Official Transfer-on-Death Deed Template for the State of Ohio

The Ohio Transfer-on-Death Deed form provides a straightforward way for property owners to transfer their real estate to designated beneficiaries upon their death, avoiding the complexities of probate. This legal instrument allows individuals to maintain full control of their property during their lifetime while ensuring a smooth transition of ownership after passing. The form requires specific information, including the names of the current owners and the beneficiaries, as well as a clear description of the property. It must be signed in the presence of a notary public and recorded with the county recorder’s office to be valid. Importantly, the Transfer-on-Death Deed can be revoked or modified at any time before the owner’s death, offering flexibility in estate planning. Understanding the nuances of this deed can help individuals make informed decisions about their property and beneficiaries, ultimately simplifying the transfer process for loved ones in the future.

Key takeaways

- Understand the Purpose: A Transfer-on-Death Deed allows property owners in Ohio to transfer real estate to beneficiaries without going through probate.

- Eligibility: Only individuals who own real estate can complete this deed. It must be signed by the property owner.

- Beneficiary Designation: You can name one or more beneficiaries. If multiple beneficiaries are named, clarify how the property will be divided.

- Revocation: The deed can be revoked at any time before the owner’s death, allowing flexibility in estate planning.

- Filing Requirements: The completed deed must be filed with the county recorder’s office in the county where the property is located.

- Effective Date: The transfer only takes effect upon the death of the property owner, ensuring the owner retains full control during their lifetime.

- Tax Implications: Consult a tax professional to understand any potential tax consequences for both the owner and the beneficiaries.

- Legal Advice: While the form is straightforward, seeking legal advice can help avoid mistakes and ensure the deed aligns with your overall estate plan.

Guide to Writing Ohio Transfer-on-Death Deed

Filling out the Ohio Transfer-on-Death Deed form requires careful attention to detail. Once completed, this form will facilitate the transfer of property upon the death of the owner, allowing for a smoother transition of assets to the designated beneficiaries. Below are the steps to accurately fill out the form.

- Obtain the Ohio Transfer-on-Death Deed form from a reliable source, such as the Ohio Secretary of State's website or a legal stationery store.

- Begin by entering the name of the property owner(s) in the designated section. Ensure that the names match the names on the property title.

- Provide the address of the property being transferred. Include the street address, city, state, and zip code.

- Clearly describe the property. This includes specifying the type of property (e.g., residential, commercial) and any relevant legal descriptions, such as parcel number or lot number.

- Identify the beneficiary or beneficiaries. Include their full names and addresses. If there are multiple beneficiaries, list them in the order of preference.

- Indicate whether the transfer is to be made to all beneficiaries equally or if specific shares are designated for each beneficiary.

- Sign and date the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Submit the completed form to the county recorder’s office in the county where the property is located. Pay any applicable recording fees.

Discover Popular Transfer-on-Death Deed Templates for Specific States

Illinois Transfer on Death Instrument - It can be a powerful way to protect your loved ones and ensure your property goes where you intend.

To streamline the process of evaluating potential tenants, many landlords turn to resources like smarttemplates.net, which offer convenient templates for creating comprehensive Rental Application forms that gather essential details from applicants.

Tod in California - This deed may not be advisable for all types of property; consulting a professional can help determine its suitability.

