Free Release of Promissory Note Template

The Release of Promissory Note form plays a crucial role in the realm of financial transactions, serving as a formal declaration that a borrower has fulfilled their obligations under a promissory note. This form not only signifies the completion of a debt repayment but also provides legal protection for both parties involved. When executed, it releases the borrower from any further liability, ensuring that the lender acknowledges the debt has been settled. Key elements of the form typically include the names of the borrower and lender, details about the original promissory note, and the date of release. Furthermore, the form may require signatures from both parties, reinforcing the mutual agreement that the debt is no longer outstanding. By utilizing this form, individuals can avoid potential disputes over payment status and maintain clear records of their financial dealings. Understanding the significance of this document is essential for anyone engaged in lending or borrowing, as it encapsulates the resolution of financial obligations in a straightforward manner.

Key takeaways

When dealing with a Release of Promissory Note form, understanding the key aspects can help ensure a smooth process. Here are some essential takeaways:

- Purpose: This form is used to formally acknowledge the repayment of a promissory note, releasing the borrower from any further obligations.

- Parties Involved: Typically, the form involves two parties: the lender and the borrower. Both must sign to validate the release.

- Clear Identification: Make sure to clearly identify the promissory note being released, including the date and amount.

- Signature Requirement: Both parties must sign the form for it to be legally binding. Without signatures, the release is not effective.

- Notarization: While not always required, having the document notarized can add an extra layer of authenticity.

- Record Keeping: Keep a copy of the completed form for your records. This serves as proof that the debt has been satisfied.

- State Laws: Be aware that laws regarding promissory notes and releases may vary by state. Check local regulations to ensure compliance.

- Clarity: Use clear and straightforward language in the form to avoid misunderstandings between parties.

- Legal Advice: If unsure about any part of the process, consider consulting a legal professional for guidance.

Guide to Writing Release of Promissory Note

Once you have the Release of Promissory Note form in hand, you'll want to ensure all necessary details are accurately filled out. This will help facilitate the process of releasing the note and ensuring all parties are on the same page. Below are the steps to complete the form effectively.

- Gather Necessary Information: Collect all relevant details such as the names of the parties involved, the date of the original promissory note, and any identifying numbers associated with the note.

- Fill in the Parties' Information: Enter the names and addresses of both the borrower and the lender in the designated sections of the form.

- Input the Date: Clearly write the date when the Release of Promissory Note is being executed.

- Reference the Promissory Note: Provide the date of the original promissory note and any reference number that may be applicable.

- Sign the Document: Ensure that both parties sign the form. It’s important that signatures are dated as well.

- Notarization (if required): If the form requires notarization, take it to a notary public to have it officially witnessed.

- Distribute Copies: After completing the form, make copies for all parties involved for their records.

After completing these steps, the form is ready for submission or filing, depending on your specific needs. It’s always a good idea to keep a copy for your records, ensuring you have proof of the release should any questions arise in the future.

Create Popular Types of Release of Promissory Note Templates

Loan Note Template - Documents the interest rate applicable to the car loan agreement.

In order to create a legally binding agreement, it is essential to use a well-structured Promissory Note. For those in need of a reliable template, the NY PDF Forms provides a comprehensive resource that simplifies the process and ensures all necessary terms are included, such as repayment conditions and implications for defaulting borrowers.

