Official Promissory Note Template for the State of Ohio

The Ohio Promissory Note form is an essential document for anyone looking to formalize a loan agreement in the state of Ohio. This form serves as a written promise from the borrower to repay a specific amount of money to the lender, typically with interest, over a designated period. It outlines key details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. By clearly stating the terms of the loan, this form helps protect both parties involved, ensuring that expectations are understood and agreed upon. Additionally, it can include clauses regarding default and remedies, providing a framework for resolution should any issues arise. Using the Ohio Promissory Note form not only adds a layer of professionalism to the transaction but also offers legal protection, making it a vital tool for personal loans, business financing, or any situation where money is borrowed. Understanding how to properly fill out and utilize this form can lead to smoother financial interactions and peace of mind for both borrowers and lenders.

Key takeaways

When filling out and using the Ohio Promissory Note form, it’s important to keep a few key points in mind to ensure clarity and legal enforceability.

- Accurate Information: Always provide accurate details about the borrower and lender, including names, addresses, and contact information. This ensures that both parties can be easily reached if needed.

- Clear Terms: Clearly outline the terms of the loan, including the principal amount, interest rate, repayment schedule, and any late fees. This helps prevent misunderstandings later on.

- Signatures Required: Both the borrower and lender must sign the document. Without signatures, the note may not be considered valid, which could lead to complications in enforcing the agreement.

- Keep a Copy: After the note is completed and signed, make sure to keep a copy for your records. This will serve as proof of the agreement and can be useful if any disputes arise.

Guide to Writing Ohio Promissory Note

After obtaining the Ohio Promissory Note form, you will need to complete it accurately to ensure that it serves its intended purpose. Carefully follow the steps outlined below to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format month, day, year.

- Next, fill in the name and address of the borrower. This is the individual or entity who will be receiving the loan.

- Provide the name and address of the lender. This is the individual or entity providing the loan.

- Clearly state the principal amount of the loan. This is the total amount borrowed, without interest.

- Indicate the interest rate. Specify whether it is fixed or variable and include the applicable percentage.

- Detail the repayment schedule. Specify the frequency of payments, such as weekly, monthly, or annually, and the due date for each payment.

- Include any late fees or penalties for missed payments. Clearly outline the terms associated with late payments.

- Sign the form. The borrower must sign and date the document to make it legally binding.

- If applicable, have the lender sign the form as well. This confirms their agreement to the terms outlined.

- Make copies of the completed form for both parties. This ensures that everyone has a record of the agreement.

Once the form is filled out and signed, both parties should retain their copies for future reference. This will help clarify the terms of the loan and provide a record should any disputes arise.

Discover Popular Promissory Note Templates for Specific States

Promissory Note Illinois - This note protects the lender by documenting the loan agreement.

Promissory Note Template Michigan - A promissory note may include stipulations regarding collateral or guarantees for the loan.

For individuals looking to navigate vehicle transactions effectively, a vital resource is the "critical Motor Vehicle Bill of Sale" that outlines necessary details for both the buyer and seller. This document ensures a smooth transfer of ownership and clarifies all transactional aspects, making it an indispensable tool for any exchange. For more insights, you can access a useful template at critical Motor Vehicle Bill of Sale.

Promissory Note Friendly Loan Agreement Format - This document empowers the lender to take legal action in case of non-payment.

