Free Purchase Letter of Intent Template

A Purchase Letter of Intent (LOI) serves as a crucial first step in the negotiation process for buying or selling a business or property. This document outlines the preliminary understanding between the buyer and seller, setting the stage for future discussions. It typically includes essential elements such as the purchase price, terms of payment, and any contingencies that must be met before the deal can proceed. Additionally, the LOI may address the timeline for due diligence and closing, ensuring both parties are aligned on expectations. While the Purchase Letter of Intent is not legally binding, it reflects the serious intent of both parties to move forward, providing a framework for the negotiation process. Clarity and mutual agreement on the key aspects of the transaction can help prevent misunderstandings later on, making this document an invaluable tool in real estate and business transactions.

Key takeaways

When filling out and using a Purchase Letter of Intent (LOI) form, there are several important aspects to consider. Understanding these can help ensure clarity and effectiveness in the transaction process.

- The Purchase LOI serves as a preliminary agreement outlining the intentions of both parties regarding a potential transaction.

- It is essential to clearly state the terms and conditions that will govern the purchase, including price, payment terms, and timelines.

- Including a confidentiality clause can protect sensitive information shared during negotiations.

- Both parties should review the document carefully to ensure that all relevant details are accurately captured.

- The LOI is generally non-binding, but it may include binding provisions, such as confidentiality or exclusivity agreements.

- It is advisable to seek legal counsel before finalizing the LOI to ensure compliance with applicable laws and regulations.

- Once signed, the LOI can serve as a roadmap for drafting a more formal purchase agreement.

Guide to Writing Purchase Letter of Intent

Once you have the Purchase Letter of Intent form in front of you, it's time to fill it out with care. This document is essential for outlining the terms of your potential purchase. After completing the form, you will typically submit it to the seller to express your interest formally. The next steps involve negotiations and possibly drafting a more detailed agreement based on the terms laid out in your letter.

- Begin by entering the date at the top of the form. This establishes when the letter is being submitted.

- Fill in your full name and contact information in the designated sections. Ensure that your email and phone number are correct for easy communication.

- Provide the name and address of the seller. This information should be accurate to avoid any confusion later.

- Clearly describe the property or item you intend to purchase. Include any relevant details such as location, size, or specific features.

- State the proposed purchase price. Be clear and precise about the amount you are willing to offer.

- Outline any contingencies or conditions that must be met for the sale to proceed. This could include financing, inspections, or other requirements.

- Indicate the timeline for the transaction. Specify any important dates, such as when you would like to close the deal.

- Sign and date the form at the bottom. Your signature indicates that you agree to the terms laid out in the letter.

Create Popular Types of Purchase Letter of Intent Templates

Intent to Rent Letter - It can serve as a starting point for negotiations regarding rental terms and conditions.

For parents considering homeschooling in Alabama, understanding the steps involved is crucial. The process begins with the completion of the necessary paperwork, including the vital formal Homeschool Letter of Intent, which serves as a declaration of the intent to educate children at home.

Statement of Intent to Marry - A Letter of Intent to Marry may assist in affirming relationships before family discussions.