Form Preview Example

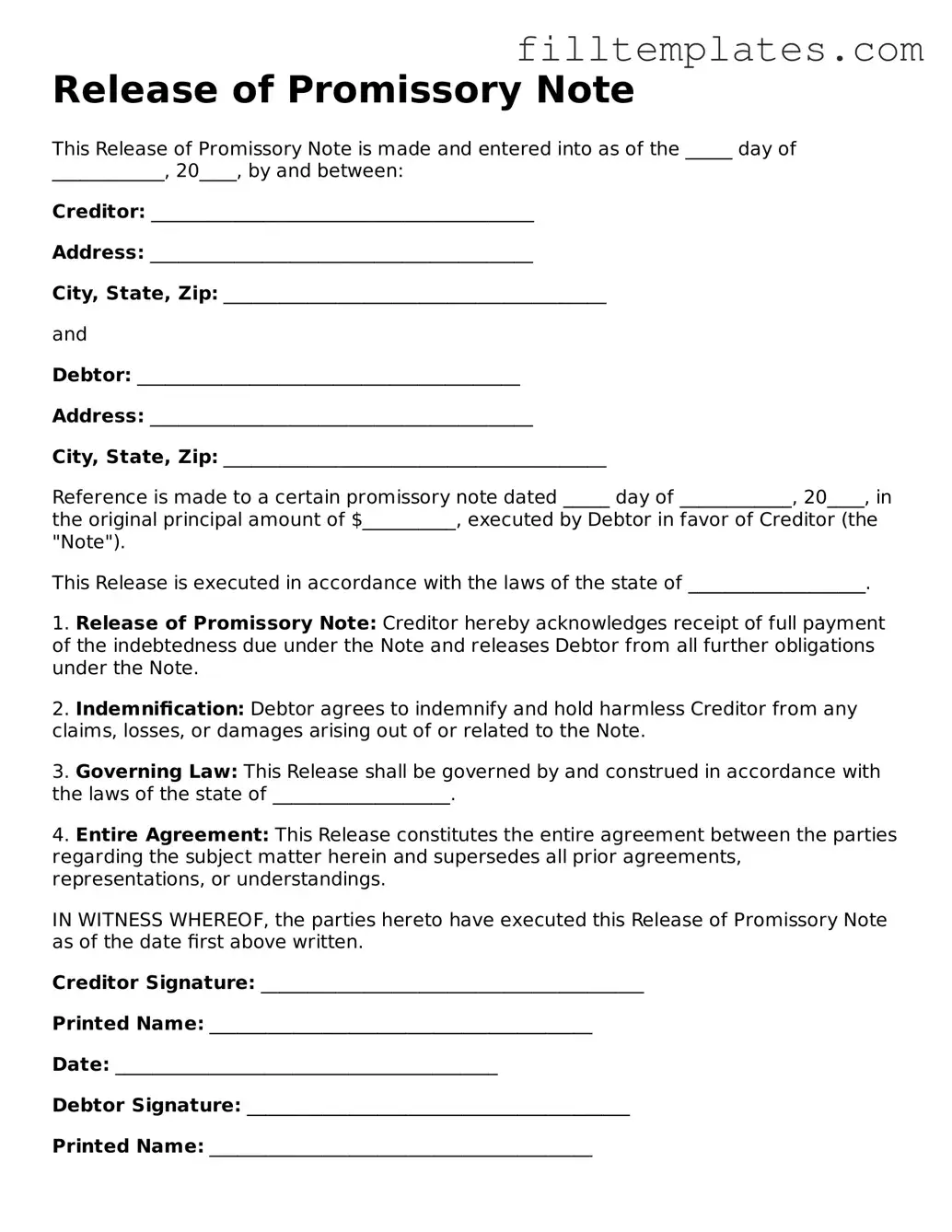

Release of Promissory Note

This Release of Promissory Note is made and entered into as of the _____ day of ____________, 20____, by and between:

Creditor: _________________________________________

Address: _________________________________________

City, State, Zip: _________________________________________

and

Debtor: _________________________________________

Address: _________________________________________

City, State, Zip: _________________________________________

Reference is made to a certain promissory note dated _____ day of ____________, 20____, in the original principal amount of $__________, executed by Debtor in favor of Creditor (the "Note").

This Release is executed in accordance with the laws of the state of ___________________.

1. Release of Promissory Note: Creditor hereby acknowledges receipt of full payment of the indebtedness due under the Note and releases Debtor from all further obligations under the Note.

2. Indemnification: Debtor agrees to indemnify and hold harmless Creditor from any claims, losses, or damages arising out of or related to the Note.

3. Governing Law: This Release shall be governed by and construed in accordance with the laws of the state of ___________________.

4. Entire Agreement: This Release constitutes the entire agreement between the parties regarding the subject matter herein and supersedes all prior agreements, representations, or understandings.

IN WITNESS WHEREOF, the parties hereto have executed this Release of Promissory Note as of the date first above written.

Creditor Signature: _________________________________________

Printed Name: _________________________________________

Date: _________________________________________

Debtor Signature: _________________________________________

Printed Name: _________________________________________

Date: _________________________________________

Documents used along the form

When dealing with financial agreements, particularly those involving loans or debts, various forms and documents come into play alongside the Release of Promissory Note form. Each of these documents serves a specific purpose in ensuring clarity and legality in transactions. Understanding these documents can help you navigate financial agreements more effectively.

- Promissory Note: This is the original document in which the borrower promises to repay a specified amount of money to the lender, detailing the terms of the loan, including interest rates and payment schedules.

- Loan Agreement: A comprehensive document that outlines the terms and conditions of the loan, including the rights and responsibilities of both the borrower and the lender.

- Security Agreement: This document provides the lender with a security interest in collateral, ensuring they can reclaim their money if the borrower defaults on the loan.

- Payment Schedule: A detailed timeline that outlines when payments are due, including amounts and any applicable late fees, helping both parties stay organized.

- Notice of Default: A formal notification sent to the borrower if they fail to make payments as agreed, often a precursor to further legal action.

- Editable Promissory Note: For those seeking a customizable option, consider utilizing an newjerseyformspdf.com/editable-promissory-note to create a tailored agreement that suits specific needs and conditions.

- Release of Lien: This document is used to formally remove a lender's claim on the borrower's asset once the loan has been repaid, providing clear ownership to the borrower.

- Assignment of Note: This document transfers the rights to receive payments under the promissory note from one party to another, often used in secondary market transactions.

- Debt Settlement Agreement: A document that outlines the terms under which a borrower can settle their debt for less than the full amount owed, often negotiated between the borrower and lender.

- Forbearance Agreement: This temporary agreement allows the borrower to pause or reduce payments for a specified period, providing relief during financial hardship.

Each of these documents plays a vital role in the landscape of financial transactions. Familiarity with them can empower you to make informed decisions and protect your interests in any loan agreement. Always consider consulting with a legal expert when navigating these forms to ensure compliance and understanding.