Download Payroll Check Template

When managing employee compensation, clarity and accuracy are paramount. The Payroll Check form serves as a critical tool in this process, ensuring that employees receive their due wages in a timely manner. This form typically includes essential information such as the employee's name, identification number, pay period, and the total amount being disbursed. Furthermore, it often outlines deductions for taxes, benefits, and other withholdings, providing a transparent breakdown of how the final amount was calculated. Employers must also ensure that the form complies with state and federal regulations, which can vary significantly. By understanding the components and importance of the Payroll Check form, both employers and employees can navigate the payroll process more effectively, fostering trust and satisfaction in the workplace.

Key takeaways

When filling out and using the Payroll Check form, it is important to keep several key points in mind. Below are essential takeaways to ensure accuracy and compliance.

- Always double-check the employee's name and address. Accurate information is crucial for proper record-keeping.

- Make sure to enter the correct pay period dates. This helps in tracking hours worked and ensures timely payments.

- Include the correct number of hours worked and the corresponding pay rate. This will prevent any discrepancies in payment.

- Verify any deductions that need to be applied. Deductions can include taxes, insurance, or retirement contributions.

- Ensure that the total amount paid is clearly stated. This helps both the employer and employee keep accurate financial records.

- Sign and date the Payroll Check form before submitting it. This step confirms that the information is accurate and that you authorize the payment.

- Keep a copy of the completed form for your records. This can be useful for future reference or audits.

By following these guidelines, you can help ensure a smooth payroll process for everyone involved.

Guide to Writing Payroll Check

Filling out the Payroll Check form is an essential task to ensure that employees receive their wages accurately and on time. This guide provides clear steps to complete the form correctly, which will help facilitate the payroll process.

- Begin by entering the date in the designated space. This should reflect the date the check is being issued.

- Next, write the employee's name in the appropriate field. Ensure the name is spelled correctly to avoid any confusion.

- In the amount section, clearly write the total payment amount. Use both numbers and words to minimize errors.

- Fill in the employee's address in the specified area. This should include the street address, city, state, and zip code.

- Complete the pay period information. Indicate the start and end dates of the period for which the payment is being made.

- Sign the check in the signature area. This verifies that the check is authorized for payment.

- Finally, provide any additional notes or information in the comments section, if applicable.

Browse Other PDFs

Payroll Advance Form - This application offers a way to obtain your wages early.

Utilizing the Free And Invoice Pdf form greatly enhances the efficiency of the billing process, which is crucial for businesses and independent contractors looking to streamline their operations. By leveraging a structured and customizable template, users can ensure that all necessary payment information is readily available, thereby promoting faster payment processing. For more resources and additional templates, visit toptemplates.info.

What Does It Mean to Be Exempt From Withholding - Cooperation assesses how well the employee works with others.

IRS E-file Signature Authorization - The form includes a unique identification number that links to the return.

