Free Personal Guarantee Template

When entering into a business agreement or securing a loan, individuals may encounter the Personal Guarantee form, an important document that can significantly impact their financial responsibilities. This form serves as a promise made by an individual to personally take on the debt or obligations of a business if that business fails to meet its financial commitments. Typically, lenders and creditors require this form to ensure that there is a reliable source of repayment. By signing the Personal Guarantee, the individual acknowledges their personal liability, which means that their personal assets could be at risk if the business defaults. It's crucial to understand the implications of this commitment, as it can affect personal credit scores and financial stability. Additionally, the form often includes specific terms outlining the extent of the guarantee, the duration of the obligation, and any conditions under which the guarantee may be released. Being well-informed about the Personal Guarantee form can help individuals make sound decisions when engaging in business ventures or securing financing.

Key takeaways

Filling out and using a Personal Guarantee form is an important step in many financial agreements. Here are key takeaways to keep in mind:

- The Personal Guarantee form holds you personally responsible for a debt or obligation.

- Read the entire document carefully before signing to understand your commitments.

- Ensure all personal information is accurate, including your name, address, and contact details.

- Consider consulting with a legal advisor if you have questions about the terms.

- Be aware that signing this form can affect your credit score and financial future.

- It is often used by business owners to secure loans or leases for their companies.

- Understand the implications of defaulting on the obligation you are guaranteeing.

- Keep a copy of the signed form for your records.

- Check if there are any limits on the guarantee, such as a maximum amount.

- Be cautious about signing multiple guarantees, as they can compound your financial risk.

Guide to Writing Personal Guarantee

After obtaining the Personal Guarantee form, you will need to complete it accurately to ensure that it meets all necessary requirements. This form is essential for establishing your commitment to the obligations outlined within it. Follow the steps below to fill out the form correctly.

- Begin by entering your full legal name in the designated field at the top of the form.

- Provide your current residential address, including street, city, state, and zip code.

- Next, fill in your date of birth. This is typically required to verify your identity.

- Enter your Social Security number in the appropriate section. Ensure that this information is accurate and complete.

- Complete the section regarding your employment. Include the name of your employer, your job title, and the length of time you have been employed.

- In the financial information section, disclose your annual income and any other relevant financial details requested.

- Read the terms of the guarantee carefully. Ensure you understand your obligations before proceeding.

- Sign and date the form at the bottom. Your signature indicates your agreement to the terms laid out in the document.

- Finally, review the entire form for any errors or omissions before submitting it.

Create Popular Types of Personal Guarantee Templates

Purchase Agreement Addendum - This addendum provides a formal avenue for addressing unexpected circumstances affecting the sale.

To facilitate a smooth property transaction, it is important to have a solid understanding of the Minnesota Real Estate Purchase Agreement and its associated requirements. For more information on how to effectively utilize this document, check out this resource: "comprehensive guide on Real Estate Purchase Agreement essentials".

Seller Financing Contract - It allows buyers to become homeowners without resorting to lengthy and costly mortgage procedures.

Real Estate Contract Termination Letter - Notifies all stakeholders of the termination of the agreement.

