Official Real Estate Purchase Agreement Template for the State of Ohio

When embarking on the journey of buying or selling property in Ohio, understanding the Ohio Real Estate Purchase Agreement form is crucial. This document serves as the backbone of any real estate transaction, outlining the terms and conditions agreed upon by the buyer and seller. It typically includes essential details such as the purchase price, property description, and closing date. Additionally, it addresses contingencies, which are conditions that must be met for the sale to proceed, such as inspections or financing approvals. The agreement also specifies the earnest money deposit, a sum that demonstrates the buyer's commitment to the purchase. Furthermore, it lays out the responsibilities of both parties, ensuring clarity on who handles repairs or closing costs. By grasping the key components of this form, individuals can navigate the complexities of real estate transactions with confidence, fostering a smoother process from initial offer to final closing.

Key takeaways

When engaging in real estate transactions in Ohio, understanding the Real Estate Purchase Agreement form is crucial. Here are some key takeaways to consider:

- Understand the Basics: Familiarize yourself with the essential elements of the agreement, including the purchase price, property description, and the parties involved.

- Contingencies Matter: Pay attention to contingencies that may be included, such as financing, inspections, and the sale of another property. These can protect your interests.

- Review Deadlines: Be aware of all deadlines outlined in the agreement. Timely responses are vital to keep the transaction on track.

- Negotiate Terms: Don’t hesitate to negotiate terms that may not align with your needs. This could include closing dates or repairs to be made before the sale.

- Legal Descriptions: Ensure that the legal description of the property is accurate. This prevents disputes regarding the property boundaries.

- Consult a Professional: Consider seeking advice from a real estate attorney or agent. Their expertise can help clarify complex aspects of the agreement.

- Keep Records: Maintain copies of all signed documents and correspondence. This documentation is important for future reference and potential disputes.

Guide to Writing Ohio Real Estate Purchase Agreement

Once you have the Ohio Real Estate Purchase Agreement form in hand, you can begin the process of filling it out. This form requires specific information from both the buyer and the seller, and accuracy is crucial. Completing the form correctly will help ensure a smooth transaction.

- Begin by entering the date at the top of the form.

- Fill in the names and contact information of the buyer(s) and seller(s). Ensure all names are spelled correctly.

- Provide the property address, including city, state, and zip code.

- Specify the purchase price of the property. This amount should reflect the agreed-upon price between the buyer and seller.

- Indicate the amount of earnest money the buyer will provide. This shows the seller the buyer's commitment.

- Outline the terms of financing. Specify whether the buyer will be using a mortgage or other financing methods.

- Include any contingencies that must be met before the sale can proceed, such as home inspections or financing approval.

- Detail the closing date, which is when the transaction will be finalized.

- Sign and date the form at the bottom. Both buyer and seller must provide their signatures.

After completing the form, both parties should review it for accuracy. Once confirmed, the agreement can be submitted to the appropriate parties involved in the transaction.

Discover Popular Real Estate Purchase Agreement Templates for Specific States

North Carolina Real Estate Purchase Agreement - It should clearly state any financing contingencies.

When engaging in a vehicle sale, it's essential to have a clear understanding of the necessary documentation, such as the California Vehicle Purchase Agreement form, which is available for reference at TopTemplates.info. This document not only lays out the key details of the transaction but also safeguards the interests of both the buyer and the seller.

Purchase Agreement Michigan Template - Allows for negotiation of repairs prior to closing.