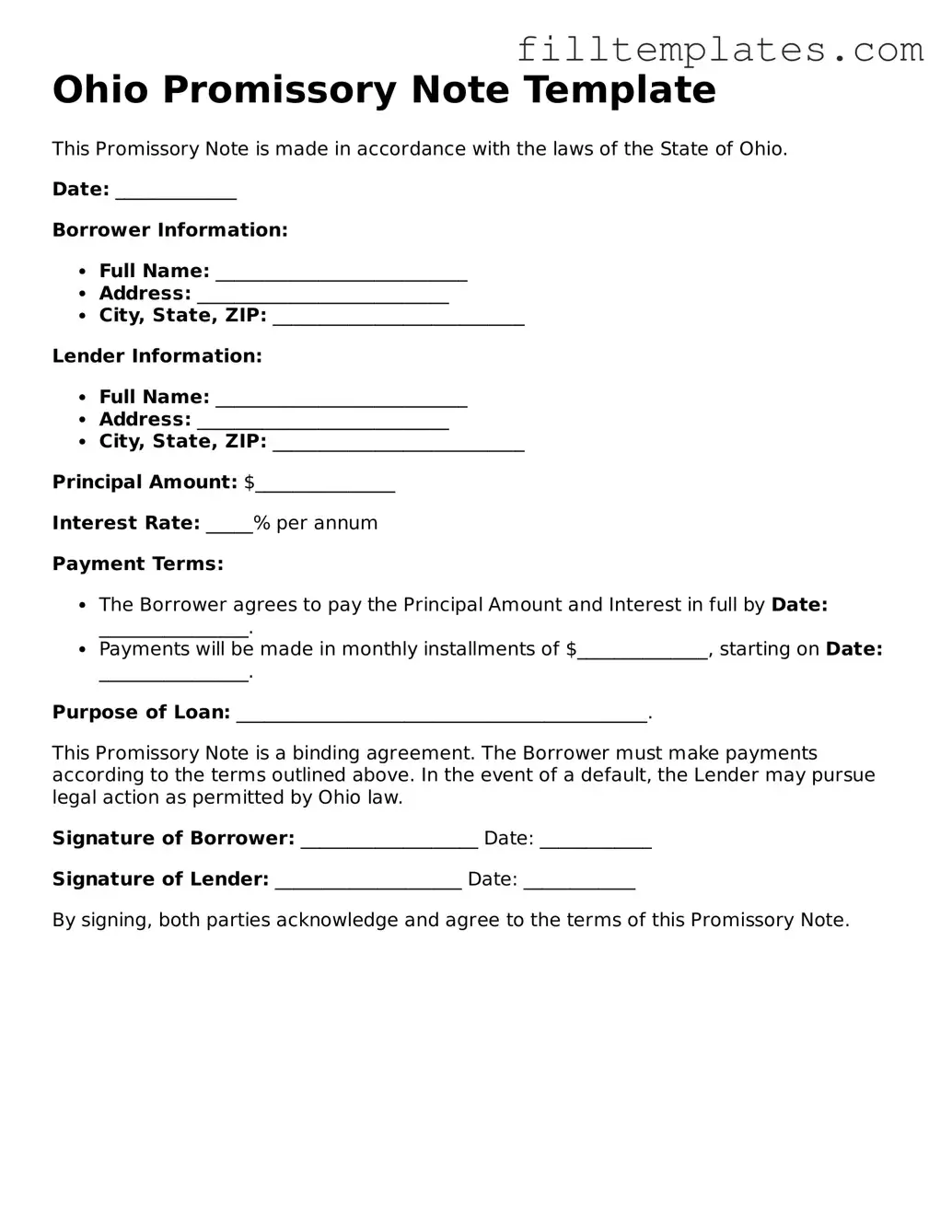

Form Preview Example

Ohio Promissory Note Template

This Promissory Note is made in accordance with the laws of the State of Ohio.

Date: _____________

Borrower Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

Lender Information:

- Full Name: ___________________________

- Address: ___________________________

- City, State, ZIP: ___________________________

Principal Amount: $_______________

Interest Rate: _____% per annum

Payment Terms:

- The Borrower agrees to pay the Principal Amount and Interest in full by Date: ________________.

- Payments will be made in monthly installments of $______________, starting on Date: ________________.

Purpose of Loan: ____________________________________________.

This Promissory Note is a binding agreement. The Borrower must make payments according to the terms outlined above. In the event of a default, the Lender may pursue legal action as permitted by Ohio law.

Signature of Borrower: ___________________ Date: ____________

Signature of Lender: ____________________ Date: ____________

By signing, both parties acknowledge and agree to the terms of this Promissory Note.

Documents used along the form

When engaging in a loan agreement, it's crucial to have all necessary documents in order. The Ohio Promissory Note is just one piece of the puzzle. Below is a list of other forms and documents that are commonly used alongside a promissory note to ensure clarity and protection for all parties involved.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets pledged as security. It defines the rights and responsibilities of both parties regarding the collateral.

- Disclosure Statement: This document provides important information about the loan, such as fees, interest rates, and terms. It ensures that borrowers are fully informed before agreeing to the loan.

- Personal Guarantee: In cases where a business is borrowing money, a personal guarantee may be required from the business owner. This document holds the owner personally responsible for the loan if the business defaults.

- Payment Schedule: A detailed outline of the repayment timeline, including due dates and amounts, helps both parties keep track of payments and avoid misunderstandings.

- Amendment Agreement: If any terms of the original promissory note need to be changed, this document formalizes those changes. It ensures that all parties agree to the new terms.

- Release of Liability: To mitigate risks, parties involved may consider including a Release of Liability form. This document ensures that all parties acknowledge and accept potential risks associated with the transaction. For more details, visit smarttemplates.net.

- Release of Liability: Once the loan is paid in full, this document releases the borrower from any further obligations. It serves as proof that the debt has been settled.

- Loan Payoff Statement: This document provides a detailed account of the remaining balance, including any interest or fees due at the time of payoff. It is essential for ensuring accurate final payments.

Having these documents in place not only safeguards the interests of both the lender and borrower but also fosters a transparent relationship. Proper documentation is key to preventing disputes and ensuring a smooth transaction.