Download Profit And Loss Template

Understanding the Profit and Loss form is essential for anyone looking to gain insight into their financial performance. This vital document summarizes revenues, costs, and expenses over a specific period, typically a month, quarter, or year. By breaking down income and expenditures, it provides a clear picture of a business's profitability. Key components of the form include total revenue, which reflects all income generated, followed by a detailed account of various expenses such as operating costs, taxes, and interest. The difference between total revenue and total expenses reveals the net profit or loss, which is crucial for decision-making and strategic planning. Whether you are a small business owner, a freelancer, or managing a large corporation, mastering the Profit and Loss form can empower you to make informed financial choices and drive your success forward.

Key takeaways

Filling out and using the Profit and Loss form is essential for tracking financial performance. Here are some key takeaways to keep in mind:

- Accurate Data Entry: Ensure that all income and expenses are recorded accurately. This will provide a clear picture of financial health.

- Regular Updates: Update the form regularly, ideally on a monthly basis. This helps in monitoring trends and making informed decisions.

- Categorization: Properly categorize income and expenses. This allows for easier analysis and understanding of where money is being earned and spent.

- Review Periodically: Review the completed Profit and Loss statements periodically to assess financial performance and adjust strategies as necessary.

- Use for Planning: Utilize the information from the form for budgeting and forecasting future financial performance. This can aid in setting realistic financial goals.

Guide to Writing Profit And Loss

Filling out the Profit and Loss form is a crucial step in understanding your financial performance. By accurately completing this form, you will be able to assess your income, expenses, and overall profitability. Follow the steps below to ensure that you fill out the form correctly.

- Gather all necessary financial documents, including bank statements, invoices, and receipts.

- Identify the reporting period for which you are completing the form, such as monthly, quarterly, or annually.

- Start with the revenue section. Enter all sources of income, including sales revenue and any other income streams.

- Next, move to the expenses section. List all business expenses, such as rent, utilities, payroll, and supplies.

- Calculate the total revenue by adding up all income entries.

- Calculate the total expenses by summing all expense entries.

- Subtract the total expenses from the total revenue to determine your net profit or loss.

- Review the completed form for accuracy. Ensure all figures are correct and that no entries are missing.

- Save a copy of the completed form for your records.

Once you have filled out the Profit and Loss form, you can use this information to make informed business decisions. It will provide insights into your financial health and help you strategize for future growth.

Browse Other PDFs

Bathroom Sign Out Sheet Pdf - Encourage feedback and suggestions based on restroom evaluations.

A Bill of Sale is a legal document that serves as proof of the transfer of ownership from a seller to a buyer for personal property. In California, this form is essential for various transactions, including vehicles, boats, and other valuable items. You can find a template for this document by visiting the Bill of Sale form. Understanding the nuances of the California Bill of Sale can help ensure smoother transactions and protect both parties involved.

Army 1750 - The DD Form 1750 is used for packing lists in military logistics.

