Free Single-Member Operating Agreement Template

A Single-Member Operating Agreement is a crucial document for anyone operating a single-member limited liability company (LLC). This form outlines the structure and management of the LLC, providing clarity on how the business will be run. It typically includes essential details such as the member's name, the business purpose, and how profits and losses will be handled. Additionally, it addresses the decision-making process, outlining the authority of the single member in managing the company’s operations. By establishing rules for governance and financial management, this agreement helps protect the member's personal assets from business liabilities. Furthermore, having a well-drafted operating agreement can enhance the credibility of the business and streamline processes in case of future changes or disputes. Overall, this document serves as a foundational tool for ensuring the smooth operation of a single-member LLC, making it an indispensable part of business planning.

Key takeaways

When filling out and using the Single-Member Operating Agreement form, consider the following key takeaways:

- Ensure all personal information is accurate. This includes your name, address, and any other relevant details.

- Clearly outline the purpose of your business. A well-defined purpose helps in understanding the scope and goals of your operations.

- Include provisions for management and decision-making. Specify how decisions will be made and who has the authority to make them.

- Address financial matters thoroughly. Outline how profits and losses will be handled, as well as any initial capital contributions.

- Consider adding clauses for amendments. This allows for flexibility as your business evolves and needs change.

- Keep the document accessible. Store it in a safe place and ensure you can easily retrieve it when needed.

Guide to Writing Single-Member Operating Agreement

Filling out a Single-Member Operating Agreement form is an important step for anyone who operates a single-member LLC. This agreement outlines how your business will function and helps to clarify your rights and responsibilities as the sole owner. The following steps will guide you through the process of completing the form accurately.

- Start with your business name: Write the official name of your LLC at the top of the form. Ensure that it matches the name registered with your state.

- Provide your personal information: Fill in your full name and address as the sole member of the LLC. This helps to identify you as the owner.

- State the purpose of the LLC: Briefly describe the nature of your business. This could be anything from providing services to selling products.

- Define the management structure: Indicate that you are the sole member and will manage the LLC. You may also note if you intend to appoint any managers in the future.

- Detail the financial arrangements: Include information about how profits and losses will be distributed. As the sole member, you will typically keep all profits.

- Address tax treatment: Specify how you want your LLC to be taxed. Most single-member LLCs are treated as sole proprietorships by default.

- Include a section on amendments: State how changes to the agreement can be made in the future, ensuring flexibility as your business evolves.

- Sign and date the document: Finally, make sure to sign and date the agreement to validate it. Your signature confirms your acceptance of the terms laid out in the document.

Once you have completed the form, keep a copy for your records. This document serves as a foundational piece for your LLC, providing clarity and structure as you move forward with your business.

Create Popular Types of Single-Member Operating Agreement Templates

Sample Operating Agreement for Two Member Llc - Serves as a legal reference point in case of conflict.

To further enhance the clarity and structure of your LLC, it is highly recommended to utilize resources such as OnlineLawDocs.com, which provide valuable guidance on creating a comprehensive Operating Agreement that ensures all members are informed of their rights and responsibilities.

