Download Release Of Lien Texas Template

In the realm of property transactions in Texas, the Release of Lien form plays a crucial role in ensuring clarity and legal integrity. This document is prepared specifically for use by legal professionals and serves as a formal acknowledgment that a lien has been satisfied. When a borrower pays off a loan secured by a property, the lender must release their claim to the property, and this form facilitates that process. It includes essential details such as the date of the release, the names of the borrower and lender, and specifics about the original loan amount and maturity date. The form also stipulates that the holder of the lien acknowledges the full payment and relinquishes all rights to enforce the lien in the future. This not only protects the borrower’s ownership but also prevents any future claims against the property by the lender. Furthermore, the document must be acknowledged by a notary public, adding an extra layer of authenticity. Understanding this form is vital for anyone involved in real estate transactions, as it helps to ensure that property titles remain clear and free of encumbrances.

Key takeaways

Filling out and using the Release of Lien Texas form can be a straightforward process, but it’s essential to understand the key elements involved. Here are some important takeaways to keep in mind:

- Purpose of the Form: The Release of Lien is used to formally acknowledge that a debt secured by a lien has been paid in full, allowing the lien to be removed from the property.

- Who Can Use It: While the form is prepared for use by lawyers, it can also be beneficial for property owners and lenders to understand its significance.

- Accurate Information: Ensure all details, such as the holder of the note, borrower, and property description, are filled out correctly to avoid any future disputes.

- Notarization Requirement: The form must be acknowledged before a notary public. This step adds a layer of authenticity and legal validity to the document.

- Recording the Document: After completing the form, it should be recorded in the county where the property is located to officially remove the lien.

- Waiving Future Claims: The holder of the lien waives any future rights to enforce the lien, which means they cannot claim the property again for past debts.

- Keep Copies: After the form is completed and recorded, retain copies for your records. This documentation can be crucial for future reference.

Understanding these key points can help ensure a smooth process when dealing with the Release of Lien Texas form. Properly managing this form not only protects your rights but also clarifies the status of property ownership.

Guide to Writing Release Of Lien Texas

Once you have gathered the necessary information, you can begin filling out the Release of Lien form. This form is essential for formally releasing a lien against a property. Follow these steps carefully to ensure that all required information is accurately provided.

- Date: Write the current date at the top of the form.

- Holder of Note and Lien: Enter the name of the person or entity that holds the lien.

- Holder’s Mailing Address: Provide the complete mailing address for the holder, including the county.

- Note Date: Fill in the date when the original note was created.

- Original Principal Amount: Write the original amount of the loan or note.

- Borrower: Enter the name of the borrower who took out the loan.

- Lender: Fill in the name of the lender who issued the loan.

- Maturity Date (optional): If applicable, include the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Specify the documents that describe the lien and where they are recorded.

- Property: Describe the property that is subject to the lien, including any improvements.

- Holder of Note and Lien Acknowledgment: State that the holder acknowledges payment in full and releases the lien.

- Acknowledgment Section: Fill in the state and county where the acknowledgment takes place, along with the date and name of the person acknowledging.

- Notary Public: The notary will sign and print their name, along with their commission expiration date.

- Corporate Acknowledgment (if applicable): If a corporation is involved, fill out this section with the necessary details.

- After Recording Return To: Indicate the law office or individual to whom the recorded document should be returned.

After completing the form, ensure that all information is correct. The next step involves having the document notarized and then recording it with the appropriate county office to finalize the release of the lien.

Browse Other PDFs

Usda Aphis 7001 - The signature block includes space for the veterinarian's stamp or name and address.

For those seeking to navigate the complexities of tax documentation, the Sample Tax Return Transcript form can be an invaluable resource, as it not only provides crucial insights into an individual’s tax information but also allows users to reference templates available at smarttemplates.net for further guidance on filling out their own tax returns accurately.

