Free Promissory Note for a Car Template

When it comes to financing a vehicle, a Promissory Note for a Car serves as a crucial document that outlines the terms of the loan agreement between the borrower and the lender. This form typically details the amount borrowed, the interest rate, and the repayment schedule, ensuring that both parties have a clear understanding of their obligations. It also includes important information such as the consequences of default, which protects the lender's interests while providing the borrower with transparency about the terms. Additionally, the Promissory Note often specifies whether the loan is secured or unsecured, which can significantly impact the borrower's liability in case of non-payment. By clearly defining these aspects, the Promissory Note helps to create a legally binding agreement that fosters trust and accountability throughout the duration of the loan. Understanding this form is essential for anyone looking to finance a vehicle, as it not only outlines financial responsibilities but also establishes a framework for a successful borrowing experience.

Key takeaways

When it comes to filling out and using the Promissory Note for a Car form, there are several important points to keep in mind. These key takeaways will help ensure that the process is smooth and legally sound.

- Understand the Purpose: A Promissory Note serves as a written promise to repay borrowed money, specifically for the purchase of a vehicle. It outlines the terms of the loan and protects both the borrower and lender.

- Include Essential Information: Make sure to provide all necessary details, including the names and addresses of both parties, the amount borrowed, the interest rate, and the repayment schedule.

- Specify the Vehicle: Clearly identify the car being financed. Include details such as the make, model, year, and Vehicle Identification Number (VIN) to avoid any confusion.

- Payment Terms: Outline how and when payments will be made. This includes the due dates, payment methods, and any late fees that may apply.

- Signatures Required: Both the borrower and lender must sign the Promissory Note. This signifies agreement to the terms and conditions laid out in the document.

- Keep Copies: After completing the form, both parties should retain copies for their records. This ensures that everyone has access to the agreed-upon terms.

- Consult Legal Advice: If there are any uncertainties or complexities, consider seeking legal advice. This can help clarify any questions regarding the terms or enforceability of the note.

By following these guidelines, individuals can effectively navigate the process of creating and using a Promissory Note for a Car, ensuring clarity and protection for both parties involved.

Guide to Writing Promissory Note for a Car

After obtaining the Promissory Note for a Car form, it's important to ensure that all necessary information is accurately filled out. This document will serve as a formal agreement regarding the loan for the vehicle. Follow the steps below to complete the form properly.

- Begin by entering the date at the top of the form. This should be the date you are completing the note.

- Next, provide your name and address in the designated fields. Ensure that your contact information is current and accurate.

- Identify the lender's information. This includes the lender's name and address, which should be clearly stated.

- Specify the total amount of the loan. This figure represents how much money you are borrowing to purchase the car.

- Indicate the interest rate, if applicable. This is the percentage that will be added to the principal amount over time.

- Fill in the repayment terms. This section outlines how and when you will repay the loan, including the frequency of payments (e.g., monthly).

- Provide details about the collateral. This typically includes the make, model, year, and Vehicle Identification Number (VIN) of the car.

- Sign and date the form at the bottom. Ensure that you have read through the entire document before signing.

Once the form is completed, review it for accuracy. It’s advisable to keep a copy for your records. If needed, present the signed form to the lender to finalize the agreement.

Create Popular Types of Promissory Note for a Car Templates

Satisfaction of Promissory Note - A straightforward solution for resolving any remnants of debt obligation.

When crafting a financial agreement, utilizing a New Jersey Promissory Note form is crucial for clarity and legal soundness. This document not only defines the relationship between borrower and lender but also ensures that all parties are on the same page regarding the amount owed and the terms of repayment. For those interested in a standardized and editable version, resources are available at https://newjerseyformspdf.com/editable-promissory-note/, making it easier to create a custom agreement that meets specific needs.

