Free Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form plays a crucial role in the financing of vehicles, outlining the terms under which a borrower agrees to repay a loan for a vehicle purchase. This document typically includes essential details such as the total amount financed, the interest rate, and the repayment schedule. Borrowers will find information regarding the duration of the loan, as well as any penalties for late payments or default. Additionally, the form may specify the rights and responsibilities of both the lender and the borrower, ensuring clarity in the transaction. By signing this agreement, individuals commit to a legally binding arrangement, which protects both parties and facilitates a smooth repayment process. Understanding each aspect of this form is vital for anyone looking to finance a vehicle, as it helps prevent misunderstandings and potential disputes down the line.

Key takeaways

Here are key takeaways regarding the Vehicle Repayment Agreement form:

- Understand the Purpose: The form is designed to outline the terms of repayment for a vehicle loan.

- Complete All Sections: Ensure every section of the form is filled out accurately to avoid delays.

- Provide Accurate Information: Include correct personal and vehicle details, such as VIN and loan amount.

- Review Payment Terms: Clearly understand the repayment schedule, including due dates and amounts.

- Sign and Date: Both parties must sign and date the form to make it legally binding.

- Keep a Copy: Retain a copy of the signed agreement for your records.

- Communicate Changes: Notify the lender promptly if there are any changes to your repayment situation.

- Seek Assistance if Needed: If unsure about any part of the form, consider seeking help from a professional.

Guide to Writing Vehicle Repayment Agreement

After obtaining the Vehicle Repayment Agreement form, you will need to fill it out accurately to ensure that all necessary information is provided. This will help facilitate the processing of your agreement. Follow the steps below to complete the form correctly.

- Begin by entering your full name in the designated field.

- Provide your current address, including city, state, and zip code.

- Fill in your phone number and email address for contact purposes.

- Indicate the make, model, and year of the vehicle in question.

- Enter the Vehicle Identification Number (VIN) as it appears on the vehicle.

- Specify the total amount owed on the vehicle.

- Outline the repayment terms, including the payment amount and frequency.

- Sign and date the form at the bottom to validate your agreement.

Once you have completed the form, review all entries for accuracy. After verifying the information, submit the form to the appropriate party as instructed.

Other Forms:

Dog Bill of Sale - Can be customized to include specific breed-related considerations.

In California, a Bill of Sale form is crucial for documenting the transfer of ownership, providing a concrete record that protects both the seller and buyer. This legal document not only helps ensure that the transaction is transparent but also reduces the risk of disputes in the future. For more information on how to effectively draft this essential paperwork, you can visit onlinelawdocs.com/california-bill-of-sale.

Dd Form 2656 March 2022 Fillable - Filling out the DD 2656 is a key step in securing your retirement from military service.