Charts in Ms Word - Column 1: Product Offerings

Form Preview Example

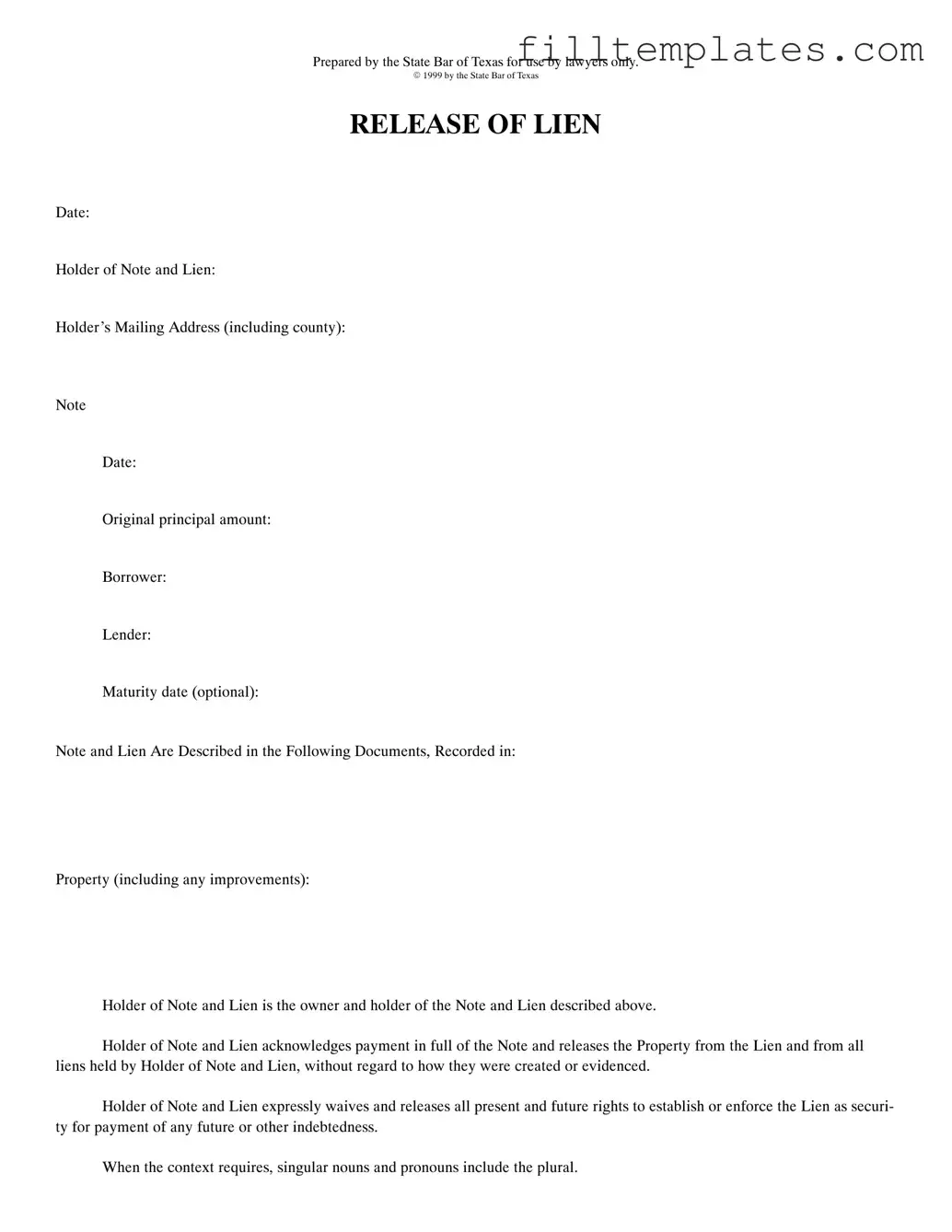

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

Documents used along the form

When dealing with the Release of Lien in Texas, several other forms and documents often accompany it. These documents serve various purposes, from establishing ownership to confirming payment. Here’s a list of commonly used forms that you might encounter.

- Promissory Note: This document outlines the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. It serves as a written promise to repay the borrowed amount.

- Deed of Trust: This instrument secures a loan by transferring the property title to a trustee until the borrower repays the loan. It provides assurance to the lender that they can claim the property if the borrower defaults.

- Mortgage Agreement: Similar to a deed of trust, this agreement details the terms under which a borrower pledges real estate as collateral for a loan. It includes payment terms and conditions for default.

- Affidavit of Payment: This sworn statement confirms that a borrower has paid off their debt. It can be used to support the Release of Lien by proving that the obligation has been fulfilled.

- Notice of Default: This document notifies a borrower that they are behind on payments. It often precedes foreclosure proceedings and serves as a formal warning.

- Title Insurance Policy: This policy protects lenders and buyers against defects in the property title. It ensures that the property is free from liens or other claims that could affect ownership.

- Trailer Bill of Sale Form: To ensure accurate documentation during trailer transactions, utilize our detailed trailer bill of sale resources for legal compliance and transparency.

- Property Appraisal: An evaluation of a property's value, which may be required by lenders to determine how much they are willing to lend based on the property's worth.

- Settlement Statement: This document outlines all the costs and fees associated with a real estate transaction. It provides transparency for both the buyer and seller regarding the financial aspects of the deal.

- Release of Mortgage: Similar to the Release of Lien, this document formally releases the lender's claim on the property once the loan is paid in full.

Understanding these forms can help streamline the process of securing and releasing liens. Each document plays a vital role in ensuring that all parties are protected and informed throughout the transaction.