Free Quitclaim Deed Template

The Quitclaim Deed form is an essential legal document that facilitates the transfer of property ownership between parties, often without the guarantees or warranties typically associated with other types of deeds. This straightforward form allows one party, known as the grantor, to relinquish any claim they may have to a property, thereby enabling another party, the grantee, to assume ownership rights. Unlike warranty deeds, quitclaim deeds do not provide any assurances regarding the title's validity, which makes them particularly useful in situations such as transferring property between family members, settling divorce agreements, or clearing up title issues. Understanding the quitclaim deed's purpose and implications is crucial for anyone involved in property transactions, as it simplifies the process while also carrying certain risks. Whether you are looking to gift property, resolve an estate matter, or clarify ownership, knowing how to properly execute and file a quitclaim deed can make a significant difference in ensuring a smooth transfer of property rights.

Quitclaim Deed - Adapted for State

Key takeaways

Filling out and using a Quitclaim Deed form can be an important step in transferring property rights. Here are some key takeaways to consider:

- Understanding the Quitclaim Deed: A Quitclaim Deed is a legal document that allows one person to transfer their interest in a property to another person without making any guarantees about the title.

- Use Cases: This type of deed is commonly used among family members, in divorce settlements, or when transferring property into a trust.

- Completing the Form: Ensure that all required fields are filled out accurately, including the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: Provide a clear and detailed description of the property being transferred. This may include the address and legal description, which can often be found in previous property documents.

- Signatures: The Quitclaim Deed must be signed by the grantor. In some states, it may also need to be notarized to be considered valid.

- Filing the Deed: After completing the form, it is important to file the Quitclaim Deed with the appropriate county office to ensure the transfer is officially recorded.

- Potential Risks: Understand that a Quitclaim Deed does not guarantee that the property is free of liens or other claims. It is essential to conduct due diligence before accepting a property through this method.

- Consulting a Professional: If there are any uncertainties or complexities involved in the property transfer, seeking legal advice can help clarify the process and protect your interests.

- Impact on Taxes: Be aware that transferring property through a Quitclaim Deed may have tax implications. It is advisable to consult a tax professional to understand any potential consequences.

By keeping these points in mind, individuals can navigate the Quitclaim Deed process more effectively and ensure a smoother transfer of property rights.

Guide to Writing Quitclaim Deed

Once you have your Quitclaim Deed form ready, you can begin filling it out. This document is essential for transferring property rights, so accuracy is key. Make sure you have all necessary information at hand, including the names of the parties involved and the property details.

- Title of the Document: Start by writing "Quitclaim Deed" at the top of the form.

- Grantor Information: Enter the name of the person transferring the property (the grantor). Include their address and any relevant details.

- Grantee Information: Next, fill in the name of the person receiving the property (the grantee). Provide their address as well.

- Property Description: Describe the property being transferred. This includes the street address, city, county, and a legal description if available. Be as detailed as possible.

- Consideration: Indicate the amount of money or value exchanged for the property, if applicable. If it’s a gift, you can state “$0” or “for love and affection.”

- Signatures: The grantor must sign the form. If there are multiple grantors, each one needs to sign. Ensure the signature is dated.

- Notary Public: Find a notary public to witness the signing. They will complete their section, which may require them to sign and stamp the document.

- Filing: After the form is complete and notarized, file it with your local county recorder's office. Check for any specific filing fees or requirements.

Once you have completed these steps, your Quitclaim Deed will be ready for submission. Be sure to keep a copy for your records. This document plays a crucial role in establishing property rights, so handle it with care.

Create Popular Types of Quitclaim Deed Templates

California Transfer on Death Deed - It allows property owners to bypass lengthy probate processes, leading to faster resolutions for their beneficiaries.

The New York Dirt Bike Bill of Sale is an important document for anyone looking to transfer ownership in a legally recognized manner. For guidance on completing this process, refer to the helpful resources available in the dirt bike bill of sale essentials.

Simple Deed of Gift Template - The Gift Deed requires both the giver and the receiver to agree on the terms of the gift.

Ladybird Deed Michigan Form - The Lady Bird Deed is a cost-effective strategy for managing estate planning needs over time.

