Download Texas residential property affidavit T-47 Template

The Texas residential property affidavit T-47 form plays a crucial role in real estate transactions, particularly for those buying or selling residential properties. This form serves as a declaration that provides important information regarding the property in question. It helps clarify the status of the property, including any improvements made, the nature of the ownership, and any encumbrances that may exist. By completing the T-47, sellers can confirm that the property has not been altered in a way that would affect the title since the last transfer. Buyers benefit from this transparency, as it helps them understand what they are purchasing and ensures that they are aware of any potential issues. The T-47 form is typically required by title companies and lenders during the closing process, making it a vital document for anyone involved in a real estate deal in Texas. Understanding its purpose and requirements can help streamline the transaction and protect the interests of all parties involved.

Key takeaways

The Texas residential property affidavit T-47 form is an important document in real estate transactions. Understanding how to fill it out and use it effectively can streamline the process of buying or selling property. Here are key takeaways to keep in mind:

- Purpose of the Form: The T-47 form is used to confirm the ownership of a residential property and to clarify the legal status of the property.

- Who Should Complete It: Typically, the seller or the property owner is responsible for filling out the T-47 form.

- Accurate Information: Ensure that all information provided on the form is accurate and up-to-date to avoid potential legal issues.

- Signature Requirement: The form must be signed by the property owner, and notarization is often required to validate the document.

- Submission: After completion, the T-47 form should be submitted to the title company handling the transaction.

- Review Period: Allow time for the title company to review the affidavit, as they may require additional information or clarification.

- Implications of Errors: Mistakes on the form can lead to delays in the transaction or complications with the title, so review carefully.

- Legal Advice: Consulting with a real estate attorney can provide guidance and ensure that the affidavit is completed correctly.

By keeping these points in mind, you can navigate the process of using the T-47 form with greater confidence and efficiency.

Guide to Writing Texas residential property affidavit T-47

Completing the Texas residential property affidavit T-47 form is an important step in documenting property ownership. Following the steps below will help ensure that the form is filled out correctly and efficiently.

- Begin by obtaining the T-47 form. You can find it online or request a copy from your local county office.

- Fill in the property address in the designated area. Make sure to include the street number, street name, city, and zip code.

- Provide your name as the owner of the property. Include your full legal name as it appears on the property deed.

- Enter the name of the previous owner, if applicable. This is important for establishing the chain of title.

- Indicate the date of acquisition. This should be the date you purchased or otherwise obtained the property.

- Complete the section regarding any liens or encumbrances on the property. Be honest and thorough, as this information is crucial for title purposes.

- Sign and date the affidavit at the bottom of the form. Your signature confirms that the information provided is accurate to the best of your knowledge.

- Have the affidavit notarized. This step adds an extra layer of authenticity to your document.

- Submit the completed T-47 form to your local county clerk’s office. Keep a copy for your records.

Browse Other PDFs

Official Girlfriend Application - Seeking a partner who values family and friendships.

A Motor Vehicle Bill of Sale form is a critical document that records the sale of a vehicle between two parties, the buyer and the seller. This form serves as a receipt for the transaction and provides proof of the transfer of ownership. It details the condition, price, and specifics of the vehicle, ensuring both parties have a clear understanding of the agreement. For more information and to access a template, you can visit toptemplates.info/bill-of-sale/motor-vehicle-bill-of-sale.

How Do I Change My Mailing Address - This form ensures that service-related requests are properly logged.

