Official Operating Agreement Template for the State of Ohio

When establishing a limited liability company (LLC) in Ohio, one crucial document comes into play: the Operating Agreement. This form serves as the backbone of your business, outlining the management structure and operational procedures that govern your LLC. It details the rights and responsibilities of members, clarifies how profits and losses are distributed, and sets forth the rules for meetings and decision-making processes. An effective Operating Agreement not only helps prevent disputes among members but also provides a clear roadmap for the company’s future. Additionally, while Ohio law does not mandate an Operating Agreement, having one in place can enhance your LLC’s credibility and protect your personal assets. Understanding the key components of this agreement is essential for any entrepreneur looking to navigate the complexities of business ownership in the Buckeye State.

Key takeaways

Filling out and using the Ohio Operating Agreement form is an essential step for any limited liability company (LLC) operating in Ohio. Here are key takeaways to consider:

- Every LLC in Ohio should have an Operating Agreement, even if it is not legally required.

- The Operating Agreement outlines the management structure and operating procedures of the LLC.

- It is important to include the names and addresses of all members in the agreement.

- Clearly define the roles and responsibilities of each member to avoid future disputes.

- Specify how profits and losses will be distributed among members.

- Include provisions for adding new members or removing existing ones.

- Consider including a buy-sell agreement to outline how ownership interests can be transferred.

- Ensure that the Operating Agreement complies with Ohio laws and regulations.

- Review and update the agreement regularly to reflect any changes in the business or membership.

- Keep the Operating Agreement in a safe place, as it serves as a crucial document for the LLC.

Using the Operating Agreement effectively can help prevent misunderstandings and provide a clear framework for the LLC's operations.

Guide to Writing Ohio Operating Agreement

After obtaining the Ohio Operating Agreement form, you are ready to complete it. This document will require specific information about your business and its members. Carefully follow the steps below to ensure accurate and complete information is provided.

- Begin by entering the name of your limited liability company (LLC) at the top of the form.

- Next, provide the principal address of the LLC. This should be a physical address where the business operates.

- Identify the date of formation for the LLC. This is the date when the LLC was officially registered with the state.

- List the names and addresses of all members of the LLC. Each member should be clearly identified.

- Indicate the percentage of ownership for each member. This reflects their stake in the company.

- Outline the management structure of the LLC. Specify whether it will be member-managed or manager-managed.

- Include any additional provisions or rules that the members agree upon. This could cover decision-making processes, profit distribution, and other operational guidelines.

- Review the form for accuracy and completeness. Ensure all required fields are filled in correctly.

- Finally, have all members sign and date the form to validate the agreement.

Discover Popular Operating Agreement Templates for Specific States

How to Write an Operating Agreement - The Operating Agreement can outline procedures for distributing assets upon dissolution.

The Employment Application PDF form is a standardized document used by candidates to provide their personal, educational, and professional information when applying for a job. By utilizing resources such as OnlineLawDocs.com, individuals can ensure that they have access to the most recent and relevant application forms. This form ensures that employers have consistent data on all applicants, simplifying the hiring process. It plays a crucial role for both employers looking to fill positions and individuals seeking employment opportunities.

Operating Agreement Illinois - An Operating Agreement is useful for tax planning strategies.