Form Preview Example

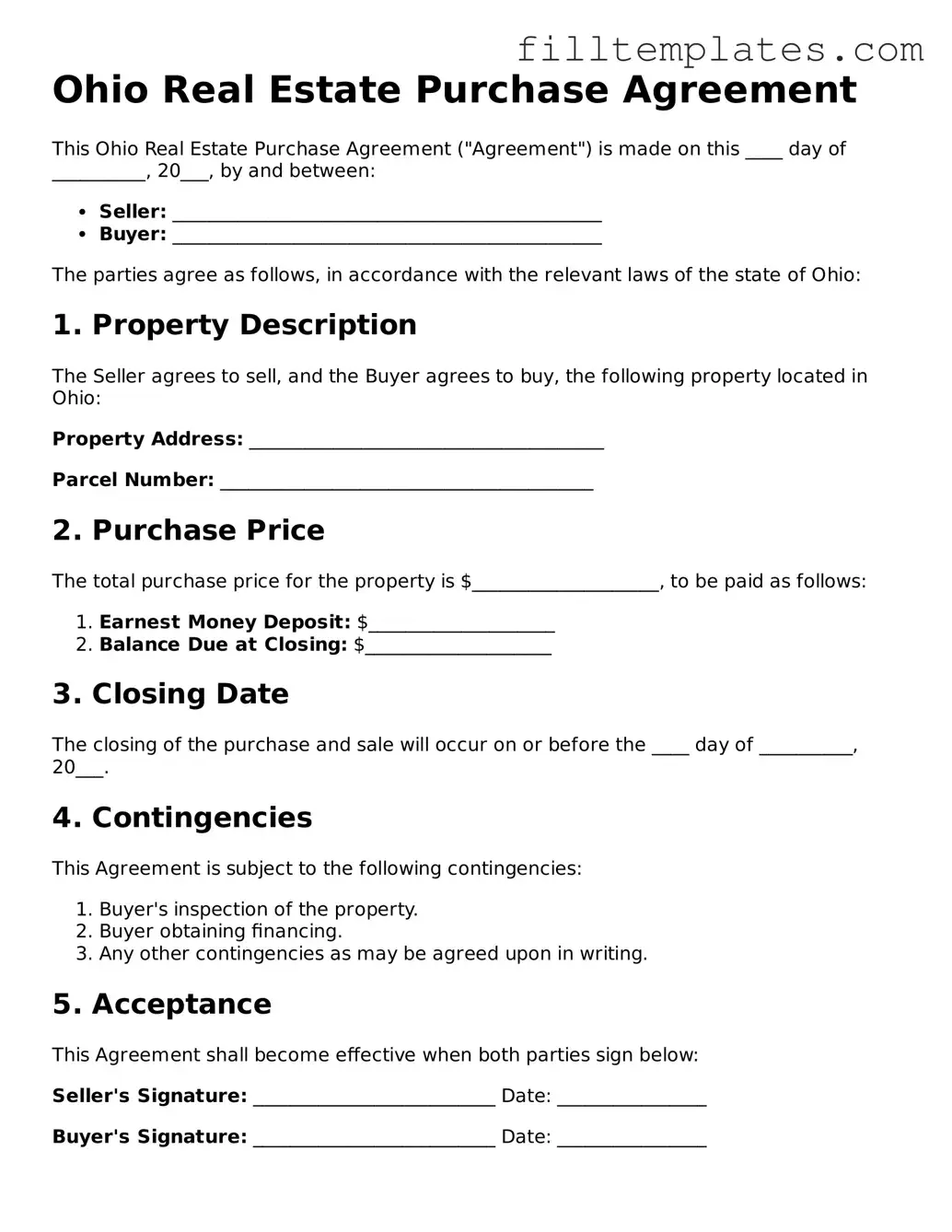

Ohio Real Estate Purchase Agreement

This Ohio Real Estate Purchase Agreement ("Agreement") is made on this ____ day of __________, 20___, by and between:

- Seller: ______________________________________________

- Buyer: ______________________________________________

The parties agree as follows, in accordance with the relevant laws of the state of Ohio:

1. Property Description

The Seller agrees to sell, and the Buyer agrees to buy, the following property located in Ohio:

Property Address: ______________________________________

Parcel Number: ________________________________________

2. Purchase Price

The total purchase price for the property is $____________________, to be paid as follows:

- Earnest Money Deposit: $____________________

- Balance Due at Closing: $____________________

3. Closing Date

The closing of the purchase and sale will occur on or before the ____ day of __________, 20___.

4. Contingencies

This Agreement is subject to the following contingencies:

- Buyer's inspection of the property.

- Buyer obtaining financing.

- Any other contingencies as may be agreed upon in writing.

5. Acceptance

This Agreement shall become effective when both parties sign below:

Seller's Signature: __________________________ Date: ________________

Buyer's Signature: __________________________ Date: ________________

By signing this Agreement, all parties acknowledge that they understand and accept the terms and conditions herein stated.

It is advisable for both parties to consult with legal and real estate professionals before entering into this Agreement.

This format is intended to comply with Ohio state laws regarding real estate transactions. Make sure to fill out all relevant blanks accurately to create a binding Agreement.

Documents used along the form

When buying or selling real estate in Ohio, several documents accompany the Real Estate Purchase Agreement. Each document plays a crucial role in the transaction, ensuring that both parties understand their rights and obligations. Here’s a list of common forms and documents used alongside the Purchase Agreement.

- Property Disclosure Form: This document requires sellers to disclose known defects or issues with the property. It helps buyers make informed decisions.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about potential lead hazards and outlines the seller's responsibilities.

- Title Commitment: This document outlines the current ownership of the property and any liens or encumbrances that may affect the sale.

- Closing Statement: Also known as a HUD-1, this form itemizes all costs and fees associated with the transaction, providing transparency for both parties.

- Bill of Sale: While primarily associated with personal property, it's essential to understand the importance of a Bill of Sale in transactions involving assets. For more details, you can refer to onlinelawdocs.com/california-bill-of-sale.

- Earnest Money Agreement: This document outlines the amount of money the buyer will deposit to show good faith and secure the purchase offer.

- Inspection Report: After a home inspection, this report details the condition of the property, highlighting any necessary repairs or maintenance.

- Appraisal Report: Conducted by a licensed appraiser, this report assesses the property's market value, which is crucial for financing.

- Loan Estimate: Provided by lenders, this document outlines the estimated costs of the mortgage, helping buyers understand their financial obligations.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and that there are no undisclosed claims against it.

- Power of Attorney: If one party cannot attend the closing, this document allows someone else to act on their behalf, ensuring the transaction proceeds smoothly.

These documents work together to create a clear and transparent process for all parties involved in a real estate transaction. Understanding each one can help buyers and sellers navigate their responsibilities and protect their interests effectively.