Free Owner Financing Contract Template

When navigating the world of real estate transactions, understanding the Owner Financing Contract form can be a game-changer for both buyers and sellers. This form serves as a crucial tool that outlines the terms of financing directly between the property owner and the buyer, bypassing traditional lending institutions. Key aspects include the purchase price, down payment, interest rate, repayment schedule, and any contingencies that may apply. Additionally, it specifies the responsibilities of each party, such as property maintenance and insurance obligations. By using this contract, buyers may find it easier to secure financing, especially if they have difficulty obtaining a conventional mortgage. On the other hand, sellers can benefit from a steady income stream while retaining the title to the property until the buyer fulfills their payment obligations. Overall, the Owner Financing Contract form not only facilitates a smoother transaction but also empowers individuals to take control of their real estate investments.

Key takeaways

When it comes to filling out and using the Owner Financing Contract form, there are several important points to keep in mind. Understanding these can help ensure a smooth transaction for both the buyer and the seller.

- Clarity is Key: Clearly outline the terms of the financing agreement, including the interest rate, payment schedule, and any penalties for late payments. This helps prevent misunderstandings down the road.

- Legal Compliance: Ensure that the contract complies with local and state laws. Different jurisdictions may have specific requirements that must be met for the contract to be enforceable.

- Property Description: Provide a detailed description of the property being financed. This includes the address, legal description, and any pertinent details that define the property.

- Consult a Professional: It’s wise to have a real estate attorney review the contract before signing. Their expertise can help identify potential issues and ensure that your interests are protected.

Guide to Writing Owner Financing Contract

Filling out the Owner Financing Contract form is a crucial step in establishing the terms of financing between a buyer and a seller. Ensure you have all necessary information at hand to complete the form accurately. Follow these steps to fill out the form effectively.

- Identify the parties involved: Write the full legal names of the buyer(s) and seller(s) at the top of the form.

- Property description: Provide a detailed description of the property being financed, including the address and any relevant identifiers.

- Financing terms: Specify the total purchase price, the down payment amount, and the financing amount that will be provided by the seller.

- Interest rate: Clearly state the interest rate applicable to the financing agreement.

- Payment schedule: Outline the payment frequency (monthly, quarterly, etc.) and the duration of the loan.

- Late fees: Indicate any late fees that will apply if payments are not made on time.

- Default terms: Describe what constitutes a default and the consequences that follow.

- Signatures: Ensure that all parties sign and date the form to validate the agreement.

After completing the form, review it for accuracy and completeness. Make copies for all parties involved and keep the original in a safe place. This contract will serve as a binding agreement for the financing arrangement.

Create Popular Types of Owner Financing Contract Templates

Personal Guarantor Meaning - Signing a Personal Guarantee form indicates the signer is willing to risk personal assets to back a loan or contract.

Purchase Agreement Addendum - It is necessary for revising terms based upon inspections or appraisals conducted.

For anyone engaging in a real estate transaction, familiarizing yourself with the process can be beneficial. The guide to understanding the Real Estate Purchase Agreement provides key insights into its critical elements, ensuring a smoother buying or selling experience.

Real Estate Contract Termination Letter - Ensures termination is documented in writing to avoid confusion.

