment status, which can be crucial for various applications, including loans or housing.

- Gather Necessary Information: Before filling out the form, collect all relevant details such as the employee's name, Social Security number, and employment dates.

- Complete All Sections: Ensure that every section of the form is filled out accurately. Incomplete forms can lead to delays or complications.

- Use Clear and Concise Language: When providing information, clarity is key. Avoid jargon or overly complex terms to ensure the form is easily understood.

- Check for Accuracy: Double-check all entries for accuracy. Mistakes can lead to misunderstandings or the need for resubmission.

- Sign and Date the Form: Don’t forget to sign and date the form. An unsigned form may be considered invalid.

- Submit in a Timely Manner: Once completed, submit the form promptly to avoid any delays in processing requests.

- Keep Copies: Always retain a copy of the completed form for your records. This can be useful for future reference.

- Know Your Rights: Employees have the right to request a copy of their employment verification. Familiarize yourself with these rights to better assist them.

By following these takeaways, you can ensure a smoother experience with the Ohio Employment Verification form, benefiting both employers and employees alike.

Guide to Writing Ohio Employment Verification

After gathering the necessary information, you can proceed to fill out the Ohio Employment Verification form. This form requires specific details about the employee and their employment status. Ensure that all information is accurate to avoid delays in processing.

- Obtain the Ohio Employment Verification form from the appropriate source.

- Fill in the employee's full name in the designated section.

- Provide the employee's Social Security number, ensuring it is accurate.

- Enter the employee's job title or position within the company.

- List the start date of the employee's employment.

- Include the current employment status, indicating if the employee is active, terminated, or on leave.

- Provide the employer's name and contact information, including phone number and address.

- Sign and date the form where indicated, confirming the accuracy of the information provided.

- Submit the completed form to the relevant agency or individual as required.

Discover Popular Employment Verification Templates for Specific States

Peachcare for Kids Income - This document provides peace of mind to employers about prospective hires.

When engaging in activities that carry inherent risks, it is vital for individuals and organizations to utilize a Release of Liability form, as highlighted on smarttemplates.net, to safeguard against potential legal repercussions stemming from accidents or injuries that may occur during these events.