Form Preview Example

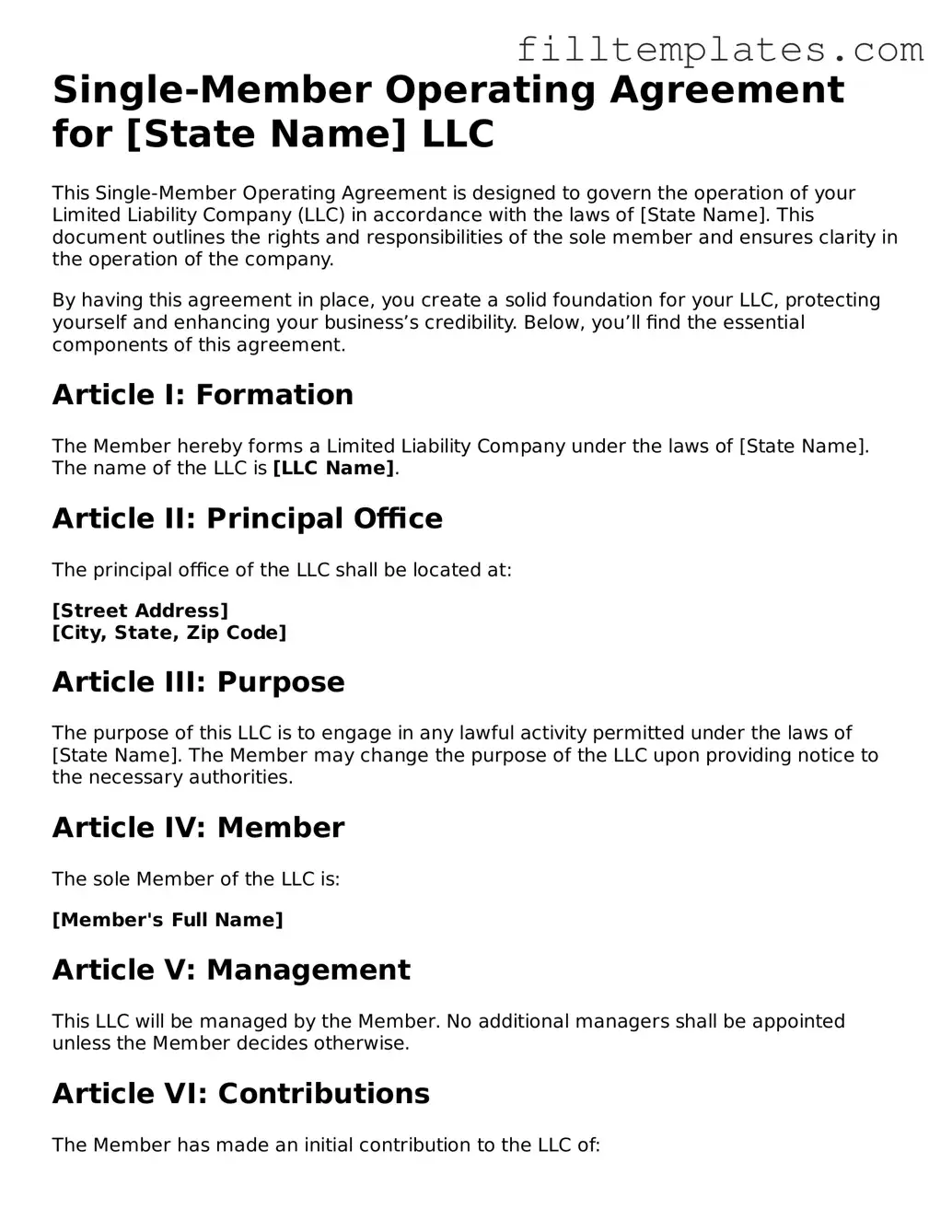

Single-Member Operating Agreement for [State Name] LLC

This Single-Member Operating Agreement is designed to govern the operation of your Limited Liability Company (LLC) in accordance with the laws of [State Name]. This document outlines the rights and responsibilities of the sole member and ensures clarity in the operation of the company.

By having this agreement in place, you create a solid foundation for your LLC, protecting yourself and enhancing your business’s credibility. Below, you’ll find the essential components of this agreement.

Article I: Formation

The Member hereby forms a Limited Liability Company under the laws of [State Name]. The name of the LLC is [LLC Name].

Article II: Principal Office

The principal office of the LLC shall be located at:

[Street Address]

[City, State, Zip Code]

Article III: Purpose

The purpose of this LLC is to engage in any lawful activity permitted under the laws of [State Name]. The Member may change the purpose of the LLC upon providing notice to the necessary authorities.

Article IV: Member

The sole Member of the LLC is:

[Member's Full Name]

Article V: Management

This LLC will be managed by the Member. No additional managers shall be appointed unless the Member decides otherwise.

Article VI: Contributions

The Member has made an initial contribution to the LLC of:

[Amount of Initial Contribution]

Article VII: Distributions

Distributions of profits shall be made to the Member at such times and in such amounts as determined by the Member. All distributions shall be made in accordance with the Member’s ownership percentage.

Article VIII: Records and Accounting

The LLC will maintain comprehensive records of all financial and business transactions. The fiscal year of the LLC shall end on the 31st day of December each year.

Article IX: Indemnification

The LLC shall indemnify the Member for any losses or damages incurred while carrying out the LLC’s business, to the maximum extent permitted by law.

Article X: Amendments

This Operating Agreement may be amended only by a written agreement signed by the Member.

Article XI: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of [State Name].

IN WITNESS WHEREOF, the undersigned has executed this Operating Agreement as of the [Date].

_________________________

[Member's Full Name]

Sole Member

Documents used along the form

When establishing a single-member limited liability company (LLC), various forms and documents are essential to ensure proper legal structure and compliance. Each of these documents serves a unique purpose, contributing to the overall functionality and protection of the business. Below is a list of commonly used documents that accompany the Single-Member Operating Agreement.

- Articles of Organization: This foundational document is filed with the state to officially create the LLC. It includes basic information such as the business name, address, and the name of the registered agent.

- Operating Agreement: The Operating Agreement form is crucial for defining the roles, responsibilities, and decision-making processes within an LLC, serving as a fundamental guideline for its operations and management.

- Employer Identification Number (EIN) Application: The EIN, obtained from the IRS, is necessary for tax purposes. It allows the LLC to open a bank account, hire employees, and file taxes.

- Membership Certificate: Although this is less common for single-member LLCs, a membership certificate can be issued to document ownership of the LLC and serve as proof of membership.

- Initial Resolution: This document outlines the initial decisions made by the single member regarding the operation of the LLC, such as opening bank accounts or entering contracts.

- Bylaws: While not always required for LLCs, bylaws can provide a framework for internal governance. They may outline procedures for decision-making and management structure.

- Business License: Depending on the nature of the business and its location, obtaining a local business license may be necessary to operate legally.

- Operating Procedures: This document can detail the day-to-day operations and management practices of the LLC, ensuring consistency and clarity in how the business is run.

- Annual Reports: Some states require LLCs to file annual reports to maintain good standing. These reports typically include updated information about the business and its operations.

- Tax Documents: Depending on the LLC's income and activities, various tax forms may need to be filed. This includes federal, state, and local tax obligations.

Understanding these documents is crucial for anyone looking to establish a single-member LLC. Each document plays a role in protecting the member's interests and ensuring compliance with legal requirements. By carefully preparing and maintaining these forms, a single-member LLC can operate smoothly and effectively.