Download Stock Transfer Ledger Template

The Stock Transfer Ledger form plays a crucial role in the management of corporate shares, ensuring accurate tracking and documentation of stock transactions. This form is specifically designed for corporations to record essential details about stock issuance and transfers. Each entry includes the name of the stockholder and their place of residence, providing a clear identification of the individuals involved. It also captures information about the certificates issued, including their corresponding certificate numbers and the number of shares issued. When shares are transferred, the form requires details about the previous owner, the amount paid for the shares, and the date of the transfer. Additionally, it notes the name of the new stockholder and the certificates that have been surrendered. The ledger culminates in a summary of the total number of shares held by each stockholder, giving a comprehensive view of share distribution within the corporation.

Key takeaways

When filling out the Stock Transfer Ledger form, consider the following key takeaways:

- Corporation Name: Always begin by entering the full name of the corporation at the top of the form.

- Stockholder Information: Clearly provide the name and place of residence of each stockholder involved in the transfer.

- Certificates Issued: Record the number of stock certificates issued to each stockholder accurately.

- Certificate Numbers: Each certificate must have a unique identification number, which should be noted on the form.

- Date of Issuance: Include the date when the shares were originally issued to the stockholder.

- Transfer Details: Specify from whom the shares were transferred, or indicate "original issue" if applicable.

- Payment Amount: Document the amount paid for the shares during the transfer process.

- Date of Transfer: Clearly indicate the date on which the shares were transferred to the new stockholder.

- Recipient Information: Provide the name of the individual or entity to whom the shares are being transferred.

- Certificates Surrendered: If applicable, note the certificate numbers of any surrendered shares as part of the transfer.

- Balance of Shares: Finally, calculate and record the number of shares held by each stockholder after the transfer.

Careful attention to these details will ensure accurate record-keeping and compliance with corporate regulations.

Guide to Writing Stock Transfer Ledger

After gathering the necessary information, you will need to complete the Stock Transfer Ledger form accurately. This form is essential for tracking stock transfers and ensuring that ownership records are maintained correctly. Follow these steps to fill out the form properly.

- Begin by entering the corporation’s name at the top of the form in the designated space.

- In the section for the name of the stockholder, write the full name of the individual or entity transferring the shares.

- Next, provide the stockholder's place of residence, including the city and state.

- Indicate the certificates issued by filling in the number of certificates that are being transferred.

- For the certificate number, write the specific number associated with the stock certificates being transferred.

- In the date issued field, enter the date when the shares were originally issued.

- Specify the number of shares issued in the appropriate space.

- Identify from whom the shares were transferred. If this is an original issue, simply write "original issue."

- Fill in the amount paid for the shares in the designated area.

- In the date of transfer of shares section, enter the date when the transfer is taking place.

- Next, indicate to whom the shares were transferred by writing the name of the new stockholder.

- In the certificates surrendered section, provide the certificate number of the shares being surrendered.

- List the number of shares being transferred in the space provided.

- Finally, record the number of shares held after the transfer in the balance section.

Browse Other PDFs

How Do I Change My Mailing Address - Customers can use the PS 3575 to request package holds.

When engaging in a transaction, it's crucial to utilize a California Bill of Sale form to document the exchange between the seller and buyer, ensuring there is no room for misunderstandings. This form not only validates the sale but also acts as a safeguard for both parties involved. For more details on how to properly create and utilize this document, you can visit https://onlinelawdocs.com/california-bill-of-sale/.

What Does It Mean If a Business Is Not Bbb Accredited - Unauthorized charges on my credit card statement.

Pest Control Forms Templates - Specific pests to be controlled are listed for clarity.