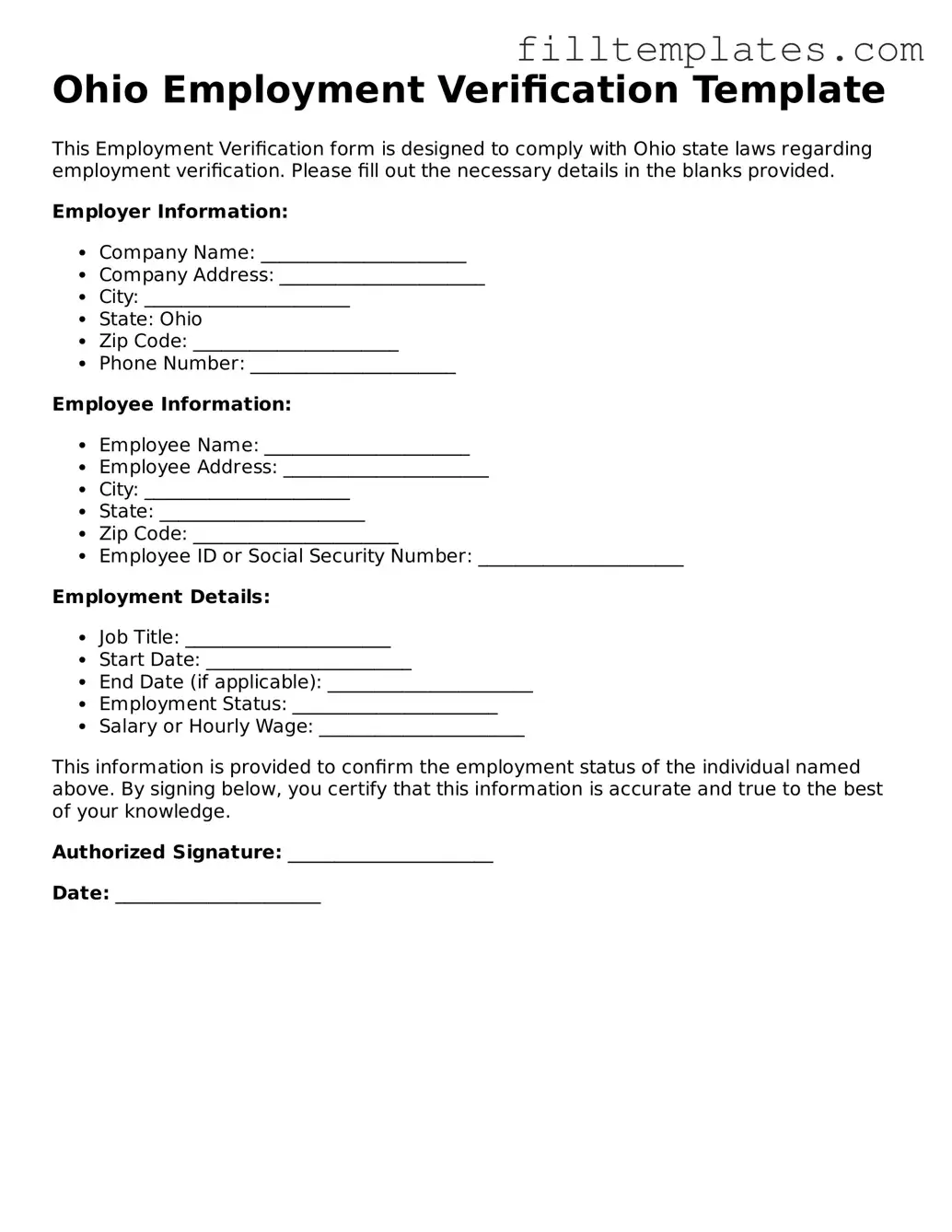

Form Preview Example

Ohio Employment Verification Template

This Employment Verification form is designed to comply with Ohio state laws regarding employment verification. Please fill out the necessary details in the blanks provided.

Employer Information:

- Company Name: ______________________

- Company Address: ______________________

- City: ______________________

- State: Ohio

- Zip Code: ______________________

- Phone Number: ______________________

Employee Information:

- Employee Name: ______________________

- Employee Address: ______________________

- City: ______________________

- State: ______________________

- Zip Code: ______________________

- Employee ID or Social Security Number: ______________________

Employment Details:

- Job Title: ______________________

- Start Date: ______________________

- End Date (if applicable): ______________________

- Employment Status: ______________________

- Salary or Hourly Wage: ______________________

This information is provided to confirm the employment status of the individual named above. By signing below, you certify that this information is accurate and true to the best of your knowledge.

Authorized Signature: ______________________

Date: ______________________

Documents used along the form

When navigating employment verification processes in Ohio, several other forms and documents may be necessary to ensure a smooth experience. These documents provide additional context and support for verifying an individual's employment status. Below are some commonly used forms that accompany the Ohio Employment Verification form.

- W-2 Form: This form is issued by an employer and summarizes an employee's annual wages and the taxes withheld. It serves as proof of income and employment history.

- Vehicle Ownership Documentation: When transferring ownership of a vehicle, the toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/california-motor-vehicle-bill-of-sale/ is essential for recording the necessary details of the transaction, ensuring legal recognition and facilitating a smooth registration process.

- Pay Stubs: Recent pay stubs can provide evidence of current employment and income. They typically show the employee's earnings for a specific pay period and can help verify employment status.

- Employment Offer Letter: This document outlines the terms of employment, including job title, salary, and start date. It serves as official confirmation of the job offer made to the employee.

- Tax Returns: Personal tax returns may be requested to verify income over a longer period. They provide a comprehensive view of an individual's earnings and can help substantiate claims of employment.

Understanding these documents can significantly ease the verification process. Having them ready can save time and provide clarity when confirming employment status in Ohio.