Form Preview Example

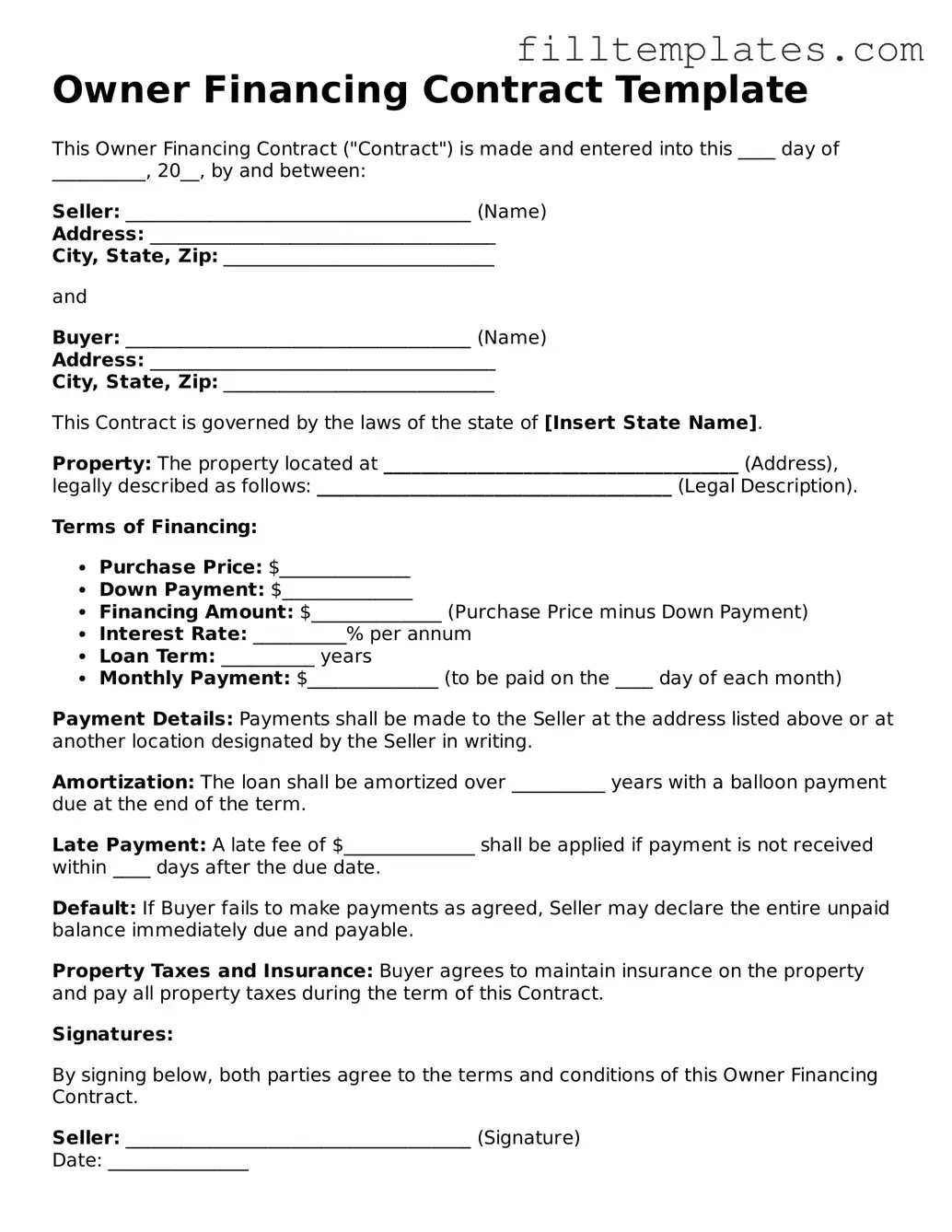

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is made and entered into this ____ day of __________, 20__, by and between:

Seller: _____________________________________ (Name)

Address: _____________________________________

City, State, Zip: _____________________________

and

Buyer: _____________________________________ (Name)

Address: _____________________________________

City, State, Zip: _____________________________

This Contract is governed by the laws of the state of [Insert State Name].

Property: The property located at ______________________________________ (Address), legally described as follows: ______________________________________ (Legal Description).

Terms of Financing:

- Purchase Price: $______________

- Down Payment: $______________

- Financing Amount: $______________ (Purchase Price minus Down Payment)

- Interest Rate: __________% per annum

- Loan Term: __________ years

- Monthly Payment: $______________ (to be paid on the ____ day of each month)

Payment Details: Payments shall be made to the Seller at the address listed above or at another location designated by the Seller in writing.

Amortization: The loan shall be amortized over __________ years with a balloon payment due at the end of the term.

Late Payment: A late fee of $______________ shall be applied if payment is not received within ____ days after the due date.

Default: If Buyer fails to make payments as agreed, Seller may declare the entire unpaid balance immediately due and payable.

Property Taxes and Insurance: Buyer agrees to maintain insurance on the property and pay all property taxes during the term of this Contract.

Signatures:

By signing below, both parties agree to the terms and conditions of this Owner Financing Contract.

Seller: _____________________________________ (Signature)

Date: _______________

Buyer: _____________________________________ (Signature)

Date: _______________

This Contract may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same agreement.

Documents used along the form

When entering into an owner financing agreement, several other forms and documents may be necessary to ensure a smooth transaction. These documents help clarify the terms, protect both parties, and comply with legal requirements. Below is a list of common forms that are often used alongside the Owner Financing Contract.

- Promissory Note: This document outlines the borrower's promise to repay the loan under specified terms. It includes details such as the loan amount, interest rate, and payment schedule.

- Deed of Trust: This serves as a security instrument for the loan. It gives the lender a claim to the property if the borrower defaults on the loan.

- Disclosure Statement: This document provides important information about the financing terms, including any fees, costs, and potential risks associated with the loan.

- Purchase Agreement: This outlines the terms of the sale, including the purchase price and any contingencies. It is essential for formalizing the buyer's intent to purchase the property.

- Title Report: A title report verifies the ownership of the property and ensures there are no liens or claims against it. This protects the buyer from potential legal issues.

- Closing Statement: This document summarizes the final financial details of the transaction, including all costs, fees, and adjustments. It is typically reviewed and signed at closing.

- Real Estate Purchase Agreement: This crucial document establishes the terms and conditions of the sale, providing legal protection for both the buyer and the seller. For a comprehensive guide, refer to All Minnesota Forms, which outlines the necessary steps for completing this essential paperwork.

- Property Inspection Report: This report provides an assessment of the property's condition. It can help buyers make informed decisions about their purchase.

- Insurance Policy: Proof of insurance is often required to protect the property against damage or loss. This document ensures that both parties are covered in case of unforeseen events.

- Amortization Schedule: This outlines the repayment plan for the loan, showing how much of each payment goes toward interest and principal over time.

Having these documents prepared and understood can greatly simplify the owner financing process. Each form plays a crucial role in ensuring that both the buyer and seller are protected throughout the transaction. Always consider consulting with a professional to ensure all necessary documents are properly completed and filed.