Form Preview Example

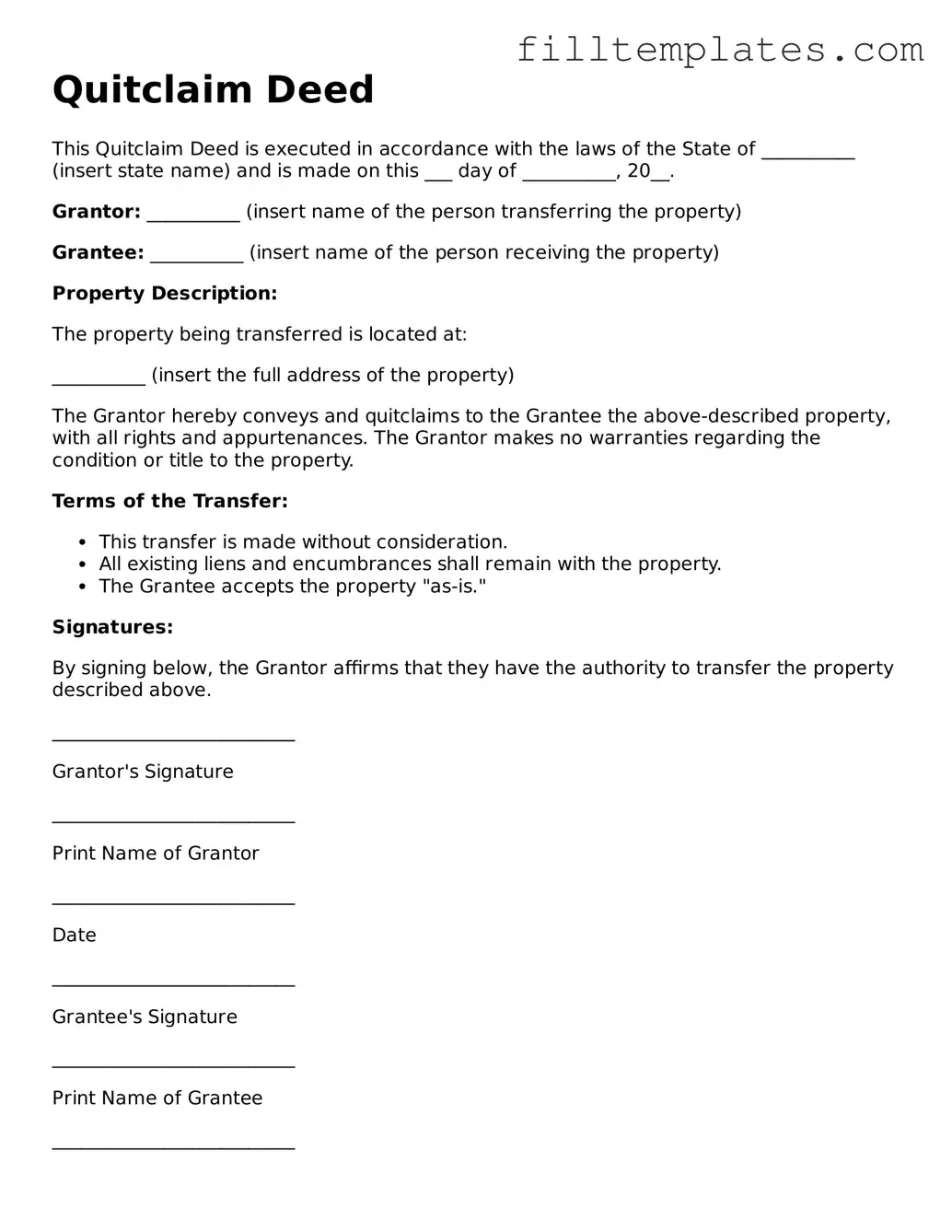

Quitclaim Deed

This Quitclaim Deed is executed in accordance with the laws of the State of __________ (insert state name) and is made on this ___ day of __________, 20__.

Grantor: __________ (insert name of the person transferring the property)

Grantee: __________ (insert name of the person receiving the property)

Property Description:

The property being transferred is located at:

__________ (insert the full address of the property)

The Grantor hereby conveys and quitclaims to the Grantee the above-described property, with all rights and appurtenances. The Grantor makes no warranties regarding the condition or title to the property.

Terms of the Transfer:

- This transfer is made without consideration.

- All existing liens and encumbrances shall remain with the property.

- The Grantee accepts the property "as-is."

Signatures:

By signing below, the Grantor affirms that they have the authority to transfer the property described above.

__________________________

Grantor's Signature

__________________________

Print Name of Grantor

__________________________

Date

__________________________

Grantee's Signature

__________________________

Print Name of Grantee

__________________________

Date

Notary Public:

State of __________ (insert state name)

County of __________ (insert county name)

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared __________ (insert names of Grantor and Grantee), known to me to be the persons whose names are subscribed to this Quitclaim Deed.

__________________________

Notary Public Signature

__________________________

Print Name of Notary Public

My Commission Expires: __________

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without making any guarantees about the title. When preparing to execute a Quitclaim Deed, it is often necessary to consider additional forms and documents that may accompany it. Below is a list of other forms commonly used in conjunction with a Quitclaim Deed.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to sell it. It provides more protection to the buyer compared to a Quitclaim Deed.

- Property Transfer Tax Form: Many states require this form to report the transfer of property and calculate any applicable taxes owed on the transaction.

- Affidavit of Title: This sworn statement confirms the seller's ownership of the property and discloses any liens or encumbrances that may affect the title.

- Title Insurance Policy: This insurance protects the buyer from potential disputes over property ownership and claims against the title that may arise after the purchase.

- Closing Statement: Also known as a HUD-1 statement, this document outlines all financial details of the transaction, including costs, fees, and the final amount due at closing.

- Escrow Agreement: This agreement outlines the terms under which a neutral third party will hold funds or documents until all conditions of the sale are met.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions, which can be useful if the seller is unable to be present.

- Employment Verification Form: This document is essential for confirming the employment history of individuals and is often required by new employers, lending institutions, or government agencies. For more information, you can visit OnlineLawDocs.com.

- Notice of Transfer: Some jurisdictions require a formal notice to be filed with local authorities to inform them of the change in property ownership.

- Lease Agreement: If the property is being rented out, this document outlines the terms of the lease between the landlord and tenant.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents provide rules and regulations governing the community, which the new owner must adhere to.

Understanding these documents can help ensure a smooth transfer of property ownership. Each serves a specific purpose and contributes to the overall security and legality of the transaction. It is advisable to consult with a legal professional to ensure all necessary forms are completed accurately and in compliance with local laws.