Free Promissory Note Template

When engaging in financial transactions, clarity and security are paramount. A Promissory Note serves as a vital tool in establishing a clear agreement between a borrower and a lender. This written document outlines the borrower's commitment to repay a specified amount of money, detailing the terms of the loan, including the interest rate, repayment schedule, and any consequences for defaulting on the agreement. By incorporating essential elements such as the identities of both parties, the principal amount, and the maturity date, the Promissory Note creates a legally binding obligation that protects the interests of both the lender and the borrower. Additionally, it may include provisions for prepayment, late fees, and other conditions that could affect the repayment process. Understanding the significance of this form is crucial for anyone involved in lending or borrowing money, as it not only formalizes the transaction but also fosters trust and accountability between the parties involved.

Promissory Note - Adapted for State

Promissory Note Categories

Key takeaways

Filling out and using a Promissory Note form is a crucial step in establishing a clear agreement between a borrower and a lender. Here are ten key takeaways to keep in mind:

- Understand the Purpose: A Promissory Note serves as a written promise to pay back a loan. It outlines the terms of the loan, including the amount borrowed, interest rate, and repayment schedule.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that all parties are correctly identified in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This is critical for avoiding misunderstandings later on.

- Include Interest Rates: If applicable, specify the interest rate. This could be fixed or variable and should comply with state usury laws.

- Outline Repayment Terms: Clearly define how and when payments will be made. Include details such as payment frequency and due dates.

- Address Late Payments: Include provisions for late payments. This may involve additional fees or changes in the interest rate.

- Consider Collateral: If the loan is secured, specify what collateral is being offered. This provides the lender with security in case of default.

- Include Default Terms: Clearly outline what constitutes a default and the consequences that follow. This helps protect the lender's interests.

- Sign and Date: Both parties must sign and date the Promissory Note. This makes the agreement legally binding.

- Keep Copies: After signing, ensure that both parties retain copies of the Promissory Note. This is important for record-keeping and future reference.

By following these key takeaways, both borrowers and lenders can create a clear and enforceable agreement that protects their interests and clarifies their obligations.

Guide to Writing Promissory Note

After obtaining the Promissory Note form, you will need to complete it accurately to ensure that all parties understand the terms of the agreement. Follow these steps carefully to fill out the form correctly.

- Identify the parties involved. Write the names and addresses of both the borrower and the lender at the top of the form.

- Specify the loan amount. Clearly state the total amount of money being borrowed.

- Set the interest rate. Indicate the annual interest rate that will apply to the loan.

- Define the repayment schedule. Outline how and when the borrower will repay the loan, including due dates and payment amounts.

- Include any late fees. If applicable, specify any fees that will be charged if payments are late.

- State the loan term. Mention the length of time over which the loan will be repaid.

- Sign the document. Both the borrower and lender must sign the form to make it legally binding.

- Date the agreement. Ensure that the date is clearly written next to the signatures.

Once you have completed these steps, review the form to ensure all information is accurate. Both parties should keep a copy for their records after signing.

Other Forms:

C or S Corporation - The form is a critical step for any business considering S Corporation election.

Mortgage Interest Statement - Delinquency notices highlight any late payments and potential consequences.

When navigating the complexities of mobile home transactions, it's important to utilize a well-drafted document. For instance, the thorough Mobile Home Bill of Sale template is invaluable for ensuring all necessary details are captured, protecting both parties involved in the sale process.

Pay Stub for Independent Contractor - It helps in tracking the frequency of payments from various clients over time.

