Free Operating Agreement Template

When starting a limited liability company (LLC), one of the most important documents you’ll need is the Operating Agreement. This form outlines the structure and rules for your business, serving as a roadmap for how the LLC will operate. It typically includes details about the ownership percentages of each member, how profits and losses will be distributed, and the decision-making process for the company. Additionally, the Operating Agreement can specify the roles and responsibilities of each member, ensuring that everyone knows their duties. It also addresses what happens if a member wants to leave the company or if new members join. By clearly defining these aspects, the Operating Agreement helps prevent misunderstandings and conflicts among members, fostering a smoother operation of the business. Having this document in place not only protects the interests of the members but also enhances the credibility of the LLC in the eyes of banks and potential investors.

Operating Agreement - Adapted for State

Operating Agreement Categories

Key takeaways

When filling out and using the Operating Agreement form, consider the following key takeaways:

- Define Roles Clearly: Specify the roles and responsibilities of each member. This helps prevent misunderstandings and ensures accountability.

- Outline Profit Distribution: Clearly state how profits and losses will be shared among members. This can help avoid disputes later on.

- Include Decision-Making Procedures: Establish how decisions will be made within the organization. This can include voting rights and the process for reaching consensus.

- Address Member Changes: Include provisions for adding or removing members. This prepares the organization for future changes in membership.

- Review Regularly: Treat the Operating Agreement as a living document. Regular reviews ensure it remains relevant as the organization evolves.

Guide to Writing Operating Agreement

Filling out an Operating Agreement is an important step for a business entity, particularly for LLCs. This document outlines the management structure and operating procedures of the company. Once completed, it will serve as a reference point for members to understand their rights and responsibilities. Follow these steps to ensure you fill out the form accurately.

- Begin with the basic information. Enter the name of your LLC as it appears on your Articles of Organization.

- Provide the principal address of the business. This should be a physical address where the company is located.

- List the names and addresses of all members. Each member's full name and residential address are required.

- Specify the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Outline the ownership percentages. Clearly state the percentage of ownership for each member.

- Detail the capital contributions. Describe what each member is contributing to the business, whether it's cash, property, or services.

- Establish the distribution of profits and losses. Explain how profits and losses will be shared among the members.

- Include provisions for meetings. State how often members will meet and the process for calling meetings.

- Define the procedures for adding or removing members. Outline the steps that must be taken if a member wants to join or leave the LLC.

- Sign and date the document. Ensure all members sign and date the agreement to validate it.

Other Forms:

High School Transcript - A tool for colleges to assess a student's academic performance.

When it comes to legal transactions, having the right documentation is crucial. For those looking for a way to transfer ownership, a reliable resource can be found at the essential Arizona Trailer Bill of Sale form website. This document provides clarity and structure for both buyers and sellers throughout the process.

How to Write Memorandum of Understanding - A MOU can facilitate joint projects, including research initiatives or community services.