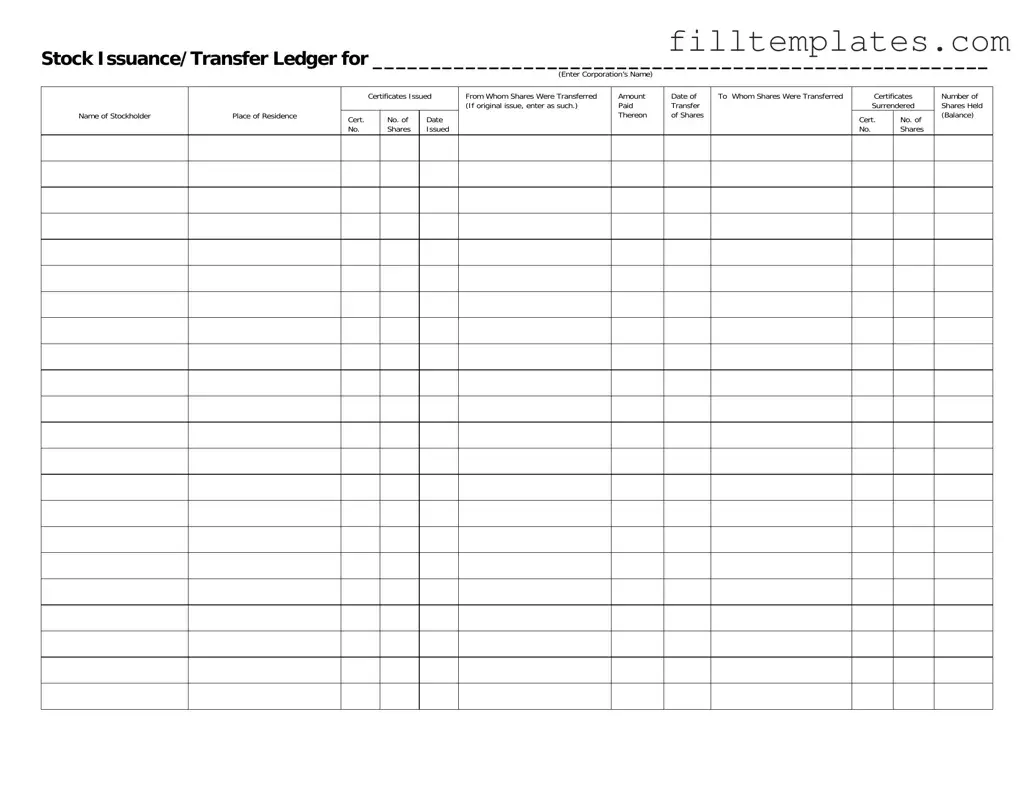

Form Preview Example

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

Documents used along the form

The Stock Transfer Ledger form is a vital document used to track the issuance and transfer of shares within a corporation. Along with this form, several other documents are commonly utilized to ensure proper record-keeping and compliance with regulatory requirements. Below are five key forms and documents that often accompany the Stock Transfer Ledger.

- Stock Certificate: This document serves as physical proof of ownership of shares in a corporation. It includes details such as the shareholder's name, the number of shares owned, and the corporation's name. Stock certificates are often issued when shares are initially sold or transferred.

- Shareholder Agreement: A shareholder agreement outlines the rights and responsibilities of shareholders. It may include provisions regarding the transfer of shares, voting rights, and procedures for resolving disputes. This document helps maintain clarity among shareholders regarding their relationship with one another and the corporation.

- Vehicle Purchase Agreement: This document outlines the terms and conditions of the sale and purchase of a vehicle. It serves as a binding contract, ensuring clarity between the buyer and seller regarding their rights and obligations. For more details, visit TopTemplates.info.

- Transfer Request Form: This form is used by shareholders to formally request the transfer of their shares to another party. It typically requires details such as the number of shares being transferred, the recipient's information, and the reason for the transfer. This document initiates the process of updating the Stock Transfer Ledger.

- Board Resolution: A board resolution is a formal document that records decisions made by a corporation's board of directors. When shares are transferred, a resolution may be required to approve the transfer and ensure compliance with corporate bylaws. This document provides an official record of the board's consent.

- Form 1099-DIV: This tax form is used to report dividends and distributions to shareholders. When shares are transferred or dividends are paid, this form helps ensure that both the corporation and the shareholders comply with tax reporting obligations. It is essential for accurate financial reporting.

Each of these documents plays a significant role in the overall process of managing stock ownership and transfers. Together, they help maintain transparency and legal compliance within the corporate structure, ensuring that all parties involved are informed and protected.