Form Preview Example

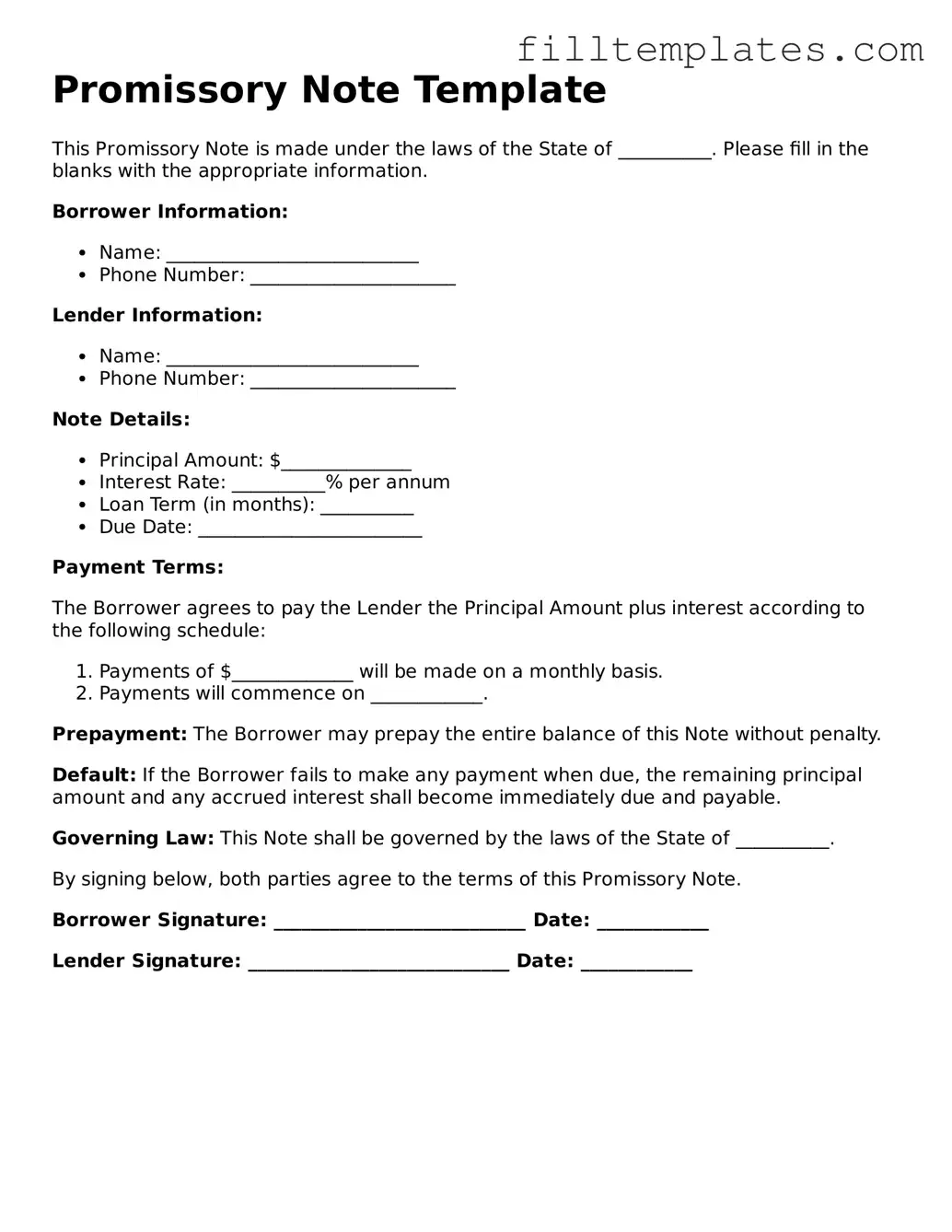

Promissory Note Template

This Promissory Note is made under the laws of the State of __________. Please fill in the blanks with the appropriate information.

Borrower Information:

- Name: ___________________________

- Phone Number: ______________________

Lender Information:

- Name: ___________________________

- Phone Number: ______________________

Note Details:

- Principal Amount: $______________

- Interest Rate: __________% per annum

- Loan Term (in months): __________

- Due Date: ________________________

Payment Terms:

The Borrower agrees to pay the Lender the Principal Amount plus interest according to the following schedule:

- Payments of $_____________ will be made on a monthly basis.

- Payments will commence on ____________.

Prepayment: The Borrower may prepay the entire balance of this Note without penalty.

Default: If the Borrower fails to make any payment when due, the remaining principal amount and any accrued interest shall become immediately due and payable.

Governing Law: This Note shall be governed by the laws of the State of __________.

By signing below, both parties agree to the terms of this Promissory Note.

Borrower Signature: ___________________________ Date: ____________

Lender Signature: ____________________________ Date: ____________

Documents used along the form

A Promissory Note is a crucial financial document that outlines a borrower's promise to repay a specified amount to a lender under agreed-upon terms. However, several other documents often accompany a Promissory Note to provide clarity, security, and legal backing to the transaction. Below is a list of commonly used forms and documents associated with a Promissory Note.

- Loan Agreement: This document details the terms of the loan, including the interest rate, repayment schedule, and any conditions that must be met by either party.

- Collateral Agreement: If the loan is secured, this document specifies the assets pledged as collateral in case of default.

- Personal Guarantee: This form may be signed by a third party, ensuring that they will repay the loan if the primary borrower defaults.

- Disclosure Statement: This document outlines the terms and costs associated with the loan, ensuring that the borrower is fully informed before signing the Promissory Note.

- Amortization Schedule: This provides a detailed breakdown of each payment, showing how much goes toward principal and interest over the life of the loan.

- Employment Application PDF: This form can be crucial for employers during the hiring process, allowing them to collect standardized information from candidates. For more details, check OnlineLawDocs.com.

- Default Notice: Should the borrower fail to make payments, this document serves as a formal notification of default, outlining the consequences.

- Modification Agreement: If the terms of the original loan need to be changed, this document formalizes any adjustments agreed upon by both parties.

- Release of Liability: Upon full repayment, this document releases the borrower from any further obligations under the Promissory Note.

- Assignment Agreement: This document allows the lender to transfer their rights under the Promissory Note to another party.

In summary, these documents work together to create a comprehensive framework around the Promissory Note, ensuring that both the borrower and lender are protected and fully informed throughout the loan process. Understanding each of these forms can help facilitate a smoother transaction and provide clarity in financial agreements.