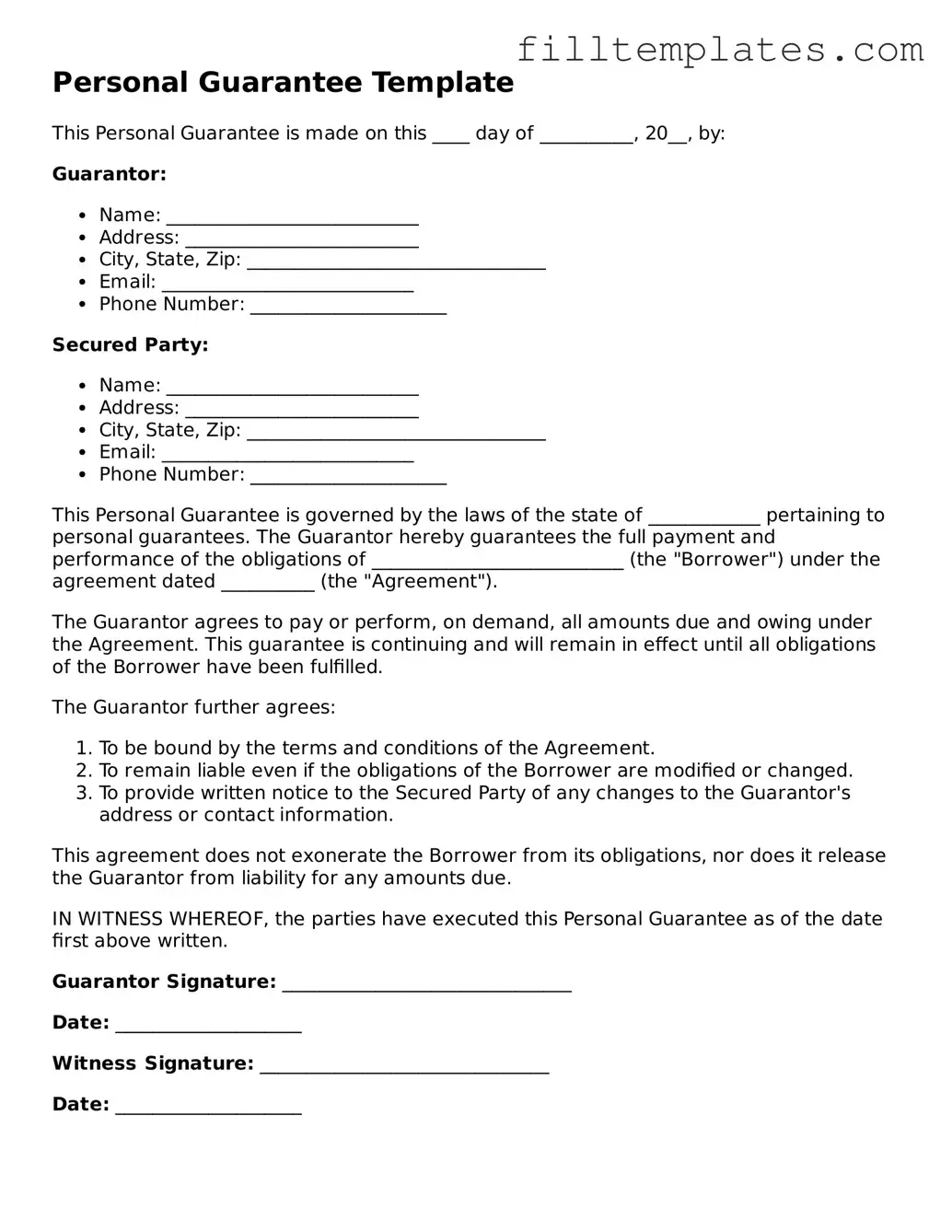

Form Preview Example

Personal Guarantee Template

This Personal Guarantee is made on this ____ day of __________, 20__, by:

Guarantor:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________________________

- Email: ___________________________

- Phone Number: _____________________

Secured Party:

- Name: ___________________________

- Address: _________________________

- City, State, Zip: ________________________________

- Email: ___________________________

- Phone Number: _____________________

This Personal Guarantee is governed by the laws of the state of ____________ pertaining to personal guarantees. The Guarantor hereby guarantees the full payment and performance of the obligations of ___________________________ (the "Borrower") under the agreement dated __________ (the "Agreement").

The Guarantor agrees to pay or perform, on demand, all amounts due and owing under the Agreement. This guarantee is continuing and will remain in effect until all obligations of the Borrower have been fulfilled.

The Guarantor further agrees:

- To be bound by the terms and conditions of the Agreement.

- To remain liable even if the obligations of the Borrower are modified or changed.

- To provide written notice to the Secured Party of any changes to the Guarantor's address or contact information.

This agreement does not exonerate the Borrower from its obligations, nor does it release the Guarantor from liability for any amounts due.

IN WITNESS WHEREOF, the parties have executed this Personal Guarantee as of the date first above written.

Guarantor Signature: _______________________________

Date: ____________________

Witness Signature: _______________________________

Date: ____________________

Documents used along the form

When dealing with financial agreements or business transactions, several documents often accompany the Personal Guarantee form. Each of these forms serves a unique purpose and can help clarify the obligations and rights of all parties involved. Below is a list of common forms that you might encounter alongside a Personal Guarantee.

- Loan Agreement: This document outlines the terms and conditions of a loan, including the amount borrowed, interest rates, and repayment schedule.

- Promissory Note: A written promise to pay a specified amount of money to a lender at a designated time or on demand.

- Security Agreement: This agreement specifies the collateral that secures a loan, detailing the rights of the lender in case of default.

- Business License: A legal authorization that allows a business to operate within a specific jurisdiction, ensuring compliance with local regulations.

- Nevada Real Estate Purchase Agreement: This essential form governs real estate transactions in Nevada, ensuring clarity in terms such as purchase price, closing date, and contingencies, and can be found in detail at All Nevada Forms.

- Operating Agreement: For LLCs, this document outlines the management structure and operational procedures of the business.

- Partnership Agreement: This document defines the relationship between partners in a business, including profit-sharing and decision-making processes.

- Credit Application: A form used to request credit from a lender, often requiring personal and financial information about the applicant.

- Financial Statement: A summary of an individual’s or business’s financial position, detailing assets, liabilities, and equity.

- Disclosure Statement: A document that provides essential information about the terms of a loan or investment, ensuring transparency for all parties involved.

Understanding these forms can help you navigate financial agreements more effectively. Each document plays a crucial role in ensuring clarity and protecting the interests of all parties involved in a transaction.