Form Preview Example

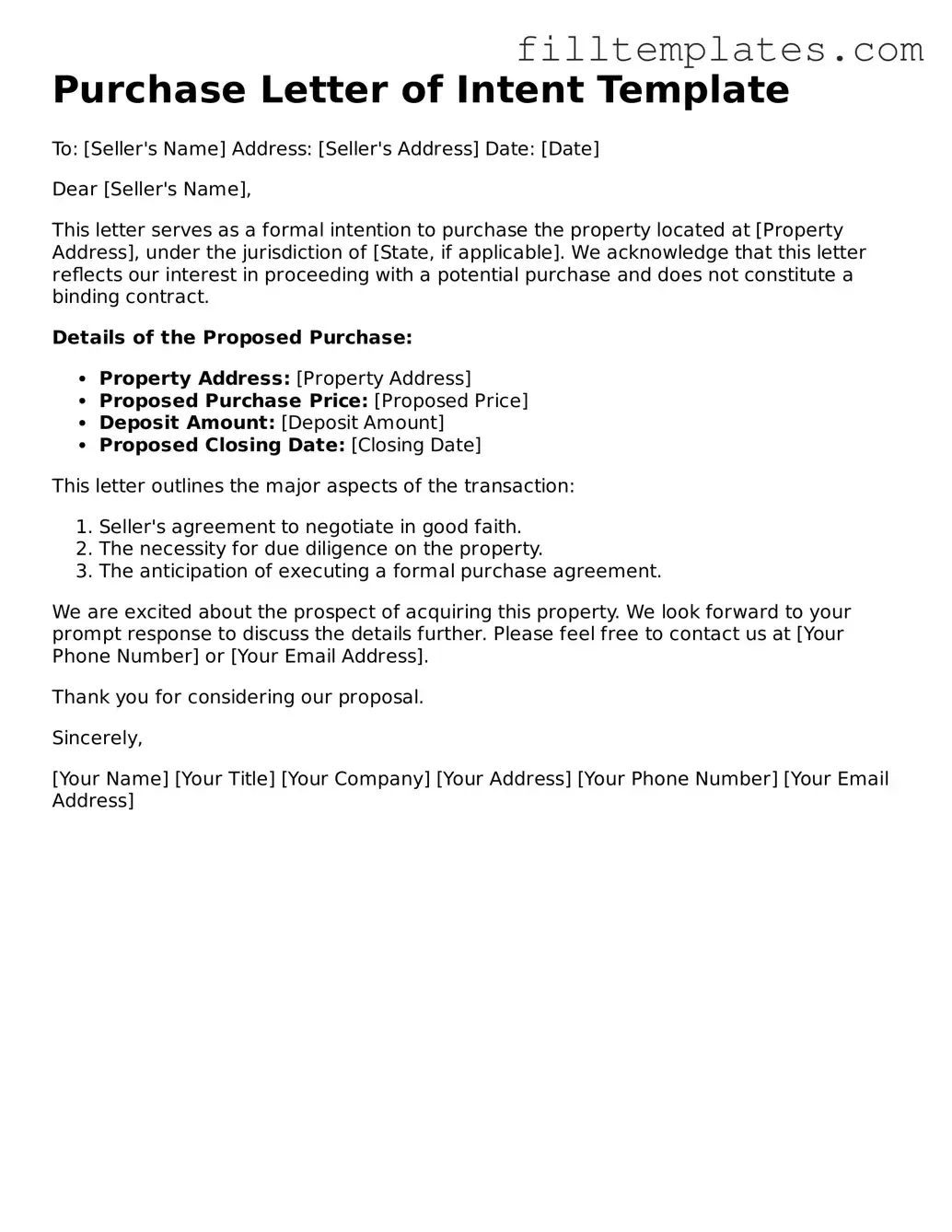

Purchase Letter of Intent Template

To: [Seller's Name] Address: [Seller's Address] Date: [Date]

Dear [Seller's Name],

This letter serves as a formal intention to purchase the property located at [Property Address], under the jurisdiction of [State, if applicable]. We acknowledge that this letter reflects our interest in proceeding with a potential purchase and does not constitute a binding contract.

Details of the Proposed Purchase:

- Property Address: [Property Address]

- Proposed Purchase Price: [Proposed Price]

- Deposit Amount: [Deposit Amount]

- Proposed Closing Date: [Closing Date]

This letter outlines the major aspects of the transaction:

- Seller's agreement to negotiate in good faith.

- The necessity for due diligence on the property.

- The anticipation of executing a formal purchase agreement.

We are excited about the prospect of acquiring this property. We look forward to your prompt response to discuss the details further. Please feel free to contact us at [Your Phone Number] or [Your Email Address].

Thank you for considering our proposal.

Sincerely,

[Your Name] [Your Title] [Your Company] [Your Address] [Your Phone Number] [Your Email Address]

Documents used along the form

A Purchase Letter of Intent (LOI) serves as a preliminary agreement outlining the intentions of parties involved in a potential transaction. However, several other documents are often utilized alongside the LOI to ensure clarity and mutual understanding. Below is a list of common forms and documents that may accompany a Purchase Letter of Intent.

- Non-Disclosure Agreement (NDA): This document protects confidential information shared between parties during negotiations. It ensures that sensitive data remains private and is not disclosed to third parties.

- Purchase Agreement: A formal contract that details the terms and conditions of the sale. It typically includes pricing, payment terms, and any contingencies that must be met before the sale is finalized.

- Due Diligence Checklist: A comprehensive list of items and information that the buyer needs to review before completing the purchase. This may include financial statements, operational data, and legal documents.

- Letter of Authorization: This document grants permission for a third party to act on behalf of one of the parties involved in the transaction. It is often used to facilitate due diligence or negotiations.

- Investment Letter of Intent: This document serves as a preliminary agreement between investors and businesses, outlining key terms of proposed investments. For further details, refer to Top Forms Online.

- Financing Agreement: If financing is involved in the purchase, this document outlines the terms of the loan or financing arrangement, including interest rates, repayment schedules, and conditions.

- Escrow Agreement: This document establishes the terms under which funds or assets are held in escrow until the completion of the transaction. It helps protect both parties by ensuring that conditions are met before the transfer occurs.

- Closing Statement: A document prepared at the closing of the sale that outlines the final financial terms of the transaction. It details the amounts due, adjustments, and any fees associated with the closing process.

- Assignment Agreement: This document allows one party to transfer its rights and obligations under the Purchase Agreement to another party. It is often used when a buyer wishes to assign their interest in the transaction to another entity.

These documents, when used in conjunction with a Purchase Letter of Intent, help clarify the intentions of the parties and provide a framework for the transaction. Each document plays a crucial role in ensuring that all aspects of the deal are addressed and understood by all parties involved.