Form Preview Example

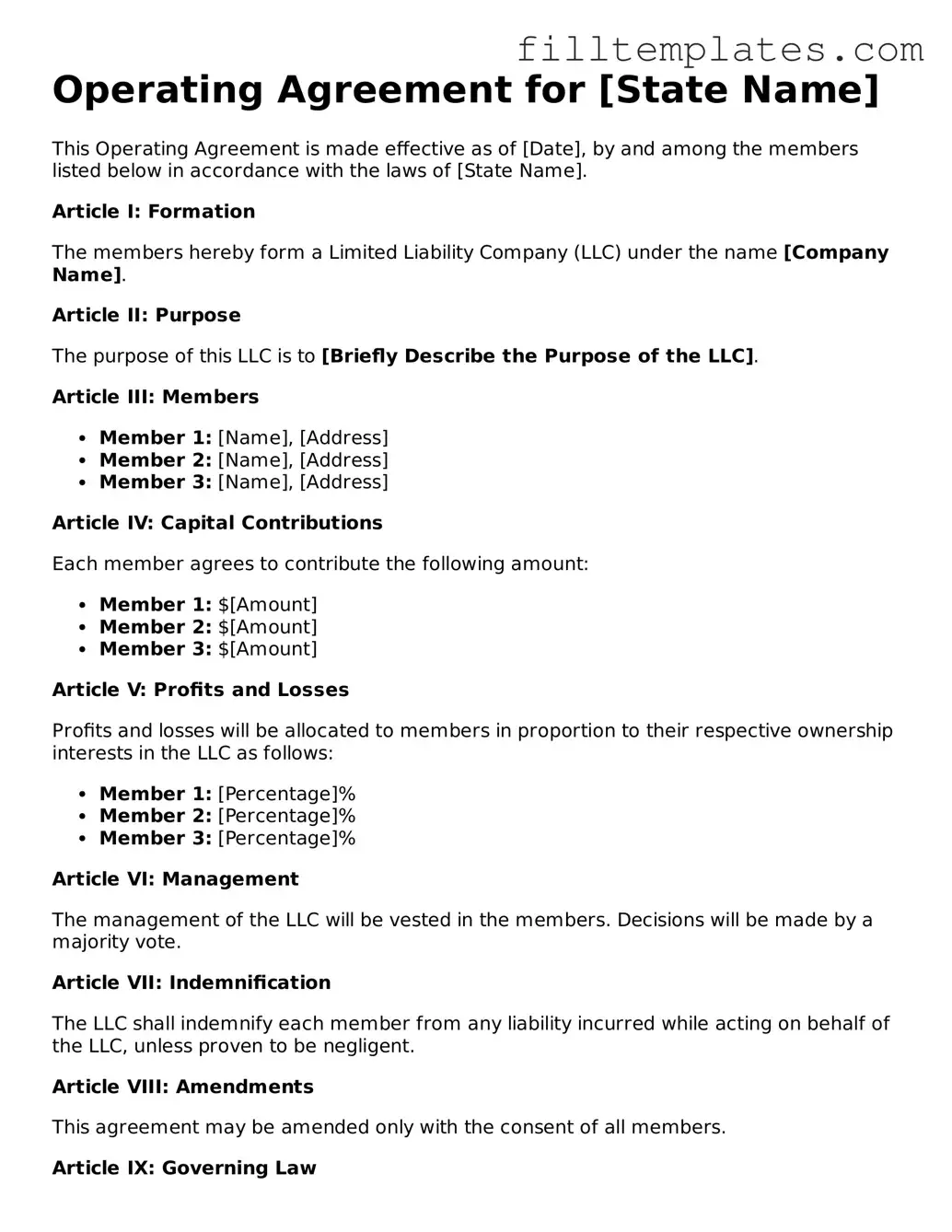

Operating Agreement for [State Name]

This Operating Agreement is made effective as of [Date], by and among the members listed below in accordance with the laws of [State Name].

Article I: Formation

The members hereby form a Limited Liability Company (LLC) under the name [Company Name].

Article II: Purpose

The purpose of this LLC is to [Briefly Describe the Purpose of the LLC].

Article III: Members

- Member 1: [Name], [Address]

- Member 2: [Name], [Address]

- Member 3: [Name], [Address]

Article IV: Capital Contributions

Each member agrees to contribute the following amount:

- Member 1: $[Amount]

- Member 2: $[Amount]

- Member 3: $[Amount]

Article V: Profits and Losses

Profits and losses will be allocated to members in proportion to their respective ownership interests in the LLC as follows:

- Member 1: [Percentage]%

- Member 2: [Percentage]%

- Member 3: [Percentage]%

Article VI: Management

The management of the LLC will be vested in the members. Decisions will be made by a majority vote.

Article VII: Indemnification

The LLC shall indemnify each member from any liability incurred while acting on behalf of the LLC, unless proven to be negligent.

Article VIII: Amendments

This agreement may be amended only with the consent of all members.

Article IX: Governing Law

This agreement is governed by the laws of [State Name].

IN WITNESS WHEREOF, the undersigned members have executed this Operating Agreement as of the date first above written.

Member Signatures:

- Member 1: ___________________________ Date: _______________

- Member 2: ___________________________ Date: _______________

- Member 3: ___________________________ Date: _______________

Documents used along the form

An Operating Agreement is a crucial document for any limited liability company (LLC), outlining the management structure and operational procedures. However, it is often accompanied by several other important forms and documents that support the establishment and functioning of the LLC. Below is a list of commonly used documents alongside the Operating Agreement.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and the names of the members.

- Member Consent Forms: These forms are used to document the agreement of all members regarding significant decisions or changes in the company, ensuring that everyone is on the same page.

- Bylaws: While not always required for LLCs, bylaws outline the internal rules and procedures for managing the company, including voting rights and meeting protocols.

- Initial Capital Contribution Agreement: This document details the initial financial contributions made by each member to the LLC, establishing ownership percentages and financial obligations.

- Membership Certificates: These certificates serve as proof of ownership for each member in the LLC, often issued upon formation or when a new member joins.

- Operating Procedures Manual: This manual provides detailed guidelines on the day-to-day operations of the LLC, covering various aspects such as employee roles and customer service protocols.

- Bill of Sale: A Bill of Sale form is essential for the transfer of ownership and can be found through Free Business Forms.

- Tax Forms: Various tax-related documents, such as IRS Form SS-4 for obtaining an Employer Identification Number (EIN), are essential for the LLC's tax reporting and compliance.

- Non-Disclosure Agreements (NDAs): These agreements protect sensitive information shared among members or with external parties, ensuring confidentiality in business operations.

- Employment Agreements: If the LLC hires employees, these agreements outline the terms of employment, including duties, compensation, and termination procedures.

In summary, while the Operating Agreement is fundamental to the operation of an LLC, it is essential to consider the other documents that support the structure and functionality of the business. Each of these forms plays a significant role in ensuring that the LLC operates smoothly and in compliance with legal requirements.