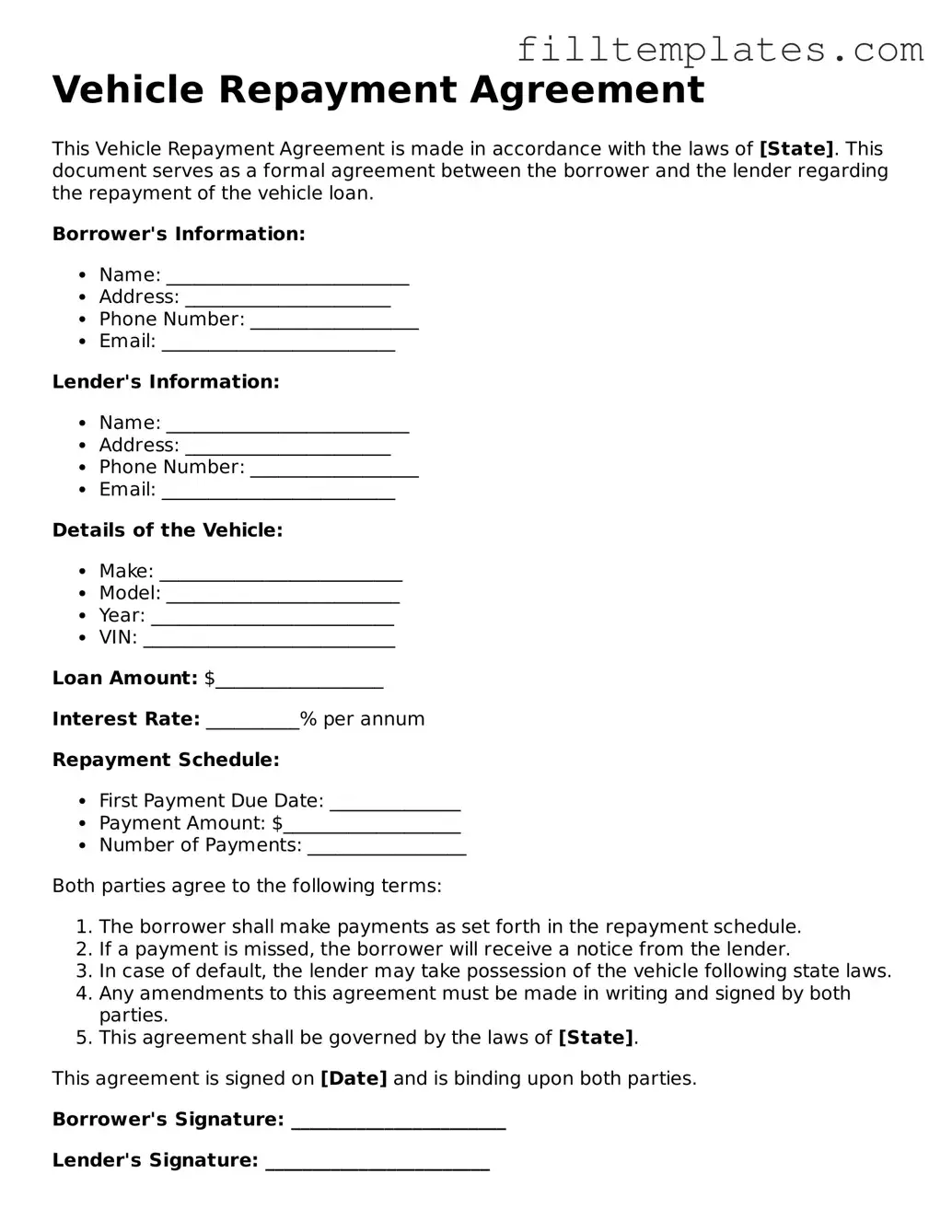

Form Preview Example

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made in accordance with the laws of [State]. This document serves as a formal agreement between the borrower and the lender regarding the repayment of the vehicle loan.

Borrower's Information:

- Name: __________________________

- Address: ______________________

- Phone Number: __________________

- Email: _________________________

Lender's Information:

- Name: __________________________

- Address: ______________________

- Phone Number: __________________

- Email: _________________________

Details of the Vehicle:

- Make: __________________________

- Model: _________________________

- Year: __________________________

- VIN: ___________________________

Loan Amount: $__________________

Interest Rate: __________% per annum

Repayment Schedule:

- First Payment Due Date: ______________

- Payment Amount: $___________________

- Number of Payments: _________________

Both parties agree to the following terms:

- The borrower shall make payments as set forth in the repayment schedule.

- If a payment is missed, the borrower will receive a notice from the lender.

- In case of default, the lender may take possession of the vehicle following state laws.

- Any amendments to this agreement must be made in writing and signed by both parties.

- This agreement shall be governed by the laws of [State].

This agreement is signed on [Date] and is binding upon both parties.

Borrower's Signature: _______________________

Lender's Signature: ________________________

Documents used along the form

The Vehicle Repayment Agreement form is a crucial document for outlining the terms and conditions related to the repayment of a vehicle loan. Alongside this agreement, several other forms and documents are commonly utilized to ensure clarity and legal compliance throughout the repayment process. Below is a list of related documents that may accompany the Vehicle Repayment Agreement.

- Loan Application Form: This document is completed by the borrower to request financing for the vehicle. It typically includes personal information, income details, and the desired loan amount.

- Promissory Note: A written promise from the borrower to repay the loan amount under specified terms. It outlines the repayment schedule, interest rate, and consequences of default.

- Title Transfer Document: This form is used to officially transfer ownership of the vehicle from the seller to the buyer. It is essential for registering the vehicle in the buyer's name.

- General Bill of Sale: A General Bill of Sale form serves as a legal document that transfers ownership of personal property from one person to another. Its uses range from the sale of vehicles and electronics to smaller items like furniture or jewelry. This vital document ensures that the transaction is recorded officially, providing peace of mind and legal protection to both parties involved. For more information, visit smarttemplates.net.

- Bill of Sale: A receipt that serves as proof of the transaction between the buyer and seller. It includes details about the vehicle, sale price, and date of sale.

- Insurance Verification Form: This document confirms that the borrower has obtained the necessary insurance coverage for the vehicle, which is often a requirement for financing.

- Credit Report Authorization: A form allowing the lender to check the borrower’s credit history as part of the loan approval process. It is vital for assessing the borrower’s creditworthiness.

- Payment Schedule: A detailed outline of the repayment plan, including due dates, amounts, and payment methods. It helps both parties keep track of the payment obligations.

- Default Notice: A document that may be issued if the borrower fails to meet the repayment terms. It outlines the default conditions and potential actions the lender may take.

Each of these documents plays a significant role in the overall process of vehicle financing and repayment. Together, they provide a comprehensive framework that protects the interests of both the lender and the borrower, ensuring a smooth transaction and clear understanding of obligations.