Form Preview Example

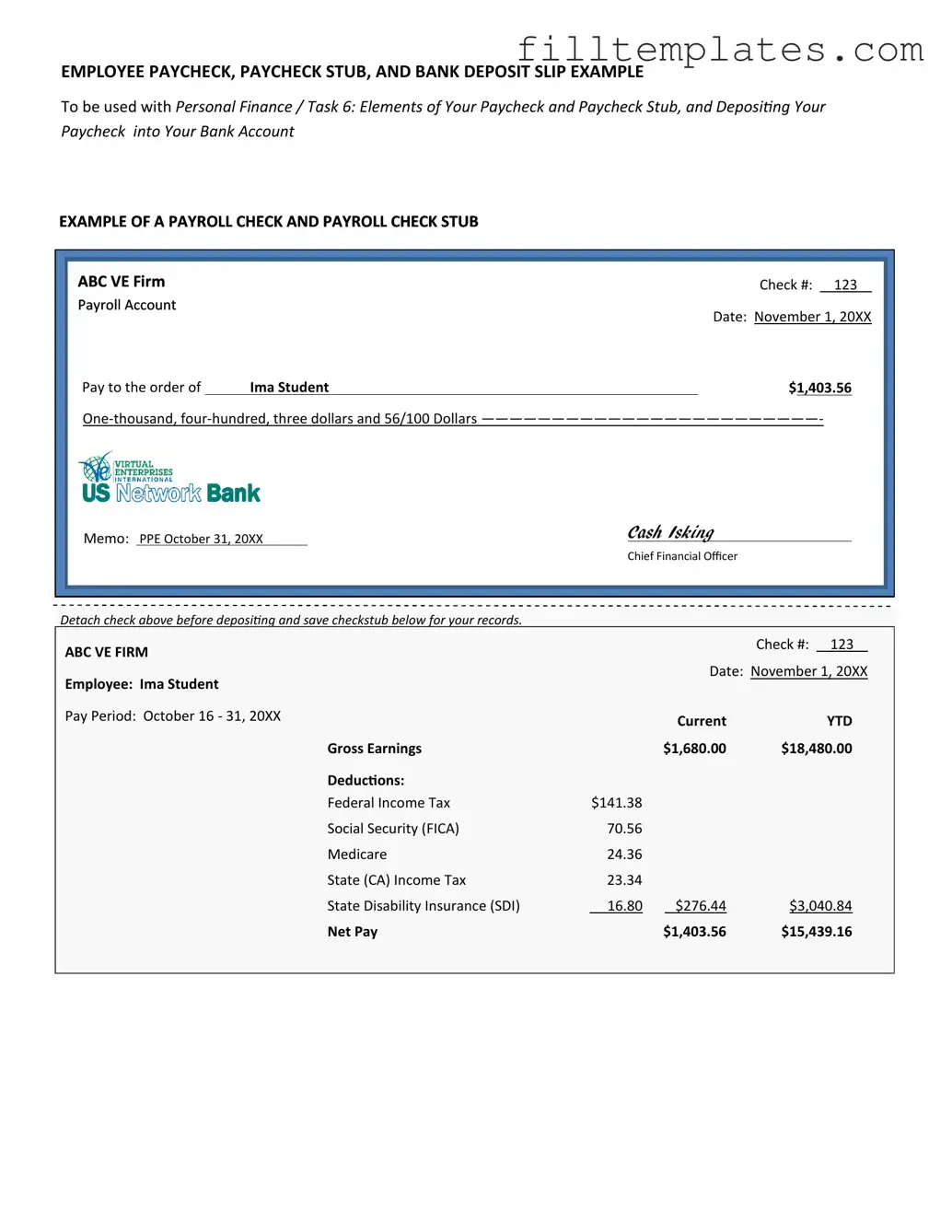

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

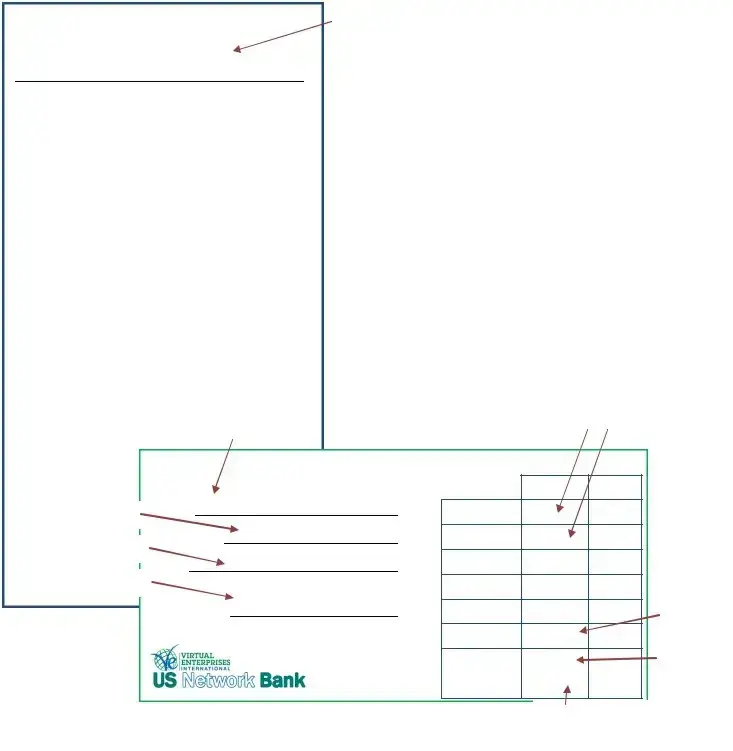

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

Documents used along the form

When managing payroll, several forms and documents are essential to ensure accurate processing and compliance with regulations. Each document serves a specific purpose and helps streamline the payroll process. Below is a list of commonly used forms alongside the Payroll Check form.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from paychecks.

- Disability Insurance Claim Form: Employees may also need to submit the https://smarttemplates.net/fillable-edd-de-2501/ to apply for disability benefits, ensuring they receive financial support during periods when they cannot work due to health issues.

- I-9 Form: This document verifies an employee's identity and eligibility to work in the United States. Employers must keep this form on file for each employee.

- Pay Stub: A detailed statement provided to employees with each paycheck. It outlines earnings, deductions, and net pay, helping employees understand their compensation.

- Direct Deposit Authorization Form: Employees fill out this form to authorize their employer to deposit wages directly into their bank accounts, ensuring timely and secure payments.

- State Tax Withholding Form: Similar to the W-4, this form is specific to state tax withholding and varies by state. Employees use it to specify their state tax withholding preferences.

- Employee Handbook: This document outlines company policies, procedures, and employee rights. It serves as a reference for employees regarding workplace expectations and benefits.

- Time Sheet: A record of hours worked by employees, which is crucial for calculating pay accurately. It can be submitted weekly or bi-weekly, depending on the payroll schedule.

- Payroll Register: A comprehensive report that summarizes all payroll data for a specific period. It includes details such as employee names, hours worked, and total wages paid.

- Form 941: Employers use this quarterly tax form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It ensures compliance with federal tax regulations.

- Termination Checklist: This form outlines the steps to be taken when an employee leaves the company, including final pay calculations, return of company property, and benefits information.

Understanding these documents is vital for both employers and employees. They ensure that payroll processes run smoothly and that everyone is informed about their rights and responsibilities. By keeping these forms organized and accessible, businesses can maintain compliance and foster a transparent workplace environment.