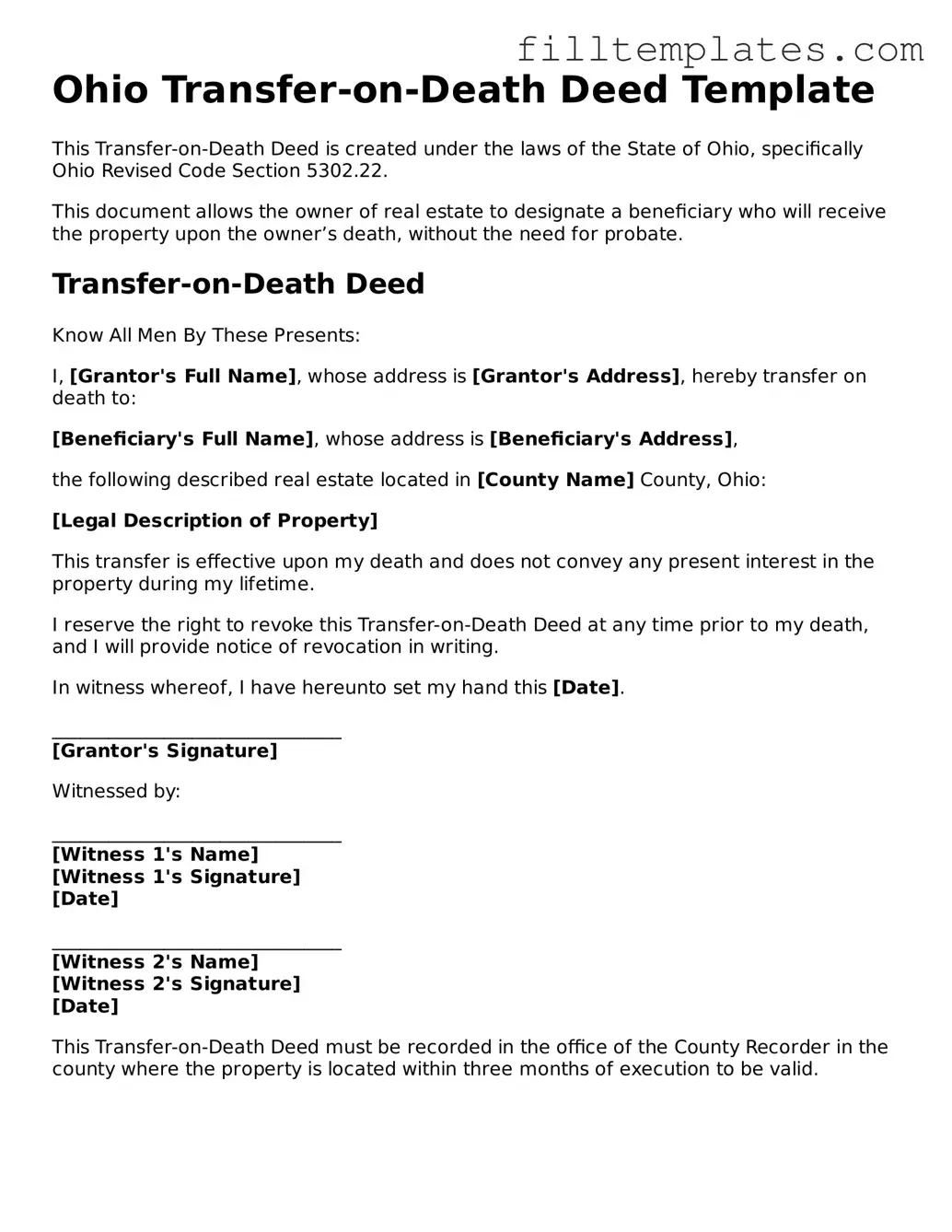

Form Preview Example

Ohio Transfer-on-Death Deed Template

This Transfer-on-Death Deed is created under the laws of the State of Ohio, specifically Ohio Revised Code Section 5302.22.

This document allows the owner of real estate to designate a beneficiary who will receive the property upon the owner’s death, without the need for probate.

Transfer-on-Death Deed

Know All Men By These Presents:

I, [Grantor's Full Name], whose address is [Grantor's Address], hereby transfer on death to:

[Beneficiary's Full Name], whose address is [Beneficiary's Address],

the following described real estate located in [County Name] County, Ohio:

[Legal Description of Property]

This transfer is effective upon my death and does not convey any present interest in the property during my lifetime.

I reserve the right to revoke this Transfer-on-Death Deed at any time prior to my death, and I will provide notice of revocation in writing.

In witness whereof, I have hereunto set my hand this [Date].

_______________________________

[Grantor's Signature]

Witnessed by:

_______________________________

[Witness 1's Name]

[Witness 1's Signature]

[Date]

_______________________________

[Witness 2's Name]

[Witness 2's Signature]

[Date]

This Transfer-on-Death Deed must be recorded in the office of the County Recorder in the county where the property is located within three months of execution to be valid.

Documents used along the form

When preparing to use the Ohio Transfer-on-Death Deed form, several other documents may be necessary to ensure a smooth transfer of property. Each of these forms serves a specific purpose and can help clarify the intentions of the property owner. Below is a list of commonly associated documents.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It may complement the Transfer-on-Death Deed by addressing other assets not covered by the deed.

- Living Will: This document expresses an individual's wishes regarding medical treatment in the event they become incapacitated. While not directly related to property transfer, it can be part of overall estate planning.

- Durable Power of Attorney: A document that allows someone to make financial and legal decisions on behalf of another person if they become unable to do so. This can be crucial for managing property before death.

- California Motor Vehicle Bill of Sale: This essential document formalizes the transfer of vehicle ownership within California, providing legal recognition of the sale and necessary details for registration and taxation purposes. More information can be found at https://toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale/california-motor-vehicle-bill-of-sale.

- Affidavit of Heirship: A sworn statement that establishes the heirs of a deceased person. This document may be necessary if the property owner passes away without a will.

- Property Deed: The official document that proves ownership of real estate. It is important to have the current deed on hand when creating a Transfer-on-Death Deed.

- Title Search Report: A document that provides a history of the property’s ownership and any liens or claims against it. This report helps confirm that the property can be transferred as intended.

- Estate Inventory: A comprehensive list of all assets owned by an individual at the time of their death. This document can help in understanding the full scope of the estate.

- Tax Returns: Previous tax filings may be required to assess any tax implications related to the transfer of property upon death.

- Notice of Death: A formal notification that a person has passed away. This document may be necessary for various legal processes, including property transfer.

Understanding the various documents that may accompany the Ohio Transfer-on-Death Deed form is essential for effective estate planning. Each document plays a role in ensuring that property is transferred smoothly and according to the owner's wishes.