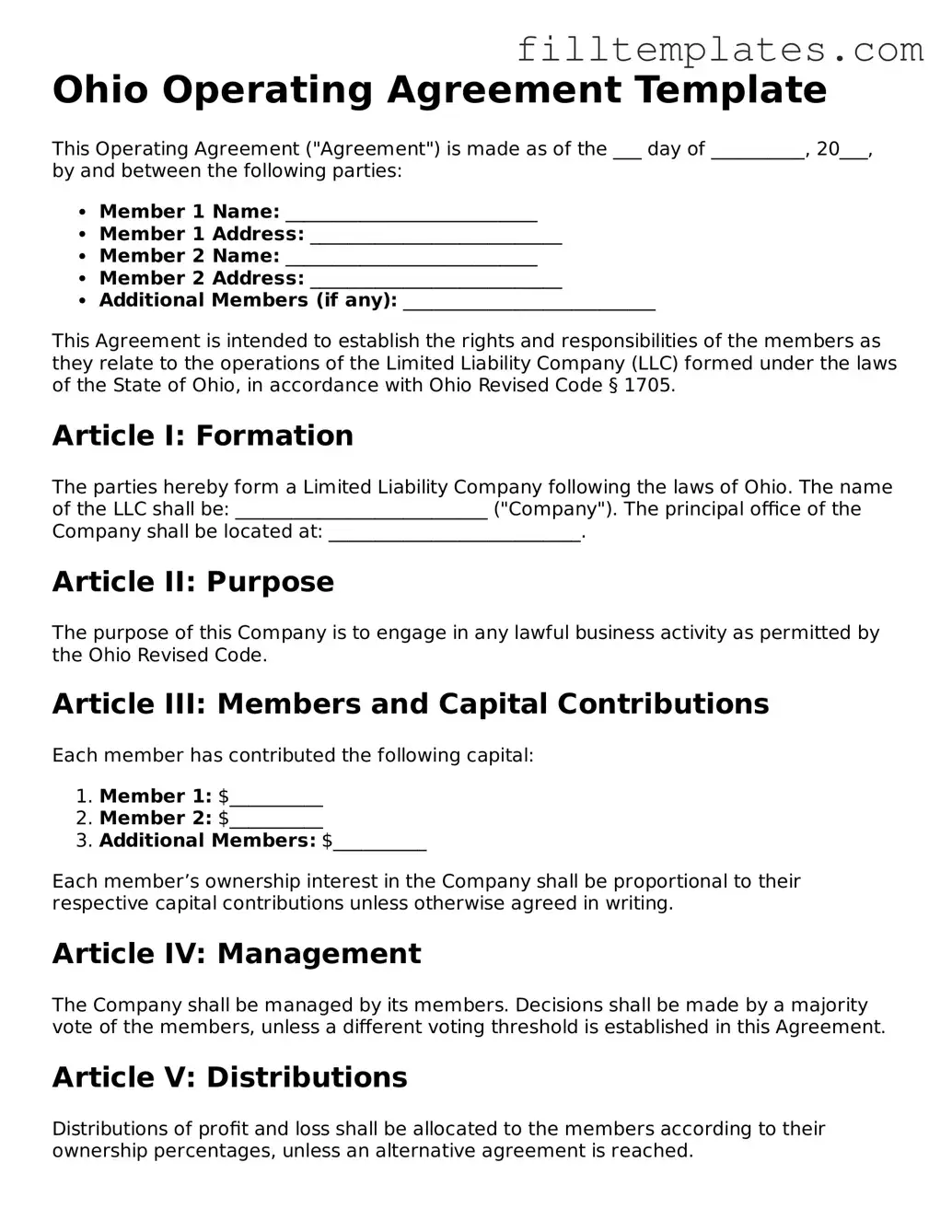

Form Preview Example

Ohio Operating Agreement Template

This Operating Agreement ("Agreement") is made as of the ___ day of __________, 20___, by and between the following parties:

- Member 1 Name: ___________________________

- Member 1 Address: ___________________________

- Member 2 Name: ___________________________

- Member 2 Address: ___________________________

- Additional Members (if any): ___________________________

This Agreement is intended to establish the rights and responsibilities of the members as they relate to the operations of the Limited Liability Company (LLC) formed under the laws of the State of Ohio, in accordance with Ohio Revised Code § 1705.

Article I: Formation

The parties hereby form a Limited Liability Company following the laws of Ohio. The name of the LLC shall be: ___________________________ ("Company"). The principal office of the Company shall be located at: ___________________________.

Article II: Purpose

The purpose of this Company is to engage in any lawful business activity as permitted by the Ohio Revised Code.

Article III: Members and Capital Contributions

Each member has contributed the following capital:

- Member 1: $__________

- Member 2: $__________

- Additional Members: $__________

Each member’s ownership interest in the Company shall be proportional to their respective capital contributions unless otherwise agreed in writing.

Article IV: Management

The Company shall be managed by its members. Decisions shall be made by a majority vote of the members, unless a different voting threshold is established in this Agreement.

Article V: Distributions

Distributions of profit and loss shall be allocated to the members according to their ownership percentages, unless an alternative agreement is reached.

Article VI: Indemnification

The members shall indemnify and hold harmless each other against any and all claims made against the Company arising from negligence or misconduct, to the fullest extent permitted by law.

Article VII: Amendments

This Operating Agreement may be amended or modified only through a written agreement signed by all members.

Article VIII: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Ohio.

Signatures

By signing below, each party acknowledges and agrees to be bound by the terms of this Operating Agreement:

- Member 1 Signature: ___________________________ Date: ____________

- Member 2 Signature: ___________________________ Date: ____________

- Additional Member Signatures: ___________________________ Date: ____________

Each member should carefully review this Agreement and consider consulting legal counsel before signing.

Documents used along the form

When forming a limited liability company (LLC) in Ohio, the Operating Agreement is a crucial document that outlines the management structure and operational guidelines of the business. However, there are several other forms and documents that are often used in conjunction with the Ohio Operating Agreement. These documents help ensure that your LLC operates smoothly and remains compliant with state regulations. Below is a list of essential forms you may need.

- Articles of Organization: This is the foundational document required to officially create your LLC in Ohio. It includes basic information such as the company name, address, and registered agent.

- Member Consent Form: This document captures the agreement of the LLC members regarding important decisions, such as the admission of new members or the dissolution of the company.

- EDD DE 2501 form: The EDD DE 2501 form, also known as the Claim for Disability Insurance (DI) Benefits form, serves as a critical document for individuals seeking to apply for disability benefits in the state. This form is the first step in the process to access financial support during times when health issues prevent someone from working. It is essential for applicants to accurately complete and submit this form to the Employment Development Department to initiate their claim. See more details at https://smarttemplates.net/fillable-edd-de-2501/.

- Bylaws: While not mandatory for LLCs, bylaws can provide additional rules governing the operation of the company, including the roles and responsibilities of members and managers.

- Operating Procedures: This document outlines the day-to-day operations of the LLC, ensuring that all members understand their roles and the processes involved in running the business.

- Membership Certificates: These certificates serve as proof of membership in the LLC and can be issued to members to signify their ownership stake.

- Tax Identification Number (TIN) Application: Obtaining a TIN from the IRS is essential for tax purposes. This number allows your LLC to open bank accounts and file taxes.

- Annual Report: Some states require LLCs to file an annual report, which provides updated information about the business, such as changes in membership or management.

- Non-Disclosure Agreement (NDA): If your LLC handles sensitive information, an NDA can protect your business secrets by preventing members or employees from disclosing proprietary information.

- Buy-Sell Agreement: This agreement outlines how ownership interests in the LLC can be transferred, providing clarity on what happens if a member wants to leave the company or passes away.

Understanding these additional documents can help you navigate the complexities of running an LLC in Ohio. Each form serves a specific purpose and contributes to the overall health and compliance of your business. Make sure to consider these documents carefully as you establish and grow your LLC.