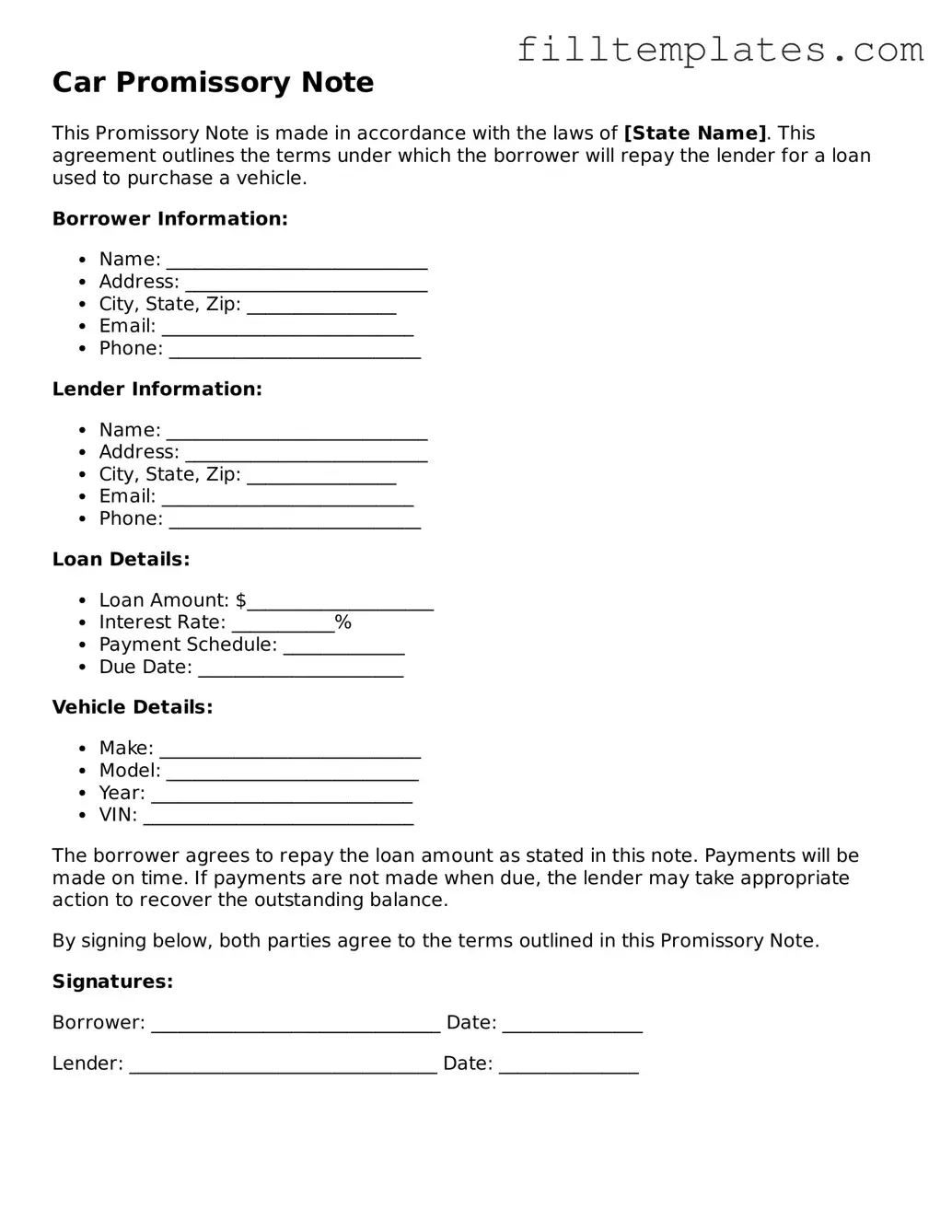

Form Preview Example

Car Promissory Note

This Promissory Note is made in accordance with the laws of [State Name]. This agreement outlines the terms under which the borrower will repay the lender for a loan used to purchase a vehicle.

Borrower Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip: ________________

- Email: ___________________________

- Phone: ___________________________

Lender Information:

- Name: ____________________________

- Address: __________________________

- City, State, Zip: ________________

- Email: ___________________________

- Phone: ___________________________

Loan Details:

- Loan Amount: $____________________

- Interest Rate: ___________%

- Payment Schedule: _____________

- Due Date: ______________________

Vehicle Details:

- Make: ____________________________

- Model: ___________________________

- Year: ____________________________

- VIN: _____________________________

The borrower agrees to repay the loan amount as stated in this note. Payments will be made on time. If payments are not made when due, the lender may take appropriate action to recover the outstanding balance.

By signing below, both parties agree to the terms outlined in this Promissory Note.

Signatures:

Borrower: _______________________________ Date: _______________

Lender: _________________________________ Date: _______________

Documents used along the form

When financing a car purchase, a Promissory Note is just one of several important documents that may be involved in the process. These documents help clarify the terms of the agreement and protect the interests of both the borrower and the lender. Here are five other forms and documents commonly used alongside the Promissory Note for a car.

- Sales Agreement: This document outlines the terms of the sale between the buyer and seller. It includes details such as the purchase price, vehicle identification number (VIN), and any warranties or guarantees that come with the vehicle.

- Title Transfer Document: When a vehicle is sold, ownership must be officially transferred. This document is essential for ensuring that the title of the car is updated to reflect the new owner. It often requires signatures from both the buyer and seller.

- Promissory Note: A NY PDF Forms is essential as it details the repayment terms and protects both parties' interests in the agreement.

- Bill of Sale: This is a receipt that serves as proof of the transaction. It includes information about the buyer, seller, vehicle details, and the sale price. A Bill of Sale is useful for record-keeping and can be required for registration purposes.

- Loan Application: If financing is involved, the borrower typically submits a loan application to the lender. This document collects personal and financial information, helping the lender assess the borrower’s creditworthiness and ability to repay the loan.

- Credit Disclosure Statement: This document provides important information about the loan terms, including interest rates, payment schedules, and any fees associated with the loan. It ensures that the borrower understands their financial obligations before signing the Promissory Note.

Understanding these documents can make the car financing process smoother and more transparent. Each one plays a crucial role in ensuring that all parties are aware of their rights and responsibilities throughout the transaction.