Form Preview Example

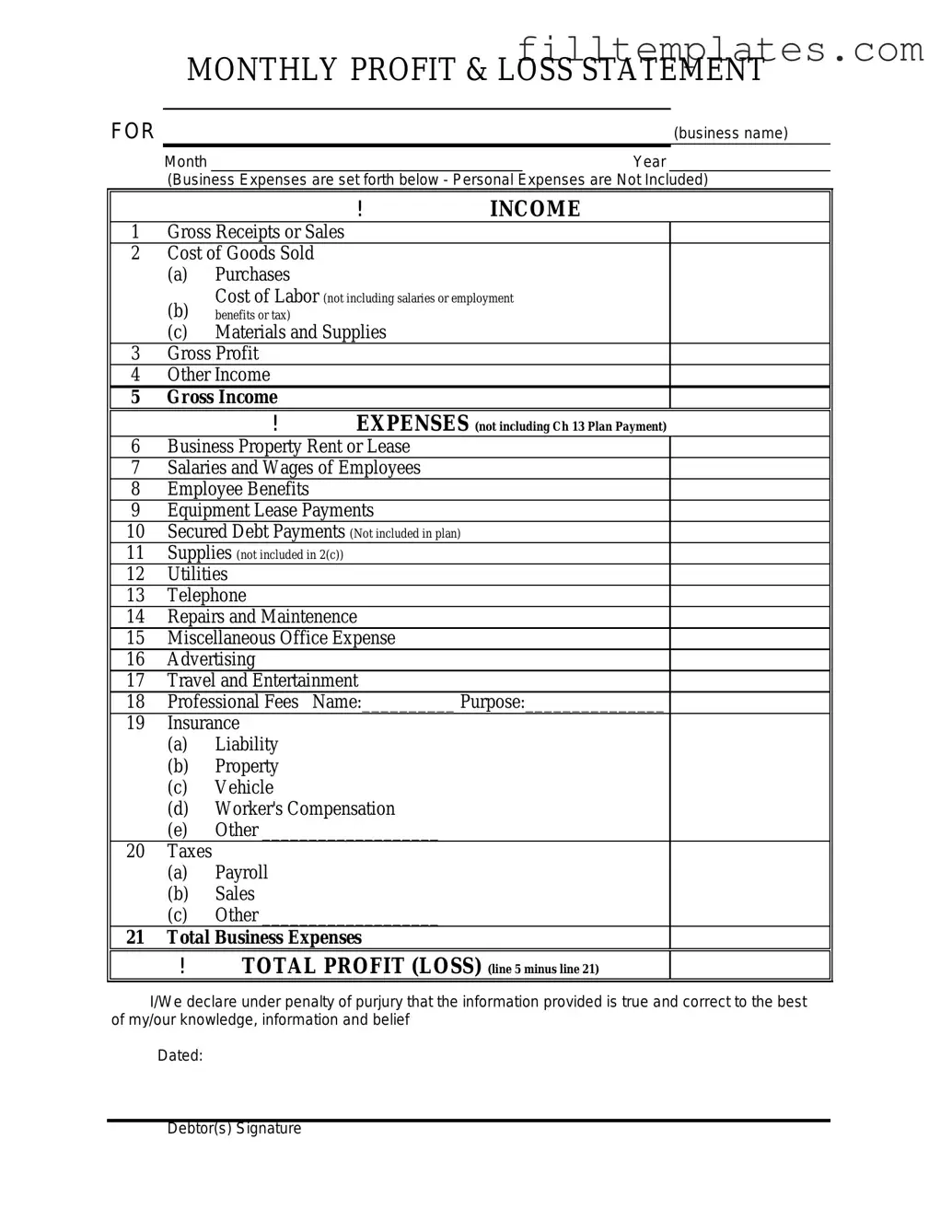

MONTHLY PROFIT & LOSS STATEMENT

FOR |

(business name) |

Month |

Year |

(Business Expenses are set forth below - Personal Expenses are Not Included)

|

|

|

! |

INCOME |

1 |

Gross Receipts or Sales |

|

||

2 |

Cost of Goods Sold |

|

||

|

(a) |

Purchases |

|

|

|

(b) |

Cost of Labor (not including salaries or employment |

||

|

benefits or tax) |

|

|

|

|

(c) |

Materials and Supplies |

|

|

3 |

Gross Profit |

|

|

|

4 |

Other Income |

|

|

|

5 |

Gross Income |

EXPENSES (not including Ch 13 Plan Payment) |

||

|

|

! |

||

6 |

Business Property Rent or Lease |

|

||

7 |

Salaries and Wages of Employees |

|

||

8 |

Employee Benefits |

|

|

|

9 |

Equipment Lease Payments |

|

||

10 |

Secured Debt Payments (Not included in plan) |

|

||

11 |

Supplies (not included in 2(c)) |

|

||

12 |

Utilities |

|

|

|

13 |

Telephone |

|

|

|

14 |

Repairs and Maintenence |

|

||

15 |

Miscellaneous Office Expense |

|

||

16 |

Advertising |

|

|

|

17 |

Travel and Entertainment |

|

||

18 |

Professional Fees |

Name:__________ Purpose:_______________ |

||

19 |

Insurance |

|

|

|

|

(a) |

Liability |

|

|

|

(b) |

Property |

|

|

|

(c) |

Vehicle |

|

|

|

(d) |

Worker's Compensation |

|

|

|

(e) |

Other ___________________ |

|

|

20 |

Taxes |

|

|

|

|

(a) |

Payroll |

|

|

|

(b) |

Sales |

|

|

|

(c) |

Other ___________________ |

|

|

21 |

Total Business Expenses |

|

||

|

! |

TOTAL PROFIT (LOSS) (line 5 minus line 21) |

||

I/We declare under penalty of purjury that the information provided is true and correct to the best of my/our knowledge, information and belief

Dated:

Debtor(s) Signature

Documents used along the form

The Profit and Loss form is a crucial document for understanding a business's financial performance. However, several other forms and documents complement it, providing a more comprehensive view of the company's financial health. Here’s a list of important documents often used alongside the Profit and Loss form:

- Balance Sheet: This document summarizes a company's assets, liabilities, and equity at a specific point in time. It provides insight into what the company owns and owes, helping assess its financial stability.

- Cash Flow Statement: This statement tracks the flow of cash in and out of a business over a period. It highlights how well the company generates cash to pay its debts and fund its operating expenses.

- Income Statement: Similar to the Profit and Loss form, the income statement details revenues and expenses. It provides a broader view of a company's profitability over a specified period.

- Budget Report: This report outlines the planned income and expenses for a future period. It serves as a financial roadmap, helping businesses plan for growth and manage resources effectively.

- Tax Returns: These documents report a company's income, expenses, and other tax-related information to the IRS. They are essential for compliance and can impact future financial planning.

- Accounts Receivable Aging Report: This report categorizes outstanding invoices by how long they have been due. It helps businesses manage collections and assess customer credit risk.

- Accounts Payable Aging Report: This document tracks outstanding bills and invoices that a company owes. It aids in managing cash flow and ensuring timely payments to suppliers.

- Sales Report: This report provides detailed information about sales activities over a specific period. It helps identify trends, evaluate performance, and inform strategic decisions.

- ADP Pay Stub: This document details an employee's earnings and deductions for a specific pay period. To create and manage your ADP Pay Stub effectively, visit My PDF Forms.

- Expense Report: This document itemizes business expenses incurred during a specific period. It is essential for tracking spending and ensuring that expenses align with the budget.

These documents, when used together with the Profit and Loss form, create a clearer picture of a company's financial situation. Understanding each document's purpose can significantly enhance financial analysis and decision-making.