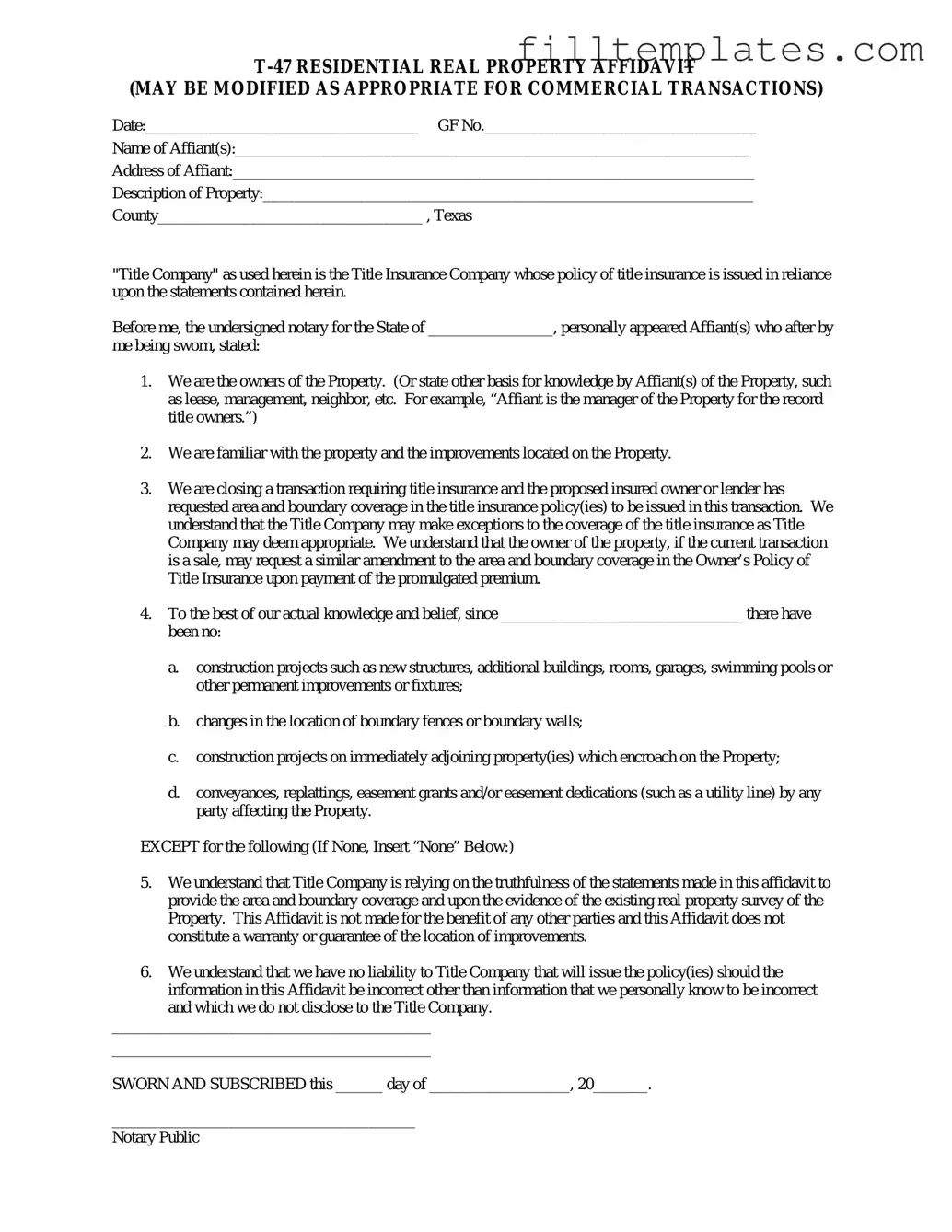

Form Preview Example

(MAY BE MODIFIED AS APPROPRIATE FOR COMMERCIAL TRANSACTIONS)

Date:___________________________________ GF No.___________________________________

Name of Affiant(s):__________________________________________________________________

Address of Affiant:___________________________________________________________________

Description of Property:_______________________________________________________________

County__________________________________ , Texas

"Title Company" as used herein is the Title Insurance Company whose policy of title insurance is issued in reliance upon the statements contained herein.

Before me, the undersigned notary for the State of ________________, personally appeared Affiant(s) who after by

me being sworn, stated:

1.We are the owners of the Property. (Or state other basis for knowledge by Affiant(s) of the Property, such as lease, management, neighbor, etc. For example, “Affiant is the manager of the Property for the record title owners.”)

2.We are familiar with the property and the improvements located on the Property.

3.We are closing a transaction requiring title insurance and the proposed insured owner or lender has requested area and boundary coverage in the title insurance policy(ies) to be issued in this transaction. We understand that the Title Company may make exceptions to the coverage of the title insurance as Title Company may deem appropriate. We understand that the owner of the property, if the current transaction is a sale, may request a similar amendment to the area and boundary coverage in the Owner’s Policy of Title Insurance upon payment of the promulgated premium.

4.To the best of our actual knowledge and belief, since _______________________________ there have been no:

a.construction projects such as new structures, additional buildings, rooms, garages, swimming pools or other permanent improvements or fixtures;

b.changes in the location of boundary fences or boundary walls;

c.construction projects on immediately adjoining property(ies) which encroach on the Property;

d.conveyances, replattings, easement grants and/or easement dedications (such as a utility line) by any party affecting the Property.

EXCEPT for the following (If None, Insert “None” Below:)

5.We understand that Title Company is relying on the truthfulness of the statements made in this affidavit to provide the area and boundary coverage and upon the evidence of the existing real property survey of the Property. This Affidavit is not made for the benefit of any other parties and this Affidavit does not constitute a warranty or guarantee of the location of improvements.

6.We understand that we have no liability to Title Company that will issue the policy(ies) should the

information in this Affidavit be incorrect other than information that we personally know to be incorrect and which we do not disclose to the Title Company.

_________________________________________

_________________________________________

SWORN AND SUBSCRIBED this ______ day of __________________, 20_______.

_______________________________________

Notary Public

Documents used along the form

The Texas residential property affidavit T-47 form is often used in real estate transactions to confirm the ownership and condition of a property. Along with this form, several other documents may be required to ensure a smooth transaction. Below is a list of some commonly used forms and documents that complement the T-47.

- Deed: This legal document transfers ownership of the property from one party to another. It includes details such as the names of the buyer and seller, the property description, and any relevant terms of the sale.

- Title Commitment: Issued by a title company, this document outlines the terms under which a title insurance policy will be issued. It includes information about the property's title history and any liens or encumbrances.

- Property Survey: A survey provides a detailed map of the property, showing boundaries, structures, and any easements. This document helps clarify the exact dimensions and features of the land being sold.

- Closing Disclosure: This form outlines the final terms of the mortgage loan, including the loan amount, interest rate, and closing costs. It must be provided to the buyer at least three days before closing.

- Release of Liability: A legal document essential for protecting parties involved in various activities, ensuring that risks are acknowledged and agreed upon; learn more at smarttemplates.net.

- Bill of Sale: This document is used to transfer ownership of personal property that may be included in the sale, such as appliances or furniture. It specifies what items are included in the transaction.

- Homeowners Association (HOA) Documents: If the property is part of an HOA, these documents will detail the rules, regulations, and fees associated with the community. Buyers should review these to understand their responsibilities as homeowners.

These documents play a crucial role in the real estate process. They help ensure that all parties are informed and protected throughout the transaction. Always consider consulting with a real estate professional for guidance tailored to your specific situation.